Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

As millions of kids around the country are getting ready to head back to school, many parents’ pocketbooks are still left reeling from one of the most enduring financial impacts of the pandemic: high inflation.

Slickdeals partnered with Suzy, a data analytics firm, to commission a survey of 1,080 parents on August 3, 2023, to help shed some insights on how parents are planning to spend for the 2023 back-to-school shopping season. While high inflation remains important for just about everyone, parents are relying on many different strategies to cope with larger back-to-school budgets.

Inflation Remains a Concern for Many Parents

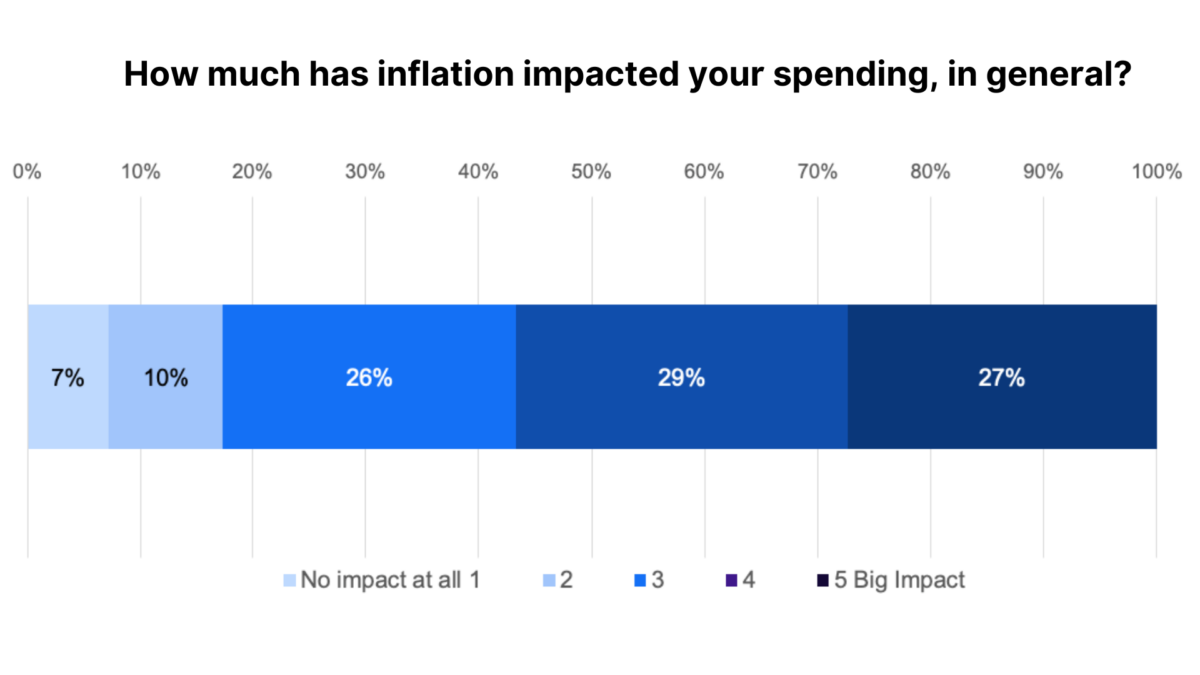

When asked how much inflation has affected their overall spending patterns, the majority of parents (56%) ranked it as having a moderate or large impact. Thankfully, inflation has been steadily decreasing since last year’s back-to-school shopping season when inflation reached its highest peak since the 1980s, but it’s remaining stubbornly high.

