Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Working for yourself definitely has its advantages. You're your own boss, and hypothetically, your earning potential is unlimited. But running your own business is tough. It hardly guarantees consistent income, and you might find yourself in a pinch one month when money is tight. You could take out a personal loan to ease the burden, but getting a loan when you’re self-employed is a bit tricky.

In this guide, we'll walk you through the ins and outs of getting a loan if you're self-employed, the inherent challenges of qualifying for one, and how to choose the best one for you.

Can You Get a Personal Loan If You're Self-Employed?

Yes, you can qualify for a personal loan if you work for yourself. A personal loan offers a lump sum up front that you can use for various purposes, from basic living expenses to home improvement and debt consolidation.

Every business owner has experienced a feast and famine cycle—the ups and downs that accompany inconsistent income. Still, lenders require proof of income to get approved for a loan. For self-employed borrowers, offering up employment pay stubs isn’t an option. The trick is to show you have a steady stream of income.

Here's the kicker: Depending on your situation, getting approved for a loan when you work for yourself might not be that hard. Some lenders may also draw from financial and credit criteria beyond your income to qualify your application, such as your debt load, payment history, education, credit score and cash flow.

Ways You Can Use Your Loan

One of the beautiful things about personal loans is their flexibility in what you can use them for. Here are some examples of ways you can use the funds:

- Debt consolidation

- Office remodeling projects

- Emergency bills

- Moving costs

- Office equipment and supplies

- Conference costs and membership fees

- Travel expenses

Just be sure to check the fine print with any lender you're considering—not all lenders will let you use a personal loan to cover business expenses.

Related Article

Related Article

14 Ways You Can Use a Personal Loan

It's worth noting that lenders might allow you to use loan proceeds to start or grow your business. But other forms of business financing likely have lower interest rates and better terms, so be sure to shop around first.

Challenges of Getting a Loan When You're Self-Employed

The major stumbling block in securing financing for self-employed folks is that you might have trouble finding proof of steady income. Lenders want to make sure you have cash flow and financial wherewithal to stay on top of your loan payments.

To get around this potential challenge, aim to pay yourself a set amount each month. If your business is set up as an S-corp, you are on your own payroll as an employee. In turn, you'll be able to provide W-2 forms to the lender.

Even if you're not set up as an S-corp, you can show steady income by paying yourself a set monthly amount. For instance, wait to deposit checks on the first of the month. It might be easier said than done, but being methodical about depositing funds into your business checking account can help show that you have consistent income.

Best Personal Loans if You're Self-Employed

You can take out a loan if you're self-employed as long as you show proof of steady income. If you're using the funds for business-related expenses, you'll probably find better rates and options through other sources of business financing. But if you decide a personal loan is the right fit for you, here are some loans to consider:

- Best for Limited Credit Profiles: Upstart

- Best for Fast Funding: LendingPoint

- Best for Competitive Interest Rates: LightStream

- Best for Bad Credit: Upgrade

- Best for Consolidating Credit Card Debt: Happy Money

- Best for Small Borrowing Amounts: LendingClub

Loan results will vary based on creditworthiness, loan purpose, loan amount, and other factors.

Best for Limited Credit Profiles: Upstart

Upstart looks beyond traditional lending criteria like credit scores and leans on education and employment factors instead. As a self-employed person, you can provide tax returns and bank statements to prove income. Plus, there are no prepayment fees, and the funds can drop into your account within one business day. Just keep in mind, though, that you’ll have to pay your loan back within three to five years.

Upstart

- Loan Amounts$1,000 – $50,000

- Loan Terms36 or 60 months

- APR Range4.60% - 35.99%

- Minimum

Credit Score300 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Using artificial intelligence to help evaluate borrowers, Upstart is a unique lending platform that looks beyond your credit score for personal loan approval.

Overview

Upstart is a first-of-its-kind online lending platform that uses artificial intelligence to help make smarter lending decisions. This means the company considers factors beyond a borrower’s credit score to help determine creditworthiness. Upstart indicates its model has resulted in 43% lower rates for borrowers than traditional credit score models.

Beyond your credit score, Upstart will also look at your employment history, income and level of education when deciding whether to approve you for a loan. The company states that borrowers with credit scores as low as 300 might be able to get approved for a personal loan, though that loan may come with a relatively high APR.

Upstart’s rates are fairly competitive and loan funds are disbursed as soon as one business day after approval. This lender charges origination fees, so it’s important to read the fine print before applying.

Pros

- Considers factors beyond your credit score in lending decisions

- Loans up to $50,000

- Fast funding time

- Check rate without affecting credit score

- Low minimum credit score requirement

Cons

- No physical locations

- Limited repayment terms

- Has origination fees

- High maximum APR

- Not available in Iowa or West Virginia

Best for Fast Funding: LendingPoint

If you're in a financial pinch and need funding quick, LendingPoint can provide funding into your account in as little as the next business day for qualified borrowers.

LendingClub

- Loan Amounts$1,000 – $40,000

- Loan Terms24 – 60 months

- APR Range9.57% – 35.99%

- Minimum

Credit Score600 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Borrowers in the fair credit range who need a small loan can appreciate LendingClub's quick funding and option for direct payments to creditors with debt consolidation loans.

