Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

If you have an emergency fund, a down payment fund or other short-term savings, a good high-yield savings account can keep your money safe and also reward you with a high interest rate.

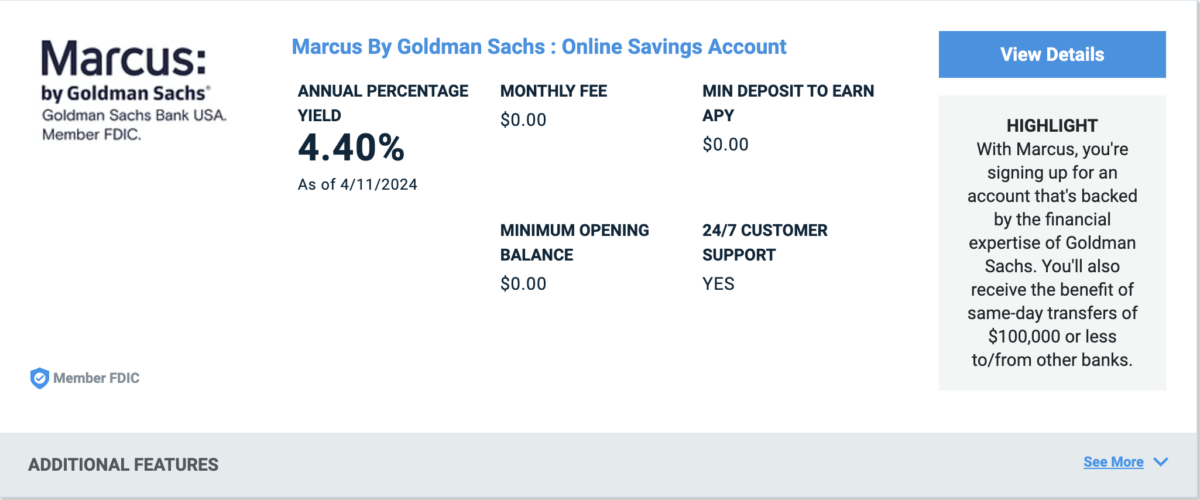

These savings accounts often offer annual percentage yields (APYs) several times higher than the national average, which the FDIC pegs at 0.42%. Marcus by Goldman Sachs® is one bank that offers such a high yield, currently offering an impressive 4.30% APY.

Here’s what you need to know about the Marcus by Goldman Sachs Online Savings Account, as well as its other savings products, and how they stack up against other options.

Marcus by Goldman Sachs Online Savings

Marcus by Goldman Sachs is an online bank, which means it doesn't have any brick-and-mortar branches. However, that means the bank has fewer overhead costs and can afford to provide a higher yield on your deposits.

Features

The Marcus Online Savings account is FDIC insured for up to $250,000. The account offers a high APY on your deposits, with no minimum deposit requirement or monthly fees.

Generous Annual Percentage Yield

This Marcus account offers 4.30% APY on your deposits, making it one of the top high-yield savings accounts on the market. The interest you earn is compounded daily and added to your account on a monthly basis, which is standard for most high-yield savings accounts.

And unlike some other high-yield savings options, your APY won't go down as your balance grows. There is, however, a general deposit limit of $1 million per account and $3 million per customer.

Remember, though, that like all bank accounts, the interest you earn is considered taxable income, and you'll receive a 1099-INT form each year, which you can use to report your earnings.

Referral Bonus

If you refer a friend who opens a Marcus account, both you and the new customer will receive a yield that's 1.00% higher than the stated APY for three months.

No Monthly Fees or Deposit Requirements

It's fairly common for high-yield savings accounts to have no monthly fees, and the Marcus Online Savings account is no different. Additionally, there's no minimum deposit requirement when you open the account, and your balance doesn't need to meet a requirement to start earning interest.

There doesn't appear to be an overdraft fee associated with the account, but if your account remains negative for 60 days, Goldman Sachs may close it.