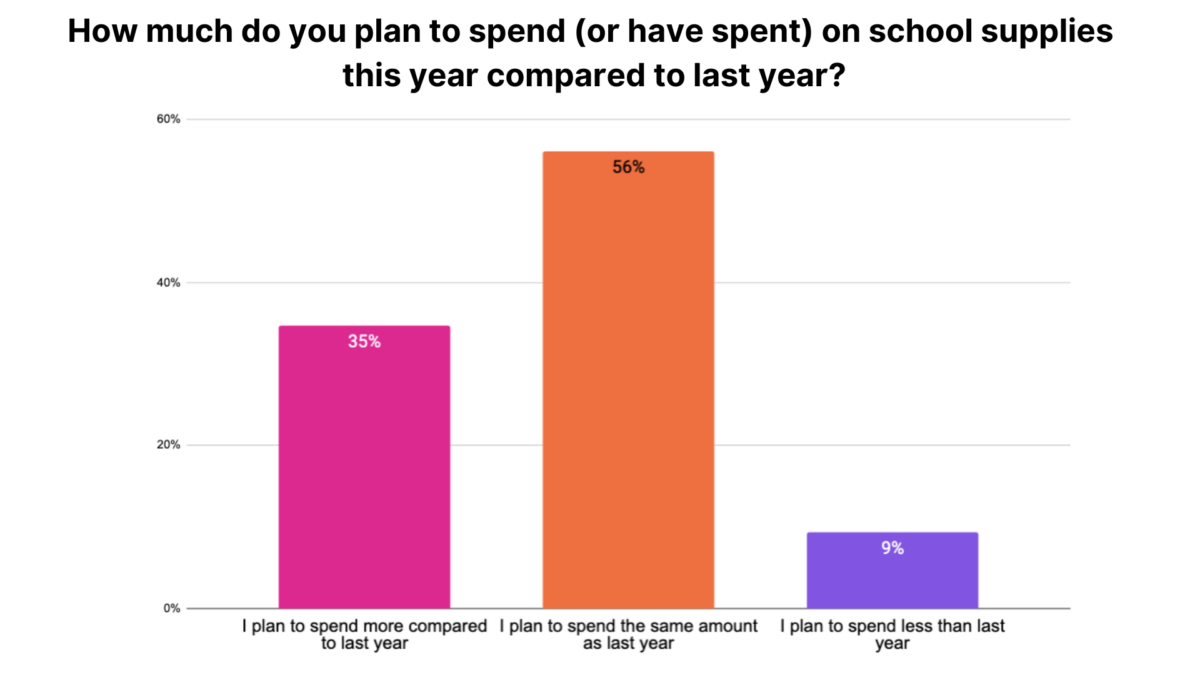

Although inflation still remains a top concern for parents, the majority of parents said they were planning to spend either the same (56%) or even more (35%) than last year. Only 9% of parents said they plan to spend less this year. It's possible that parents may be cutting back on spending in other areas to accommodate higher prices and bigger back-to-school budgets.

