Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Roughly 50,322,166 households in the U.S. are renters, according to the latest data from the U.S. Census Bureau. If you belong to one of those households, the Bilt Mastercard® is designed for you.

The first of its kind, the Bilt Mastercard® offers valuable features, including some unique ones, that make it incredibly appealing to renters. Here are the top seven reasons

Bilt Mastercard®

- Our Rating 4.5/5 How our ratings work

- APRSee site for details.

- Annual Fee$0

The Bilt Mastercard is absolutely worth it if you’re a renter interested in maximizing your rewards potential. Being able to earn points on rent without paying transaction fees is huge. But what makes “points” valuable is how you use them. Bilt’s loyalty program is comparable to Chase Ultimate Rewards because it has 10 travel partners in common with Chase. Just be sure you can use the card 5 times each statement period to qualify for earning points.

Overview

The Bilt Mastercard has quickly gained popularity since it launched and it’s easy to see why. The card has been dubbed a game-changer because it offers rewards on rent payments, without transaction fees. Between generous category bonuses and premium travel perks, Bilt has created a card that appeals to frequent travelers and those who want a simple rewards card.

Pros

- Earn points on rent without the transaction fee

- Generous earnings on dining and travel

- Strong rental car and purchase protections

Cons

- Doesn't earn points on mortgages

1. You Can Finally Earn Rewards on Rent

Rent is the most expensive monthly cost for millions of Americans, but using a credit card to make your monthly payment often results in convenience fees — and that's if you can use a credit card at all.

With the Bilt Mastercard®, you can pay your rent directly with your credit card — set up your payment through the Bilt app, and it'll send your landlord a check. What's more, you'll earn 1 point per dollar on your rent payments, up to 100,000 points total each calendar year, and there's no transaction fee.

Just keep in mind that you'll need to use the card for more than just rent to earn points. Wells Fargo, the card's issuer, requires you to use the card at least five times each statement period to earn rewards. Fortunately, you'll also get 3 points per dollar on dining, 2 points per dollar on travel and 1 point per dollar on all other

2. You'll Earn Double Points on Rent Day

Every month, Wells Fargo offers double points on the first day of the month. That means you'll earn 6 points per dollar on dining, 4 points per dollar on travel and 2 points per dollar on everything else.

While rent payments aren't included in the promotion, you can rack up a lot of rewards every month by timing your dining and travel

3. You Can Build Credit on Rent Payments

Unlike mortgage payments, on-time rent payments haven't historically been reported to the three national credit bureaus. While the credit reporting agencies have the infrastructure for it, and credit scoring models include rent payments, it hasn't caught on with landlords.

Fortunately, there are now several rent reporting services, such as Experian Boost, that can help you add rent payments. And now, you can also do it with the Bilt Mastercard®. If your landlord is part of the Bilt Alliance, rent payments are reported automatically. But if not, you can still use your rent to build credit by paying your Bilt credit card on time.

Related Article

Related Article

5 Credit Card Myths Hurting Your Credit Score

Just be sure to maintain a low credit utilization rate and avoid missing any payments. Otherwise, your credit score could take a

4. The Card Offers Solid Insurance Protections

While some credit card issuers have pulled back on the insurance benefits they offer, the Bilt Mastercard® has a solid set of perks to go along with its rewards program. Here's what you can expect:

- Trip cancellation and interruption insurance: You can get up to $5,000 in reimbursement for a non-refundable passenger fare if your trip is interrupted or canceled for a covered reason and you booked with your card.

- Trip delay protection: If your trip is delayed by more than six hours due to a covered reason, such as inclement weather, mechanical breakdown or air traffic control delays, you can get reimbursed for certain expenses, including meals.

- Primary auto rental collision damage waiver: If you pay for a rental car with the Bilt Mastercard® and decline the rental agency's coverage, you'll get up to $50,000 in coverage in the event that the vehicle is damaged or stolen. With most credit cards, this coverage is secondary, forcing you to rely first on your personal auto insurance policy.

- Cell phone protection: Use your card to pay your phone bill, and you'll get up to $800 in protection against theft and certain damages (there is a $25 deductible).

- Purchase security: Eligible items purchased with your card can be covered up to $10,000 if they're damaged or stolen within 90 days of your purchase.

