Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Ally Bank® is an online bank that offers checking and savings accounts, certificates of deposit (CDs), credit cards, loans and investment accounts. The bank's savings accounts and CDs offer competitive interest rates, allowing you to earn up to a 5.00% annual percentage yield (APY) on your deposits.

If you're looking for a place to stash some cash for the short term or for a while, here's how Ally Bank's Online Savings Account and CDs can help you make the most of your money.

Ally Bank Online Savings Account

Ally Bank's Online Savings Account is a high-yield savings account that offers 4.00% APY on your balance. While far from the best high-yield savings rate available right now, it's still considerably higher than the national average, according to the FDIC.

Note, however, that savings and CD rates can fluctuate regularly, so be sure to visit Ally Bank's website for the most up-to-date APYs.

The Ally Bank Online Savings Account has no minimum balance requirement, no minimum opening deposit and no monthly maintenance fee. There's also no fee for overdrafts, expedited ACH transfers, cashier's checks or incoming wire transfers. The account also offers some tools to help you with your savings goals:

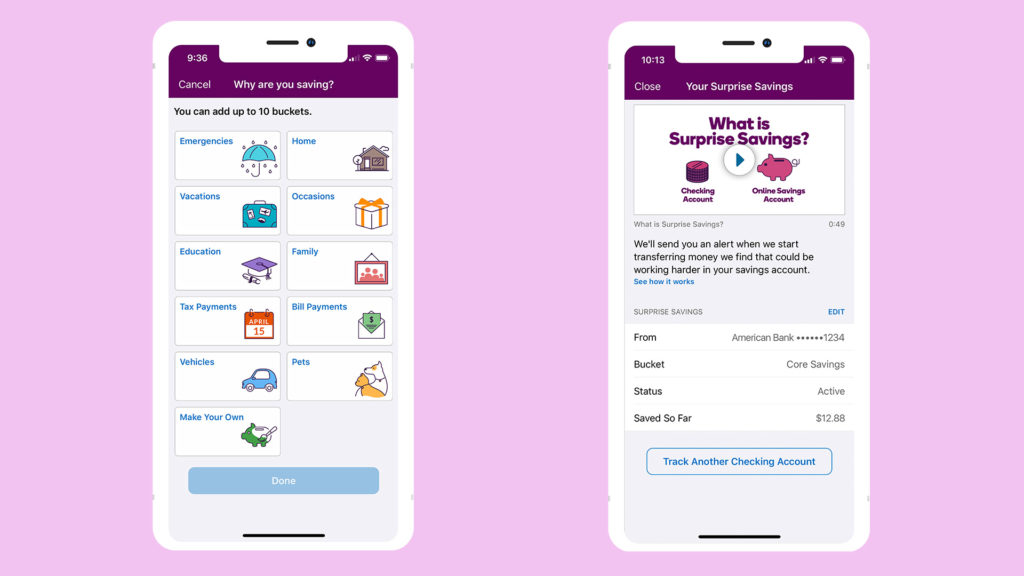

- Buckets: With buckets, you can create digital envelopes within your savings account for different financial goals. You'll be able to separate your savings into up to 10 sub-accounts, set goals and track your progress toward them. Some other banks allow you to create multiple savings accounts for the same purpose, but Ally's approach keeps things simple with just one account.