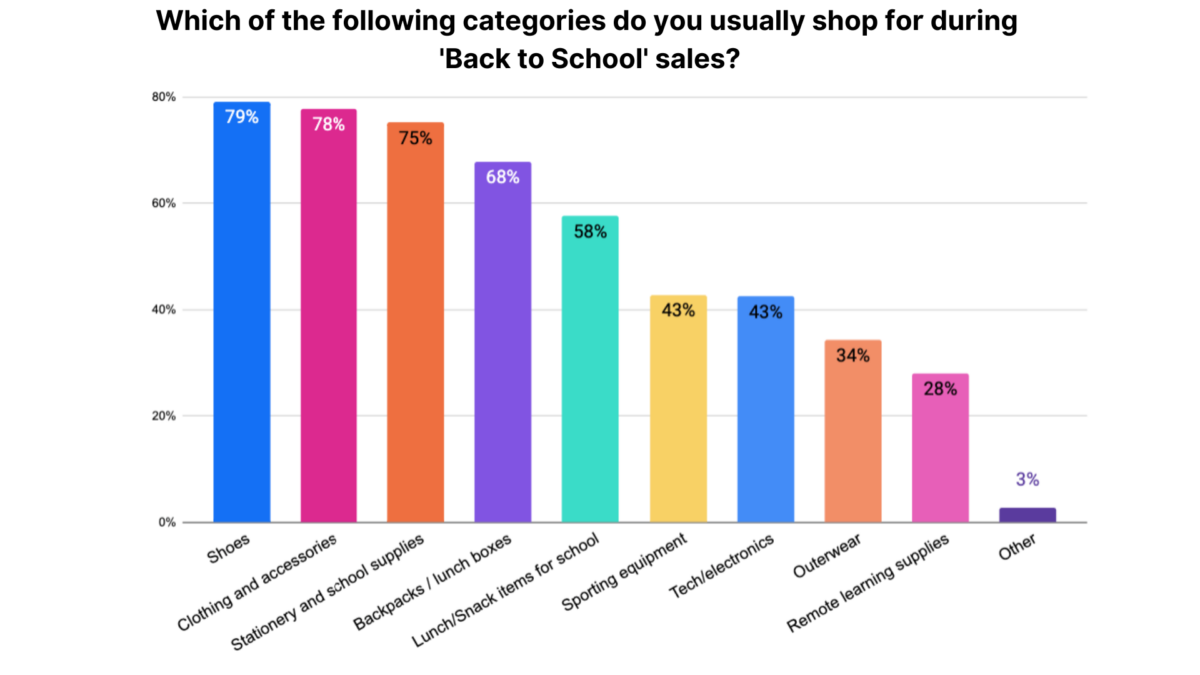

Most people planned to buy familiar staples during their shopping, with shoes, clothing and accessories, stationery and school supplies, and backpacks and lunchboxes making it onto the majority of parents’ shopping lists.

Most Parents Are Planning on More Debt

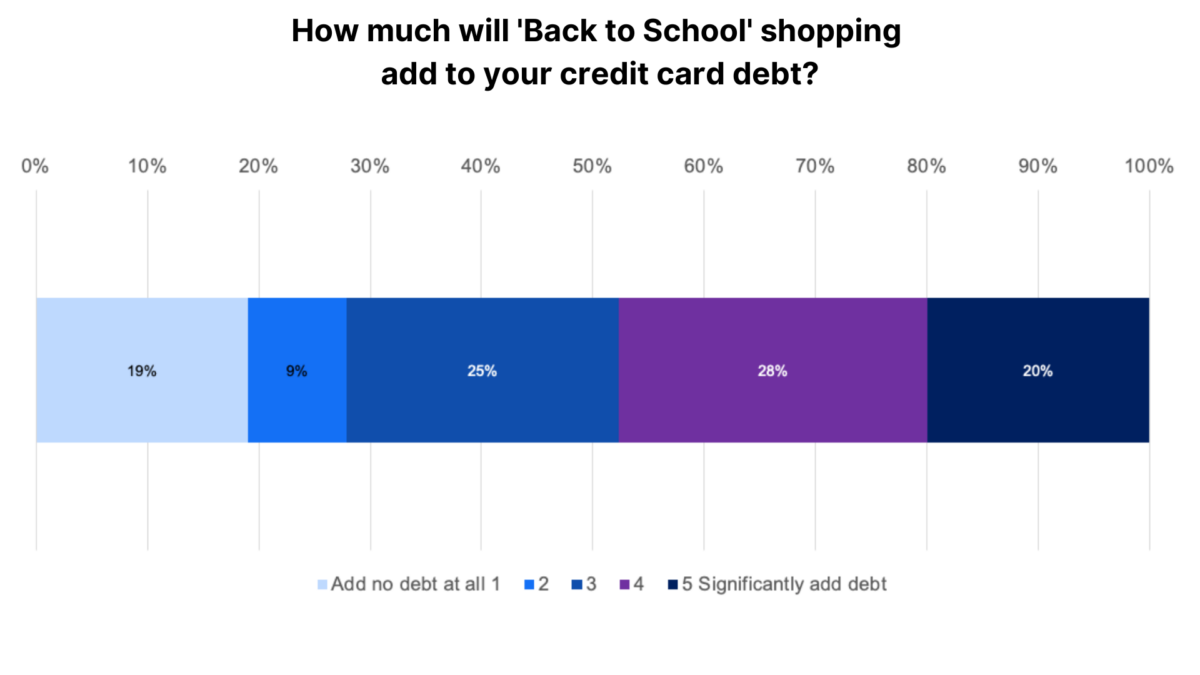

Higher prices are forcing many parents to make tough calls. If parents aren’t able to pay for back-to-school shopping out of pocket, they have two choices: not buy anything at all, or go into debt. Many parents choose the latter.

