Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Many consumers love the convenience of Buy Now, Pay Later (BNPL) financing, a type of short-term loan that allows shoppers to pay off a purchase over time across several installments.

A BNPL plan charges a portion of the full balance at checkout, with the remaining payments billed in equal installments until the purchase has been paid off. Some BNPL plans charge interest and late fees, while others are interest-free.

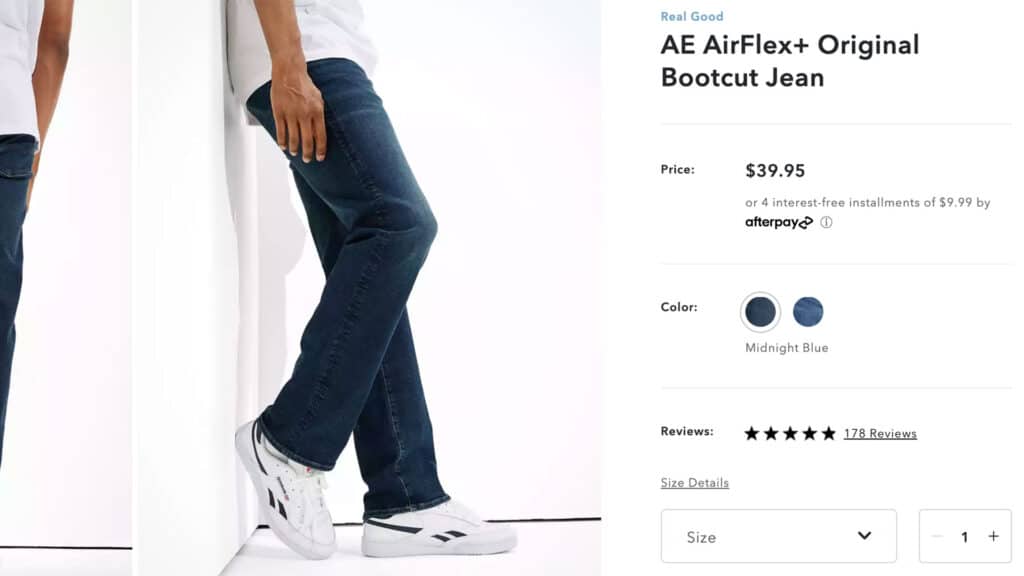

BNPL is commonly utilized for retail purchases, although BNPL options are also available for health care expenses or travel. Online shoppers will often see a BNPL offer on the checkout page, and some stores offer BNPL payment options at checkout.

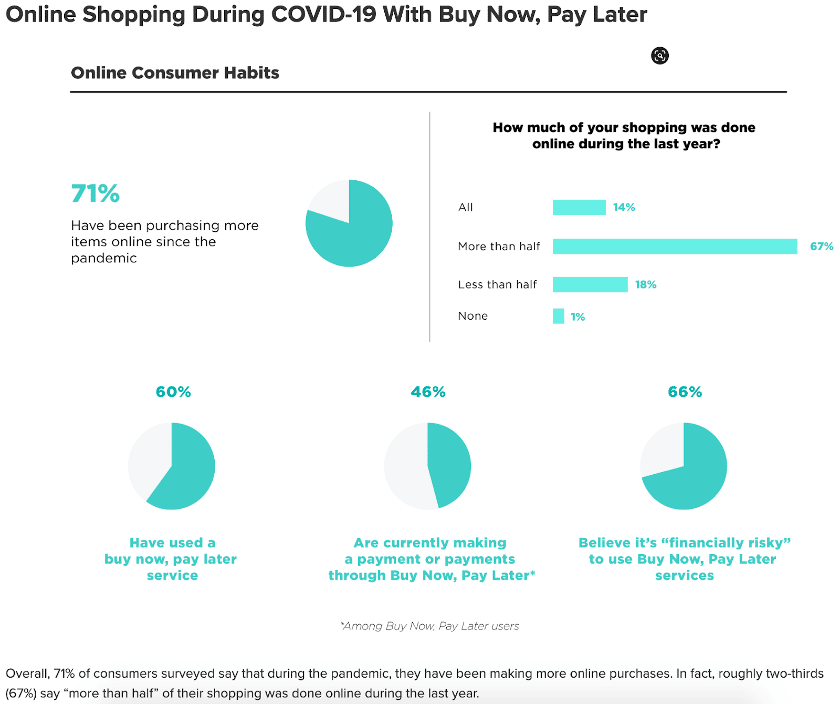

Although installment-based financing isn’t new, consumers began relying more on BNPL financing during the COVID-19 pandemic when online shopping skyrocketed.

Almost half of BNPL shoppers say that they used the service to buy goods outside of their budget, according to a March 2021 survey by financial services review site The Ascent.