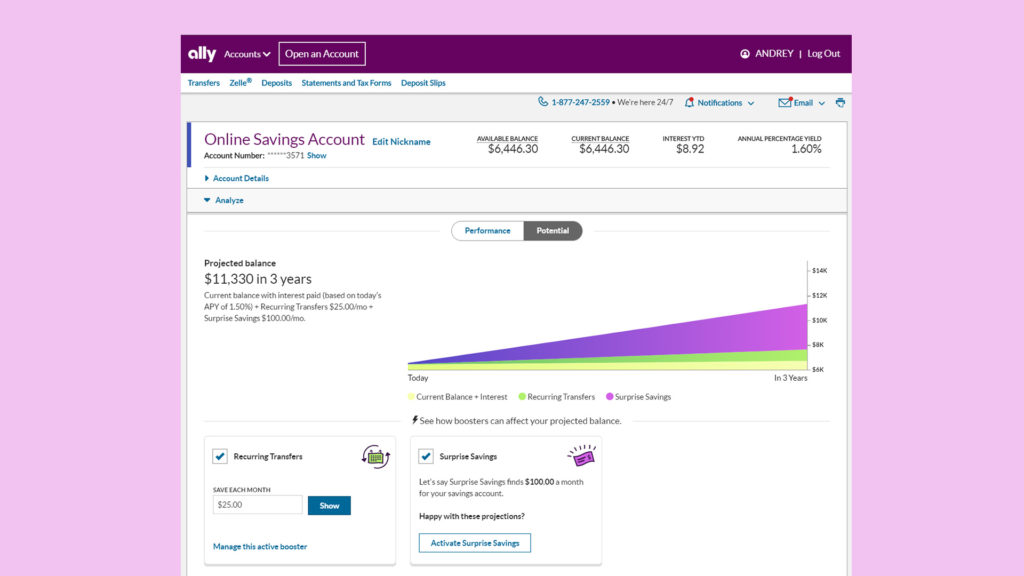

- Surprise Savings: Ally can analyze your linked checking accounts and automatically transfer money that's safe to save — meaning it's not earmarked for bill payments based on your account activity — so you don't have to do it manually.

- Round Ups: If you have an Ally Interest Checking account, Ally can round up certain transactions, including debit card purchases, electronic payments and checks, to the nearest dollar. Once those round ups have reached $5 to $20, the bank will automatically transfer the money to your online savings account.

- Recurring Transfers: As with most banks, Ally allows you to set up recurring transfers from your checking account to your savings account, making it easier to budget your savings.

If you're looking for tools and resources to help you set and work toward your financial goals, Ally has a lot to offer.

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

UFB Direct Portfolio Savings Account |

3.90%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

3.75%

Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of day account balance. *APYs — Annual Percentage Yields are accurate as of November 20, 2025: 0.25% APY on balances of $0.01 to $4,999.99; 3.75% APY on balances of $5,000.00 or more. Interest Rates for the Platinum Savings account are variable and may change at any time without notice. The minimum to open a Platinum Savings account is $100. |

$100 minimum deposit |

Open Account |

|

|

3.65%

APY — Annual Percentage Yield is accurate as of November 20, 2025. Interest Rates for the Savings Connect Account are variable and may change at any time without notice. The minimum to open a Savings Connect account is $100. Fees could reduce earnings on the account. |

$100 minimum deposit |

Open Account |

Ally Bank Certificates of Deposit

Ally offers three types of CDs, including a traditional high-yield CD, a bump-up CD and a no-penalty CD. These CDs offer a high fixed APY in exchange for keeping your money tied up for a predetermined time. However, the bank's specialty CDs offer a bit of flexibility. Here's what to know about your options.

Related Article

Related Article

5 Great Uses for a High-Yield Savings Account

Ally Bank High-Yield Certificates of Deposit

- Our Rating 5/5 How our ratings work

- Minimum

Deposit Required$0 - 1 Year APY4.85%

- 3 Year APY4.25%

- 18-Month APY APY5.00%

If you're in the market for a CD with a term length under two years, Ally Bank offers a lot of value with minimal risk. There's no minimum opening deposit required to open an Ally CD, and customers are protected by Ally's Ten Day Best Rate Guarantee, which is especially valuable in today's variable economic climate. In particular, Ally's 18-month CD offers one of the best interest rates currently available, regardless of term length.

Ally Bank's High-Yield CD comes with seven maturities ranging from three months to five years. Here's how the terms and interest rates break down:

| Term Length | APY |

|---|---|

|

3 months |

2.50% |

|

6 months |

3.50% |

|

9 months |

5.00% |

|

12 months |

4.85% |

|

18 months |

5.00% |

|

36 months |

4.25% |

|

60 months |

4.10% |

There's no monthly maintenance fee or minimum deposit requirement with the account, but keep in mind that you can't add more money to your CD after your initial deposit. If you renew your CD after it matures, Ally offers a loyalty reward, which is 0.05% at the time of this article's publication—check the bank's website for the current rate.

Additionally, Ally offers a Ten Day Best Rate Guarantee, which means that if you deposit your money within 10 days of opening the account, you'll get the best APY the account offers for your term and balance tier during that time.

If you withdraw your money before the account matures, Ally will assess a penalty worth between 60 and 150 days of interest, depending on your CD's term.

Other CDs to Consider

CIT Bank Term Certificates of Deposit

- Our Rating 3.5/5 How our ratings work

- Minimum

Deposit Required$1,000 - 1 Year APY0.30%

Annual Percentage Yield is accurate as of March 31, 2023. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

- 3 Year APY0.40%

Annual Percentage Yield is accurate as of March 31, 2023. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

- 6-Month APY5.00%

Annual Percentage Yield is accurate as of March 31, 2023. Interest rates for CIT Bank's term CDs are variable and subject to change at any time without notice

Many banks that offer CDs require customers to commit to lengthy terms of several years or more in order to earn the highest interest rates available. However, with CIT Bank's term CDs, the opposite is true. To get the best rates at CIT, you'll need to open one of its shorter-term CDs, such as its 6-month CD that pays 5.00% APY. If you want an easy way to save more money without having to wait years, CIT Bank's term CDs are a solid option.