Only 19% of parents didn’t plan on going into debt for their back-to-school shopping choices. That leaves 81% of parents who do choose debt, and sometimes by a large amount: About 20% of parents believe their back-to-school shopping will “significantly” add to their household debt levels.

Women Are More Budget-Conscious Shoppers

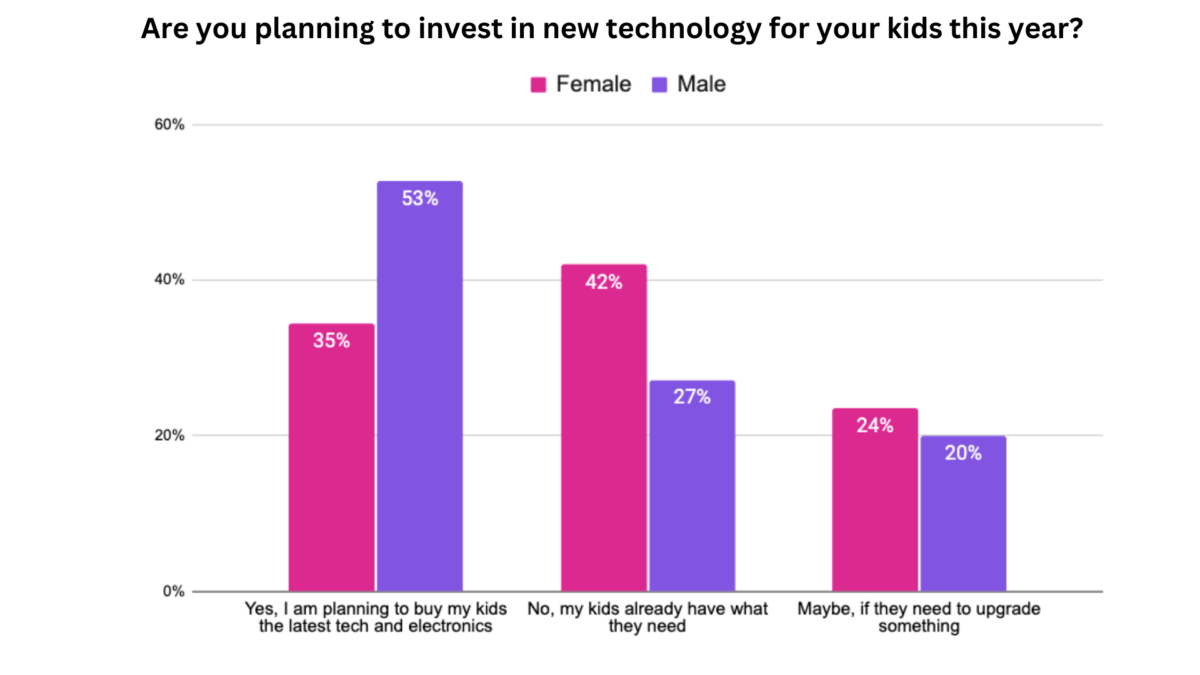

Technology and electronics were a particularly interesting case; more men tended to spend in this area than women. While 42% of women said their kids already had all the techy things they needed, the majority (53%) of men were planning on buying new gadgets for their kids in this category. Men were also more likely to shop for sporting gear for their kids than women (52% vs. 34%, respectively).

