Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

This page includes information about American Express products currently unavailable on Slickdeals.

People tend to focus on high-end perks to determine whether rewards credit cards are worth keeping or not. Because of this, merchant offers often go overlooked, even though they can be a treasure trove of potential value.

American Express, Chase and Citi partner with hundreds of well-known retailers to extend substantial discounts to their cardholders. The great thing about these programs is that you don’t need a premium credit card to participate. In fact, you can get in on them with a no-annual-fee card and generate hundreds of dollars in savings every year.

If you’re ready to maximize this underutilized benefit, here’s everything you need to know about several of our favorite merchant offer hubs.

Amex Offers

Perhaps the most robust and lucrative of the three programs, Amex lists up to 100 offers at a time and will populate more as you add them to your account.

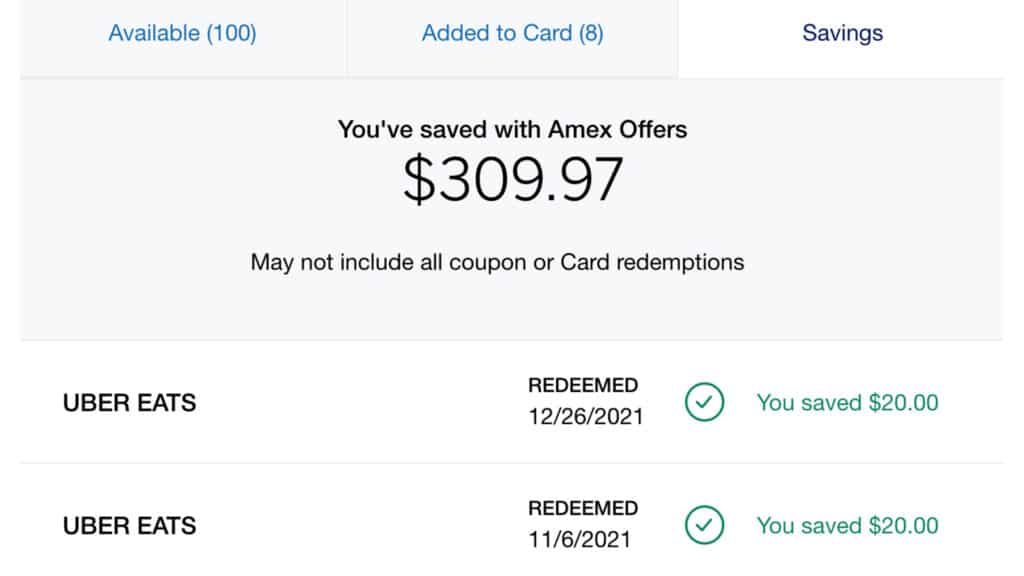

I’ve personally saved over $700 through Amex Offers over the last year, offsetting most of the annual fees on my five Amex cards through savings on essential purchases. At $309.97 in Amex Offers savings, my Hilton Honors American Express Aspire Card has been the most lucrative:

All American Express cards are eligible for Amex Offers, including no-annual-fee and business cards.

How to Use Amex Offers

Adding Amex Offers to your account is easy. Simply log into your account and scroll down to the “Amex Offers” section. You can filter offers by merchant or rewards type. When you see an offer you like, add the offer to your account and use the linked card to make a qualifying purchase. Be sure to track the offer’s expiration date to avoid missing out on exceptional offers.

While there is no limit to the number of offers you can add, there is a limit to the number of people who can sign up for a single offer. Once that limit is reached, the offer drops off. With that in mind, checking Amex Offers frequently for deals can pay off. It also means if you sign up for offers without intending to use them, someone else could miss out. So we don’t recommend adding Amex Offers unless you plan to redeem them.

Once you’ve added an offer to your card, simply use your card to make a qualifying purchase. Some offers are in-store or online only. Be sure to read the fine print to ensure your purchase is eligible for the offer. You’ll get an email confirmation afterward and your points or statement credits will usually post within 90 days.

Chase Offers

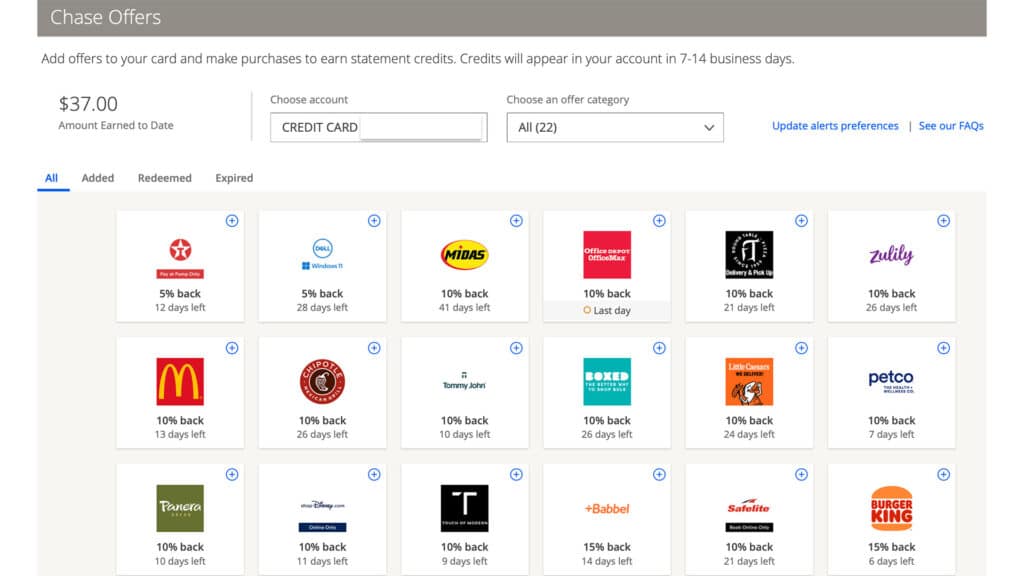

I don’t use Chase Offers much but have already saved $37 to date on my World of Hyatt Credit Card. The card has an annual fee, but it's proving to be worth it between the annual free night award and Chase Offers.