And amongst users who began using BNPL during the pandemic, 41% say they relied on the service to keep emergency funds untouched, while another 25% of applicants reported using buy now, pay later services due to job layoffs and other sources of lost income.

What Companies Offer Buy Now, Pay Later?

A growing number of financial companies offer BNPL payment plans. You may recognize some of the most popular retail issuers on this list.

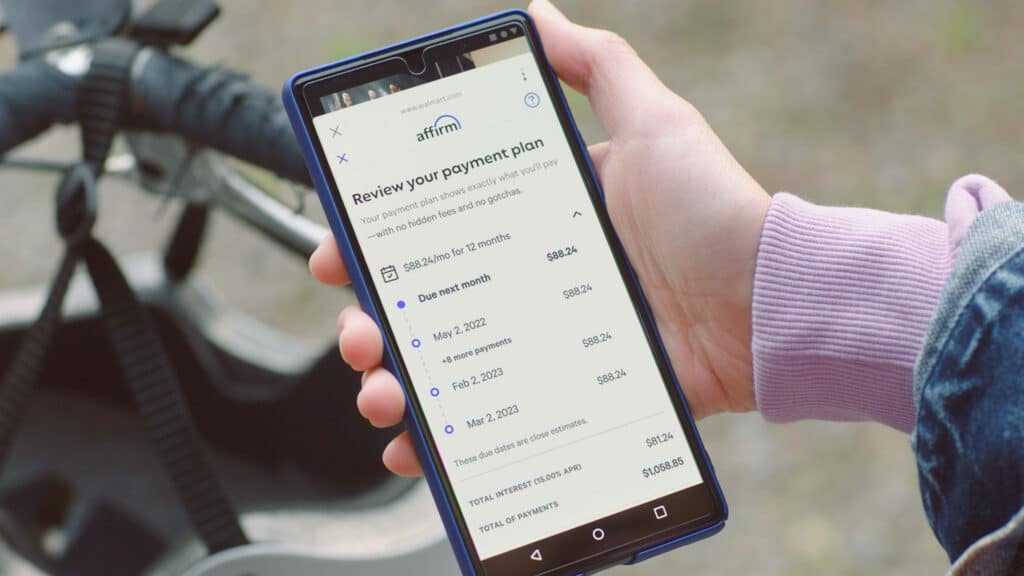

Affirm

Affirm offers several BNPL payment options and does not charge any fees. However, some plans may charge interest. Eligible shoppers can choose between different payment options, depending on the retailer.

Payment options may include:

- Four biweekly payments with no interest

- Six monthly payments with an APR between 0% to 30%, depending on credit score

- 12 monthly payments with an APR between 10% to 30%, depending on credit score

More than 168,000 businesses such as Walmart, Cole Haan, and Oura offer Affirm BNPL plans.

Afterpay

You’ve almost certainly seen an Afterpay plan offered online, even if you didn’t notice it at the time. Afterpay’s BNPL plan splits your purchase into four equal biweekly payments (pay-in-four), and is available with thousands of retailers including major brands such as GAP Inc., RayBan and Nordstrom.

Afterpay doesn’t charge any fees if installments are paid on time, but you’ll pay a late fee of up to 25% of the purchase price if you miss a payment due date. Afterpay does not charge interest.

Klarna

Klarna partners with thousands of retailers nationwide including Nike, Sephora and Wayfair. Klarna offers a few payment options:

- Pay-in-four with no interest. You’ll incur late fees if you don’t pay on time.

- With ‘Pay in 30 Days’, you can place an order with no money down up front, then have up to 30 days to pay the balance without incurring any interest and fees. If you make a return, you’ll only pay for the items you keep. You can also extend the payment due date for a fee if needed.

- Purchase financing. This payment option requires a credit check to determine your eligibility. Depending on the retailer, you may be able to spread out your purchase repayment for up to three years. APR rates vary from 0% to 19.99%.

PayPal Credit

PayPal’s pay-in-four plan does not charge any interest or late fees, and can be used with millions of retailers including Best Buy, Under Armour and Target.

Sezzle

More than 47,000 retailers partner with Sezzle, which offers a pay-in-four biweekly BNPL plan with no interest. You may incur fees for rescheduled or failed payments.

Zip

Previously known as Quadpay, this BNPL provider offers a pay-in-four plan that charges a $1 convenience fee per payment. And if you miss a payment deadline, you’ll be charged a late fee of $7.

How Do I Use Buy Now, Pay Later?

BNPL consumers must be over the age of 18 and have a mobile phone number. Interested shoppers also need to provide the following information:

- Full name

- Address

- Date of birth

- Phone number

- Social Security number

- A payment method such as a credit or debit card, Paypal or bank account

Some BNPL providers require a soft credit check before your payment plan is approved. The soft check will not impact your credit score, and you will be approved or denied almost immediately after the check is completed.