Funding Your Account

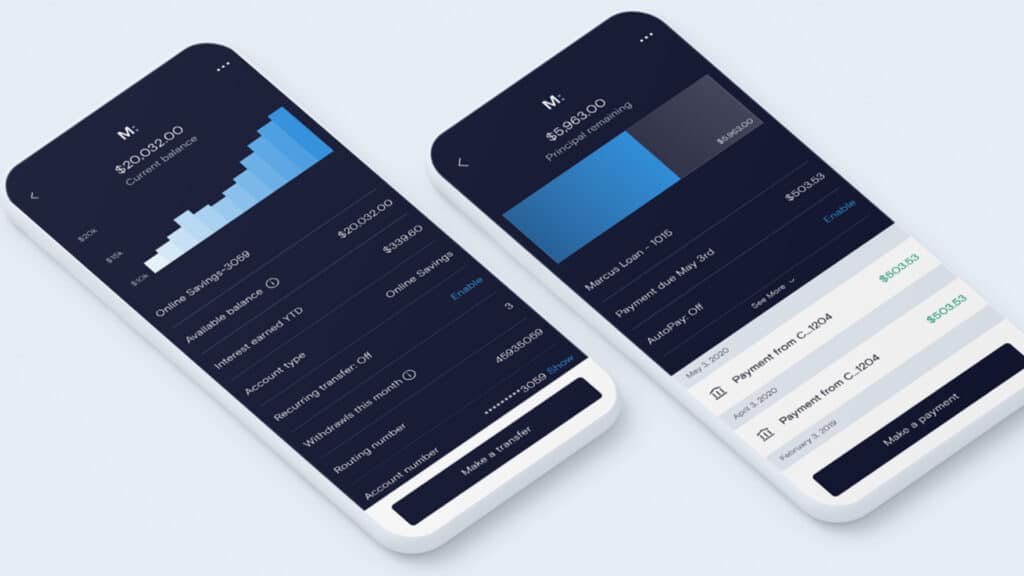

Unlike other bank accounts, the Marcus account doesn't offer check deposits via the mobile app. However, there are four other ways you can fund your account, including:

- ACH transfers, with the option for same-day transfers of $100,000 or less, depending on when you submit your request

- Direct deposit from your employer

- Mail a check (cash deposits are not allowed)

- Send a domestic wire transfer from your primary checking account

Accessing Your Funds

Unfortunately, you won't receive a debit or ATM card with your savings account. However, you can access the funds in your online bank account in the following ways:

- ACH transfers initiated with Marcus or your other bank account

- Wire transfer initiated through customer service

- Have a check sent to you

Additionally, Marcus by Goldman Sachs doesn't limit your withdrawals to six per month as many other banks do. You can make as many withdrawals as you'd like without worrying about an extra fee.

Customer Service

The Marcus customer service team is available 24/7, so you don't have to worry about being left high and dry outside of business hours with your Online Savings Account. You can reach customer service by calling 1-855-730-7283 or through a live chat function in your online account (not available in the Marcus app).

Other Financial Products

Goldman Sachs offers a handful of other financial products. One notable absence is a checking account, which you can't get alongside your Online Savings account with the bank.

With that said, here's what else you might consider for long-term savings, borrowing or investing.

High-Yield Certificate of Deposit

With a high-yield CD from Goldman Sachs, you'll get some of the best CD rates on the market. The bank offers maturities ranging from six months to six years:

| CD Term | APY |

|---|---|

|

10 months (special expires 9/15/23) |

5.05% |

|

7-month No-Penalty CD |

0.45% |

|

11-month No-Penalty CD |

0.35% |

|

13-month No-Penalty CD |

4.50% |

|

6 months |

4.85% |

|

9 months |

4.90% |

|

12 months |

5.00% |

|

18 months |

4.90% |

|

24 months |

4.40% |

|

36 months |

4.30% |

|

48 months |

4.00% |

|

60 months |

3.80% |

|

72 months |

3.70% |

What's more, Goldman Sachs offers a 10-day rate guarantee, which means that if the yield increases within 10 days of opening your account, you'll get the higher rate.

There is, however, a $500 minimum balance when you open the account. The account is insured by the FDIC.

No-Penalty Certificate of Deposit

With the Goldman Sachs No-Penalty CD, you can withdraw your money at any time (beginning seven days after funding the account) without incurring a penalty. For that, however, you'll be offered a lower rate. You can choose between a 7-, 11- or 13-month term, and APYs range from 0.35% to 4.50%. To maximize your CD rates, it's best to go with the 13-month option.