Logging in recently, I was surprised to find some exceptional deals. There were savings on gas, discounts on Hyatt hotels, restaurants and more. The nice thing about Chase Offers is that cash back typically posts within 7-14 days of purchase, while Amex Offers can take 90 days.

How to Use Chase Offers

To review your Chase Offers, log in to your account and look for the “Chase Offers” box on the right side of the page. Click on “See all offers” for a complete selection. Offers are tailored to each card. So if you have multiple Chase cards, you should toggle between accounts to review them all.

I recently logged into my own account and found 74 offers under my Chase Freedom Unlimited® card and zero under my Chase Sapphire Preferred®. That’s surprising since I use my Sapphire Preferred more often than the Freedom Unlimited. Moreover, my Sapphire card features an annual fee, whereas the Freedom Unlimited does not. So it’s definitely worthwhile to check Chase Offers across all of your accounts for the best deals.

Citi Merchant Offers

Citi Merchant Offers, from our partner Citi, tends to fly under a lot of people's radar. It's hardly as hyped as Amex Offers, but you can find some solid deals. You can filter the vast selection of deals by merchant type.

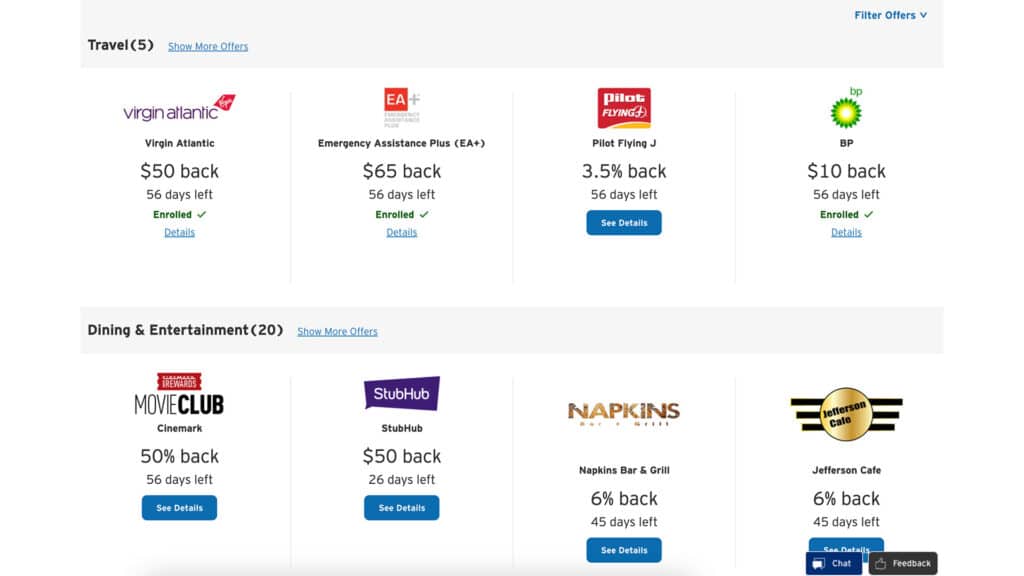

I logged in recently and found terrific deals on everything from travel to retail purchases, gas and more. There were over 140 deals listed under my Citi Prestige® Card, from our partner Citi, and I quickly added a $50 cash back deal from Virgin Atlantic and $10 off $20 at BP gas stations. Other offers included $50 off at Stubhub, 50% at Movie Club and more.

Overall, I find Citi Merchant Offers on par with American Express. I will definitely make it a habit to check this site more often.

How to use Citi Merchant Offers

You’ll need to log in and head to the Citi Merchant Offers page to add offers to your card. If you have multiple Citi cards, you’ll notice different offers for each card.

If you’re interested in an offer, simply click on it to review the terms and select “add to card.” Use your linked card to make a qualifying purchase before the expiration date to earn cash back.

Keep in mind that most offers are limited to one across all of your cards. So you should consider your credit card’s category bonuses when deciding which card to add an offer to.

How to Stack Offers

The great thing about Amex, Chase and Citi Offers is that you can stack them with shopping portal rewards. You can opt for cash back or bonus points from dozens of loyalty programs. To compare shopping portal rates, head over to Cashback Monitor or CashbackHolic and enter the merchant name. You’ll get a list of shopping portals broken down by reward type.

Sometimes shopping portals offer spend-based bonuses, especially during back-to-school and the holidays. You’ll sometimes earn a bonus of 500 points or more for hitting certain spending thresholds.

In addition to shopping portals, you can “quadruple-dip” with a shopping app like Dosh. Dosh partners with popular retailers to provide cash back rewards. All you have to do is download the app, register your credit card and use it at participating merchants. I have, on occasion, used Dosh to earn 2% rewards at office supply stores. If those office supply stores show up in Amex Offers and shopping portals, you can earn a ton of rewards.

Related Article

Related Article

The 10 Best Ways to Use American Express Membership Rewards Points