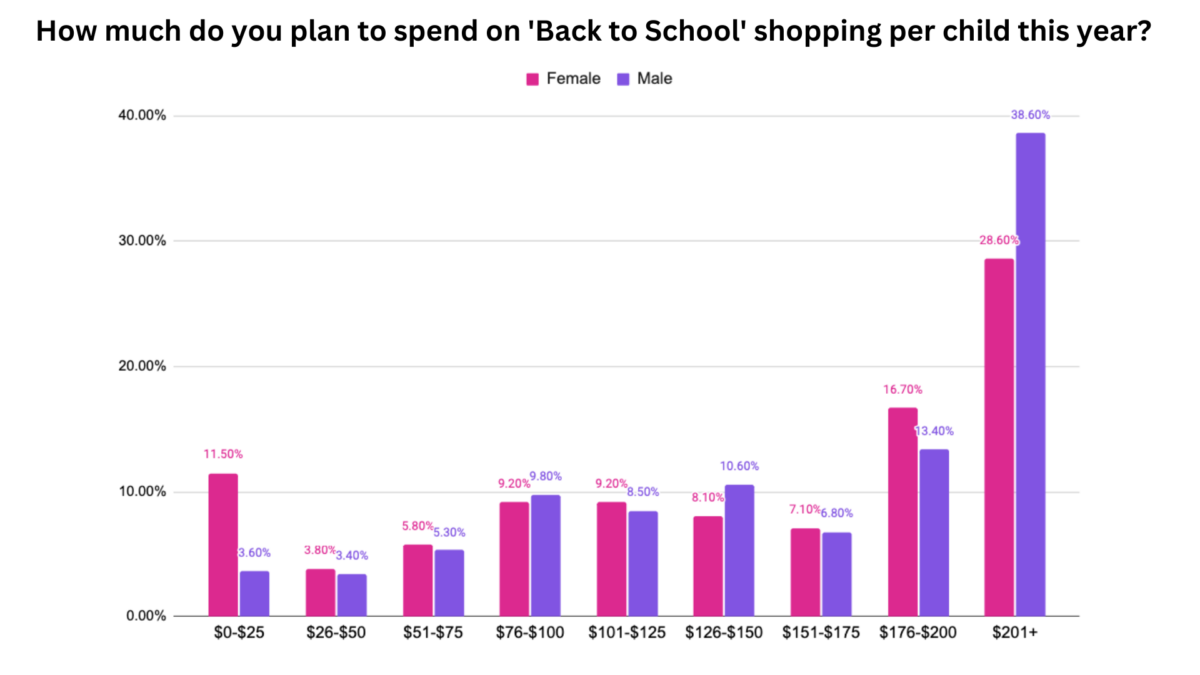

Shopping for pricey electronics and sports gear was likely one of the reasons why men tended to spend a lot more than women, too: 39% of men were planning on spending over $200 on their kids’ school shopping, compared to only 29% of

In fact, it seemed rather polarizing for women. Almost half still planned to spend at least $175 on their kid’s back-to-school shopping, even if they weren’t planning on spending as much as men. But if mothers weren’t spending that much, the remainder tended to nearly forego back-to-school shopping entirely, with 12% spending $25 or less. Relatively few women aimed for the middle, spending between $25 and $175.