Synchrony Bank Certificates of Deposit

- Our Rating 5/5 How our ratings work

- Minimum

Deposit Required$0 - 1 Year APY5.10%

- 3 Year APY4.30%

- 9 Months APY5.00%

Synchrony Bank offers some of the most flexible CD options currently available. With terms ranging from three months to five years, as well as a Bump-Up CD and No-Penalty CD option, there's likely a certificate of deposit in Synchrony's roster that lines up with your needs. Additionally, none of Synchrony's CDs require a minimum opening balance, which is remarkably rare (many of the best CD rates require a minimum deposit of $1,000 or more). Across the board, Synchrony offers higher rates than most traditional banks, and some even outpace the best online banks' rates. All this makes Synchrony CDs an easy recommendation.

Raise Your Rate CD

Ally Bank's bump-up CD offers just two terms: 24 months and 48 months. Currently, the APY is 3.75% for both terms, but if Ally raises its rate on the account at any time during your account's term, you can raise your rate along with it. The bank allows you to bump up to the current rate once with a two-year term and twice with a four-year term.

As with the High-Yield CD, Ally offers a 0.05% loyalty reward if you renew your CD after it matures and a Ten Day Best Rate Guarantee. There's no minimum deposit requirement or monthly maintenance fee, and the penalty for early withdrawal will be either 60 days of interest or 120 days of interest, depending on which term you choose.

Ally Bank No Penalty Certificate of Deposit

- Our Rating 5/5 How our ratings work

- Minimum

Deposit Required$0 - 11-Month APY APY4.55%

With no minimum opening deposit requirement and no early withdrawal penalties, there is a lot to like about Ally Bank's 11-Month No Penalty CD. Its interest rate is competitive with similar no penalty CDs, and even stands up to some regular one-year CDs.

Committing to leaving your money in a CD for an extended period can be challenging for some people, especially if the penalty eats into their principal balance. With Ally's No-Penalty CD, however, you won't have to worry about getting charged to access your money.

Ally offers an 11-month term with 4.55% APY—the lower rate is to compensate for the flexibility you get. After you deposit your funds (there's no minimum requirement), you can take your money out after six days.

The account offers a 0.05% loyalty reward for renewals and the Ten Day Best Rate Guarantee benefit.

5 Best No-Penalty CD Rates in January 2026: Earn Up to 4.90% APY

Ally Bank's Online Savings vs. Certificates of Deposit

As with any financial product, there's no single best option for everyone, so it's important to think about your financial goals and your need for access to your cash to determine the right fit for you.

Ally's Online Savings Account can be a great place to stash cash for short-term goals and emergency savings. The buckets allow you the flexibility to work toward multiple savings goals at once, and the Surprise Savings, Round Ups and recurring transfer features can help you maximize your savings.

But if you know that you don't need some money for an extended period and you don't want to risk your balance by investing it, one of the bank's CDs can be a good choice. Just make sure you compare the terms and APYs to ensure you're not leaving the money in the account for too long without getting more value from it.

If you want something in the middle—a higher rate with the flexibility of withdrawing money when you need it—consider Ally's No-Penalty CD. Regardless of which option you choose, your money will be FDIC insured up to the applicable limits.

About Ally Bank

Ally Bank is a direct banking subsidiary of Ally Financial, one of the leading digital financial services companies in the U.S. The online bank can trace its roots back to 1919 when General Motors Acceptance Corporation (GMAC) was founded as a division of General Motors.

While the automaker's financing arm initially focused solely on auto financing, it added new products over the decades that followed, including insurance and home loans. At the turn of the century, GM established GMAC Bank, which was rebranded as Ally Financial in 2010.

Ally Bank not only has a rich history but also has solid products and services for your everyday banking and lending needs. The bank offers 24/7 customer service, so you can get help with your account whenever you need it.

Should You Open an Ally Bank Savings or CD Account?

Before you open an account with Ally Bank, take some time to shop around and compare high-yield savings accounts and certificates of deposit with other banks. While Ally offers some nifty tools to help you increase your savings, the bank doesn't offer the best rates on the market. As such, you'll want to weigh the value of a high APY against the features that Ally Bank offers that you won't get elsewhere.

If you want all of your banking under one roof, you'll also want to consider Ally's Interest Checking account, one of the best free checking accounts on the market, and compare it to your other options. Take your time to consider all account features to ensure you're getting the best deal.