The card also doesn't charge a foreign transaction fee when you use it to make purchases

5. You Can Transfer Your Points to Travel Loyalty Programs

The Bilt Mastercard® isn't the only no-annual-fee credit card with the ability to transfer your points to airline and hotel loyalty programs, but its list of transfer partners is one of the best out there. You'll be able to transfer your rewards at a 1:1 ratio to the following travel programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- American Airlines AAdvantage

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Emirates Skywards

- Flying Blue Air France/KLM

- Hawaiian Airlines HawaiianMiles

- IHG Rewards Club

- Iberia Plus

- Turkish Airlines Miles & Smiles

- United Airlines MileagePlus

- Virgin Flying Club

- World of Hyatt

Depending on how you redeem your rewards with one of these partners, you could get far more than the standard 1 cent per point

6. You Can Redeem Points Toward Homeownership

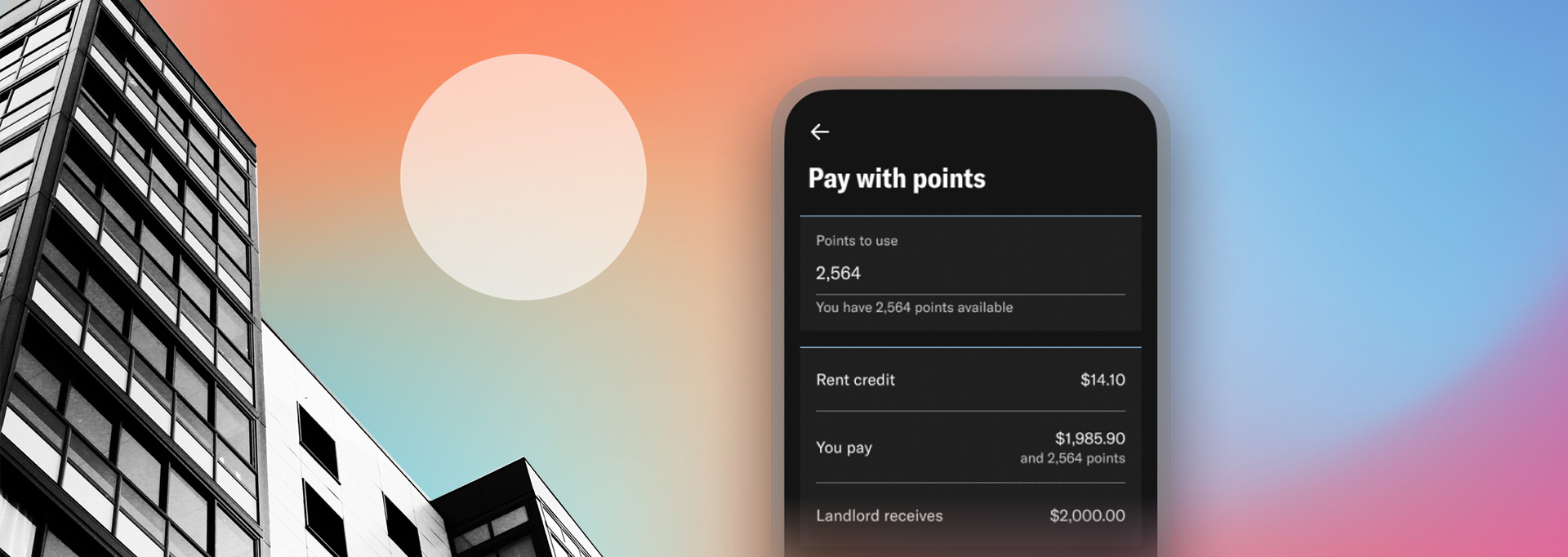

You can redeem your points for a number of things, including future rent payments. That said, your points are worth only 0.55 cents each when you redeem them this way.

You can also save up your hard-earned rewards and put them toward a down payment on a home purchase, giving you up to 1.5 cents per point in value. If you like the idea of buying a place of your own someday, the second option can be incredibly appealing.

Another solid redemption option is to use your points to book travel through the Bilt travel portal. Redeeming them this way will give you 1.25 cents per point in

7. You Can Earn Interest on Your Points

Once you've earned 25,000 points with Bilt Rewards, you can start earning interest on your points. The rate at which you earn isn't super high — Bilt bases it on the FDIC published national savings rate, which is 0.42% as of July 17, 2023.

However, offering even a little interest on your rewards makes the Bilt Mastercard® unique among rewards

The Bottom Line: Is the Bilt Mastercard® Right for You?

The Bilt Mastercard® by Wells Fargo offers some impressive rewards and benefits for a card that doesn't charge an annual fee. If you're a renter and don't plan on changing that anytime soon, this card offers something you can't get with any other credit card — the chance to earn rewards on your rent payments without a convenience fee.

Even if you don't use it as your primary credit card — just be sure to use it at least five times a month — the card can offer a lot of value on your most consistent monthly expense.

One notable feature the card is missing is a welcome bonus. Similar no-annual-fee credit cards typically offer bonuses worth $200 to $300, depending on the card. But considering you can get far more value each year on rent payments alone with this card, it's worth missing out on a one-time incentive.

Ready to Apply for the Bilt Mastercard®? Start here.

As with any credit card, however, it's important to take your time and compare the Bilt Mastercard® with other available options. Shop around and compare credit cards based on your credit profile, spending habits and feature preferences to determine the best fit