Parents Prefer a Better Selection Over the Lowest Price

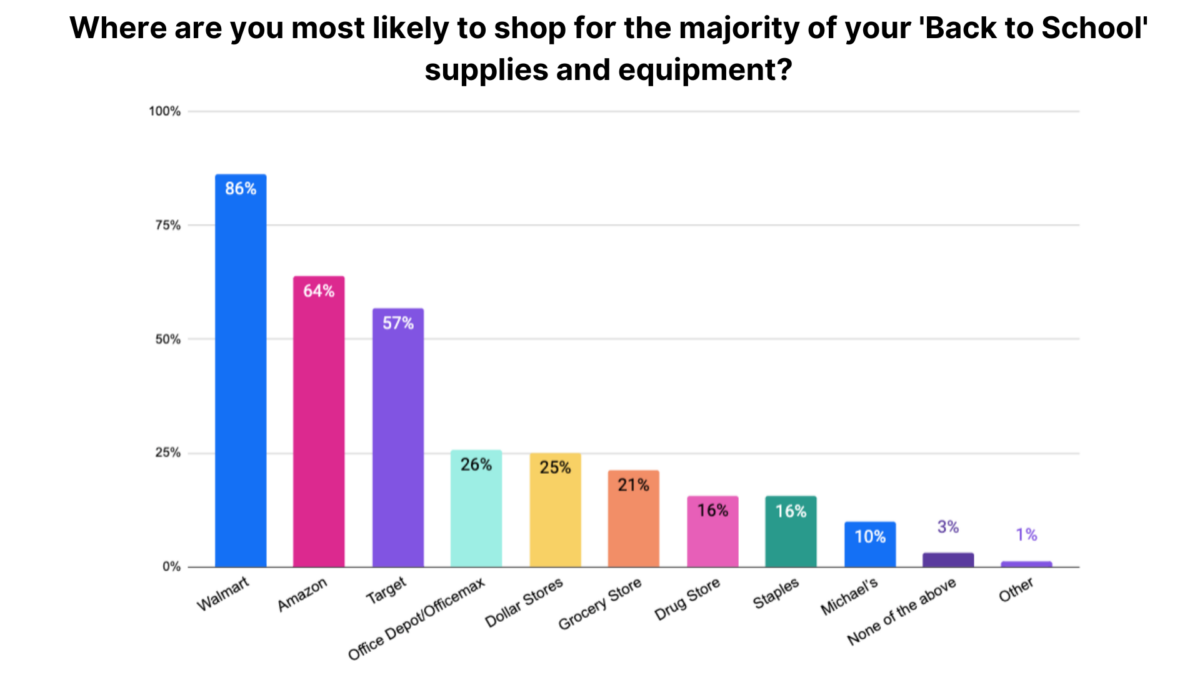

Heading to the big-box retailers to get their back-to-school shopping done was a popular option for surveyed parents, likely because respondents believe those stores tend to carry the best selection on school supplies.

As you might expect, Walmart topped the list of places most parents (86%) were planning to get their back-to-school shopping done, with Amazon (64%) and Target (57%) trailing behind.

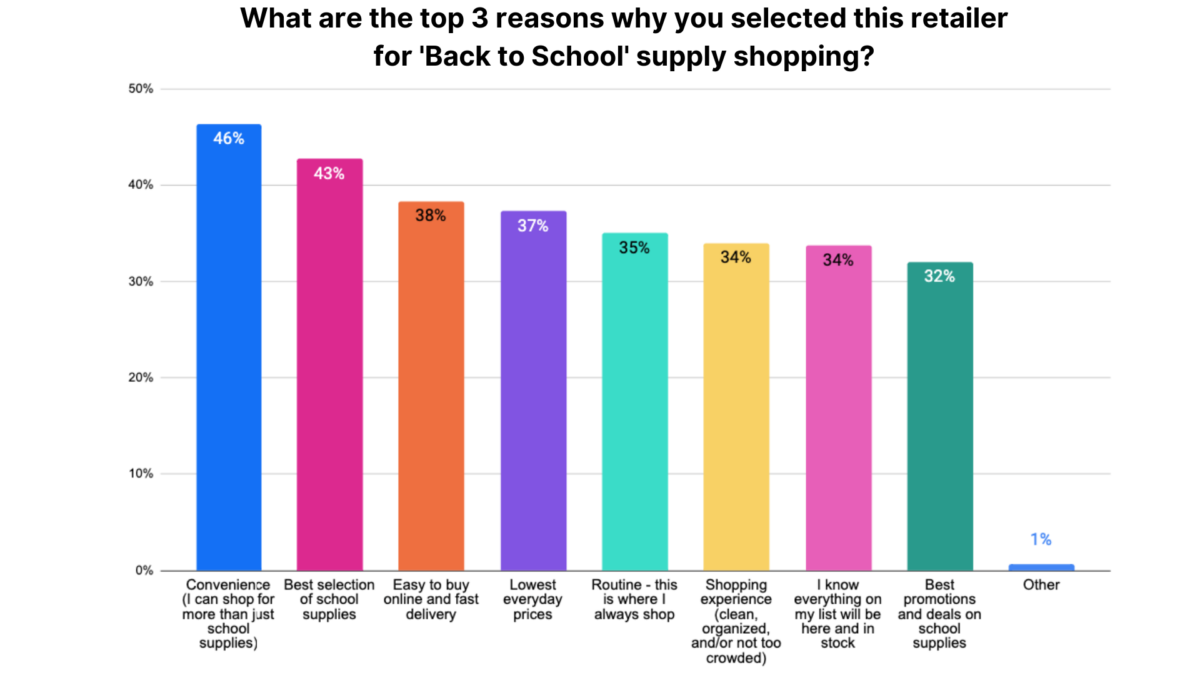

In fact, having the biggest selection of items to choose from—beyond school supplies—was the most important factor when parents were deciding where to get their shopping done, even more so than the prices.