The only limitation is that you have to wait at least seven days after funding the account to access your money. As with the high-yield CD, the minimum deposit requirement is $500. The account is insured by the FDIC.

Rate Bump Certificate of Deposit

This specialized CD allows you to take advantage of increasing interest rates, even after you open your account. If Goldman Sachs raises the interest rate on the account, you can bump your APY up to the new rate once during your term.

The Rate Bump CD has a 20-month maturity and a 4.35% APY. There is a penalty if you withdraw your money before the account matures, and there's a $500 minimum balance. The account is insured by the FDIC.

Build your savings fasterExplore the Best CD Rates

Visit the Marketplace

Borrowing

Goldman Sachs Bank USA offers no-fee personal loans from $3,500 to $40,000, which you can use for debt consolidation or home improvements. The bank also offers a Buy Now, Pay Later service called Marcus Pay®, which allows you to make point-of-sale purchases from $300 to $10,000, and pay them off over six, 12 or 18 months with interest.

However, Marcus is now only offering personal loans to applications with a personal invitation code, which will limit this option for most people.

Marcus by Goldman Sachs

- Loan Amounts$3,500 – $40,000

- Loan Terms36 - 72 months

- APR Range6.99% – 24.99%

- Minimum

Credit ScoreNot disclosedA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Personal loans offered through Marcus by Goldman Sachs come with unique features, such as no fees, rewards for on-time payments, rate discounts, and the ability to change your due date.

Investments

With Marcus Invest, you can take advantage of investment portfolios built by the experts at Goldman Sachs. The robo-advisor platform uses algorithms to manage your portfolio for a light 0.25% annual fee.

Marcus by Goldman Sachs Online Savings Account Pros and Cons

This savings account offers solid value, but there are some notable drawbacks to keep in mind if you're thinking about opening one.

Pros

- The APY is much higher than the national average

- Can transfer up to $100,000 to another account on the same day

- Don't have to maintain a certain balance to earn interest or to avoid monthly fees

Cons

- No ATM network

- No checking account

- No cash deposits

How the Marcus Online Savings Account Stacks Up

There are a lot of high-yield savings accounts out there, so it's important to shop around and compare all of your options before settling. Here are some other banks to consider.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

UFB Direct Portfolio Savings Account |

3.90%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

3.75%

Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of day account balance. *APYs — Annual Percentage Yields are accurate as of November 20, 2025: 0.25% APY on balances of $0.01 to $4,999.99; 3.75% APY on balances of $5,000.00 or more. Interest Rates for the Platinum Savings account are variable and may change at any time without notice. The minimum to open a Platinum Savings account is $100. |

$100 minimum deposit |

Open Account |

|

|

3.65%

APY — Annual Percentage Yield is accurate as of November 20, 2025. Interest Rates for the Savings Connect Account are variable and may change at any time without notice. The minimum to open a Savings Connect account is $100. Fees could reduce earnings on the account. |

$100 minimum deposit |

Open Account |

Is the Marcus Online Savings Account Right for You?

The online high-yield savings account offers a decent interest rate, but it's not the best on the market. So, if you're looking to maximize your savings, take the time to shop around and compare accounts to determine the right one for you.

The account does skip the fees and doesn't have a minimum balance requirement, but you can find those features among other accounts as well.

One feature that does set Goldman Sachs apart from the competition is the ability to make same-day transfers from your external accounts. Because this is one of the only ways to fund your account, it's a great benefit, particularly if you need to transfer money out of savings for an emergency or other immediate need.

With that said, the account likely isn't a good fit for someone who prefers to have in-person service or who wants to maintain their checking and savings accounts with the same financial institution. And if you use cash often and want the option to deposit cash into your savings account or withdraw cash from your account with an ATM, the Marcus account can't help you with either of those options.

Bottom Line

Finding the right savings account for your short-term funds can take time. While some accounts may offer high yields, they may not provide a lot of the same features you're looking for.

The Marcus Online Savings Account may be such an account for some consumers, so it's important to research and compare multiple options before you make a decision.

The most important thing is that you determine which high-yield savings account is the right one for you based on its features, fees, balance minimums, customer service and other financial products.