In rare cases, a BNPL provider may perform a hard credit check, so be careful to read the fine print when you apply for a purchase payment plan.

Does My Credit Card Company Offer Buy Now, Pay Later?

Most credit cards charge high-interest rates on unpaid balances. If you are carrying a credit card balance, a payment plan can help you avoid interest on purchases that you can’t pay off in full.

You may already have a BNPL plan at your fingertips if you hold an eligible credit card through one of these companies:

American Express Plan It

American Express Plan It allows you to pay off larger purchases over a longer period of time. You’ll be offered one to three plan duration options to choose from, and each will incur a monthly fixed fee until your balance is paid off.

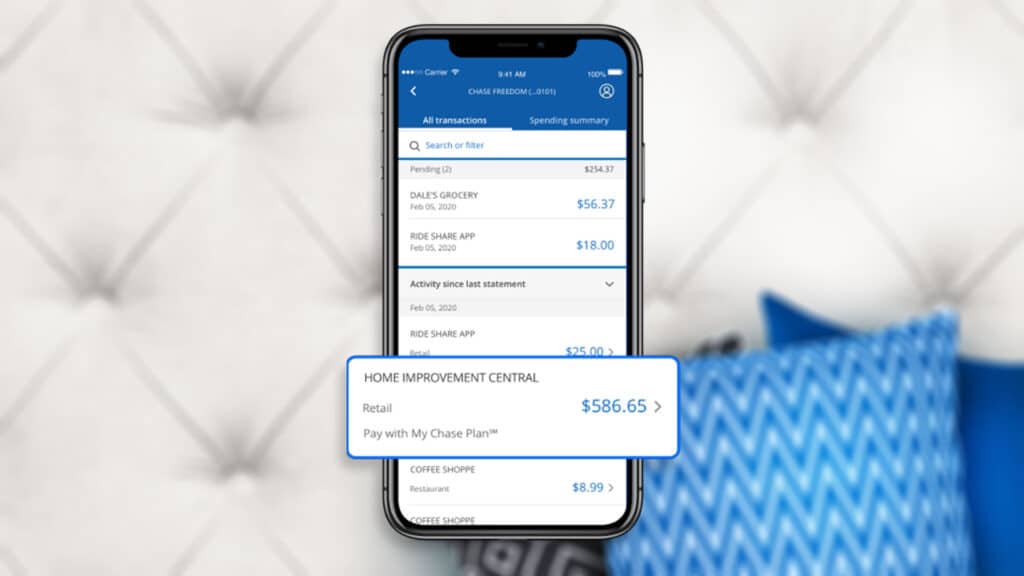

Chase My Chase Plan

With My Chase Plan, you will be offered one to three plans ranging from three to 18 months in duration. Plan durations and fees are based on the purchase amount, as well as your credit history and creditworthiness.

Citi Flex Pay

Citi Flex Pay can be used at checkout on qualified purchases with Amazon, or similarly to Plan It or My Chase Plan after completing an eligible transaction through any other retailer. The monthly payment will be added to your minimum payment due each month.

Apple Card Monthly Installments

The Apple Card, issued by Goldman Sachs, offers a 0% APR monthly payment option (ACMI) on certain Apple products when purchased directly through an Apple Store.

Apple’s BNPL plan is more like Klarna or Affirm than the plans offered by Amex and Chase. If you don’t select the ACMI option at checkout when purchasing an eligible Apple product, your purchase will appear as a standard transaction on your Apple Card, and you’ll have to pay it off on your next statement.

Buy Now, Pay Later: Pros and Cons

Pros

- Available at checkout with many major retailers.

- Easier to obtain than a traditional loan.

- Many plans are interest-free and incur no fees if paid off on time.

- Allows consumers to finance necessary purchases.

Cons

- Tempting to spend beyond budget or make unnecessary purchases.

- Some plans may trigger a hard credit check.

- Plans may incur late fees and interest if not paid on time.

- Late or missed payments may hurt credit score.

- Consumers may not have access to credit card protections in some cases.

Should I Use Buy Now, Pay Later?

At the end of the day, BNPL is simply a tool; whether it benefits or hurts your finances depends on how you use it.

If you need to purchase a new laptop or furniture right away, for example, a BNPL plan can help you acquire the products you need without incurring credit card debt. But if you have a shopping habit that’s getting out of control, BNPL can easily tempt you down a slippery slope of overspending.

If you do decide to sign up for a BNPL plan, make sure you read the fine print carefully — and save a copy somewhere that is easy to find later on.

Where possible, choose a no-interest plan and set up calendar alerts to remind yourself to pay your installments on time to avoid incurring late fees. If your plan automatically charges your credit card or debits your bank account for the remaining payments, make sure you have enough money on hand to avoid declined transactions and subsequent late fees — or even having your debt sent to collections if you forget about what you owe.