Around 46% of all respondents ranked a one-stop shop as the number one factor when choosing where to buy. Surprisingly, the lowest everyday prices did not make it into the top three reasons for many people, with only 37% of respondents ranking it in their top three.

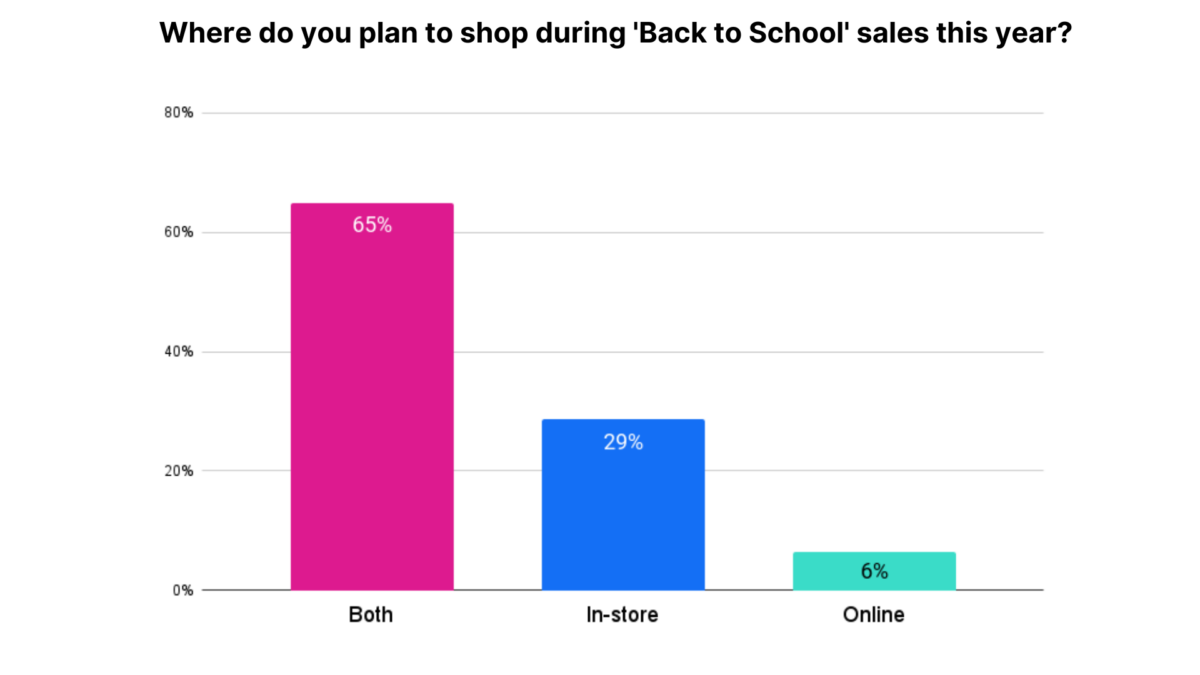

Given that most parents placed a higher emphasis on having an abundance of items to choose from, you’d think that online shopping would be preferred; yet only 6% of parents planned to do all of their back-to-school shopping online. Most parents (65%) planned to do a mix of both online and in-person shopping. That makes sense, given that items like shoes and clothing topped parents’ lists, and these can be tough to find a good fit for growing children without being able to try things on in person.

Debit Cards Still More Popular Than Credit Cards

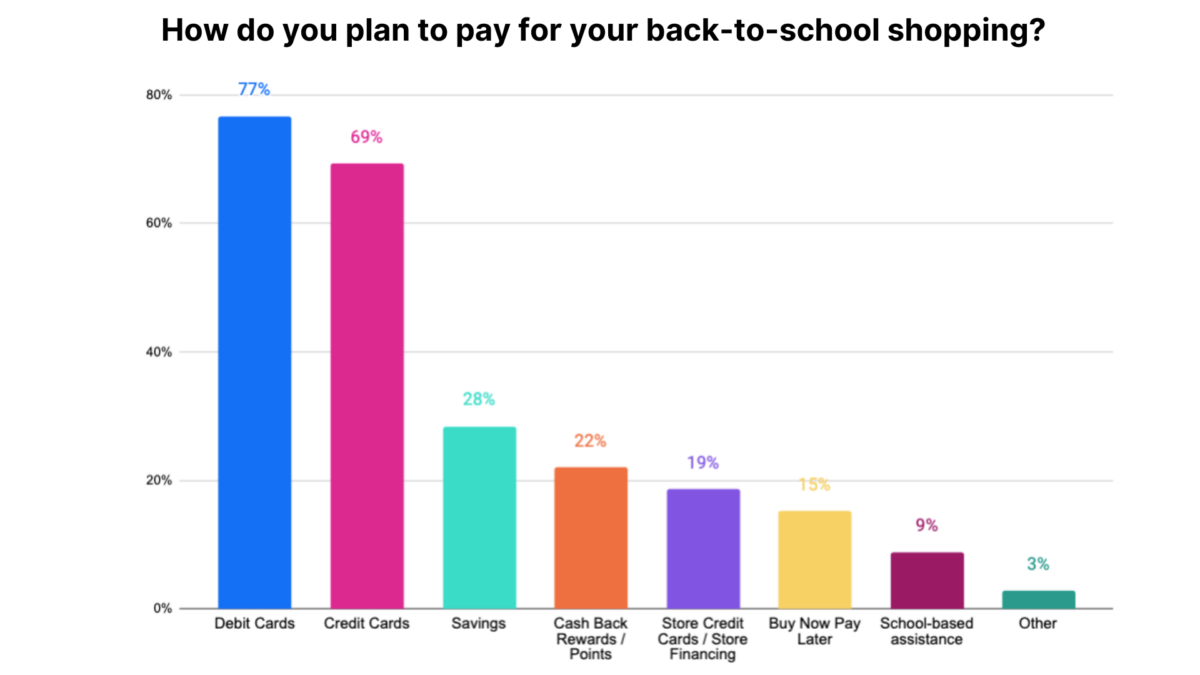

There are many ways you can pay for something, and how you pay sometimes says volumes. Paying by credit card, for example, can mean you’re looking to finance those purchases or earn cash-back rewards—or both.

Credit cards and debit cards remain the most popular payment options for parents: 69% of survey respondents planned to use credit cards and 77% planned to use debit cards. Debit cards may not offer rewards like credit cards, but they are commonly used as a strategy to help curb debt, and some may like the ease of a debit card because you don't need to worry about having to pay a bill later on.

Buy Now, Pay Later plans and store credit cards, on the other hand, were much less popular.

Start Saving for Next Year Now

Going back-to-school shopping with your kids can be an exciting but equally stressful time, especially since the pandemic has done no favors for parents. That doesn’t mean you can’t do yourself a favor in prepping your finances for next year’s school shopping season.

If you plan on taking on credit card debt, make a plan now to pay it off. There are many ways you can do this, such as taking out a debt consolidation loan, opening a new 0% intro APR balance transfer card, or just coming up with a plan to pay extra on your debt each month.

Related Article

Related Article

How ‘No Annual Fee’ Credit Cards Can Save You Money and Earn Rewards

When you’re done paying off your card—or if you’re not taking on any debt for your kid’s school expenses—make a plan to save up for next year. Create a budget so you can figure out how much you can afford to set aside monthly, then set up automatic transfers into a high-yield savings account right after you get paid each month. This way, you'll be in a better position when the new school year comes.