Overview

LendingClub can be a good fit for those looking to consolidate high-interest debt, as they offer the ability to pay your creditors directly from your loan. You can also use LendingClub loans for almost any purpose, from home improvements to medical bills. Eligible borrowers who need some assistance qualifying can apply for a joint loan, and borrowers can expect to receive funding as soon as 24 hours after approval. However, APRs do start at relatively higher rates than some competitors.

Pros

- Low minimum loan amount

- Fast funding for personal loans (receive funds as little as 24 hours after approval)

- Joint loans allowed

- Direct payment to creditors

- Check rates without a hard credit inquiry

Cons

- Has origination fees

- No physical branches

- Lower maximum loan amount than some lenders

Best for Competitive Interest Rates: LightStream

If you have solid credit and at least several years of credit history, you'll be able to snag a low interest rate from LightStream, which is among the lowest across lenders. Note that the lowest rates are only available for borrowers with high credit scores, and certain amounts and term lengths. While the online lender does boast competitive rates, you won't be able to get prequalified on the website.

LightStream

- Loan Amounts$5,000 – $100,000

- Loan Terms24 – 144 months

- APR Range7.99% – 25.49% (with autopay)

- Minimum

Credit Score660 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

LightStream is a solid online lender offering no fees, high loan maximums and low-rate personal loans for several purposes.

Overview

LightStream offers personal loans for several purposes, including debt consolidation, medical expenses, home improvement, weddings, car purchases and more, making this worth considering for those seeking flexibility. The lender offers relatively low rates compared to competitors, including autopay discounts. Its personal loans also have no origination fees or late fees, which can help keep borrowing costs low. However, borrowers will likely need to have good-to-excellent credit in order to be approved for a LightStream personal loan. Overall, it’s a good lender to add to your shortlist if you’re looking for flexible funding, no fees and a low APR. Lightstream may also disburse loans as soon as the same day you’re approved, making this lender a worthy choice if you need fast funding.

Pros

- Low minimum APR

- No origination fees, no late fees

- High loan maximum of $100,000

- Autopay discount

- Joint applications allowed

Cons

- Rates and terms vary by loan purpose

- No soft pull prequalification

- Must have good-to-excellent credit

- No physical branches

Best for Bad Credit: Upgrade

If your credit score is less-than-stellar, Upgrade's lenient minimum credit score requirement could help you land a loan. Rates are higher, and you’ll pay an origination fee, but you can also apply with a joint applicant.

Upgrade

- Loan Amounts$1,000 – $50,000

- Loan Terms24 – 84 months

- APR Range8.49% – 35.99%

- Minimum

Credit Score560 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Borrowers with less-than-stellar credit profiles may find Upgrade personal loans accessible, and its quick funding and flexible payment due dates convenient.

Overview

Upgrade offers personal loans that are accessible to those with not-so-ideal credit scores. The low loan minimum of $1,000 also makes it an easy choice for those with small financing needs. However, borrowers in certain states will be subject to higher minimum loan amounts. With this lender, you can expect to pay an origination fee. Borrowers can view their rate before applying without impacting their credit score. Overall, Upgrade is worth considering if you’re looking for a lender that is willing to work with lower credit scores and offers loans with competitive rates and flexible terms.

Pros

- Accessible to borrowers with bad credit

- Flexible loan terms

- Joint applications allowed

- Secured loan options

- Direct payment to creditors

Cons

- Has origination fees

- No physical branches

- Higher APRs than some competitors

Best for Consolidating Credit Card Debt: Happy Money

Happy Money offers debt consolidation specifically for high-interest credit cards. If you'd like to get a handle on your credit card debt so you can focus on growing your business, Happy Money could be a strong fit for your needs. By rolling your credit card balance into a single, new loan, you not only simplify payments, but you could potentially save in interest, lower your monthly payments or both.

Happy Money

- Loan Amounts$5,000 – $40,000

- Loan Terms24 – 60 months

- APR Range11.52% – 24.81%

- Minimum

Credit Score640 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Happy Money can help pay off and consolidate credit card debt into one fixed monthly payment.

Overview

Happy Money, formerly known as Payoff, offers loans for credit card debt payoffs. Eligibility is clearly stated online, so borrowers will appreciate the transparent criteria. Borrowers have the option to have Happy Money deposit funds directly to their credit cards to help streamline the payoff process. Funding can take between three to six business days, which is longer than other lenders, but still considered a decent turnaround time.

Personal loans are accessible to borrowers with fair credit, and there are no options for co-signers or joint applicants. Unfortunately, the loans are not available in Massachusetts or Nevada, so borrowers will need to look elsewhere for lending options.

Pros

- No late fees

- Direct payment to creditors

- Prequalification with no hard credit check

- All loans come with a hardship payment protection plan

Cons

- Most loans can only be used to pay off credit card debt

- Has origination fees

- High loan minimum

- No joint or co-signed loans

- Not available in all states

- Funding slower than other lenders

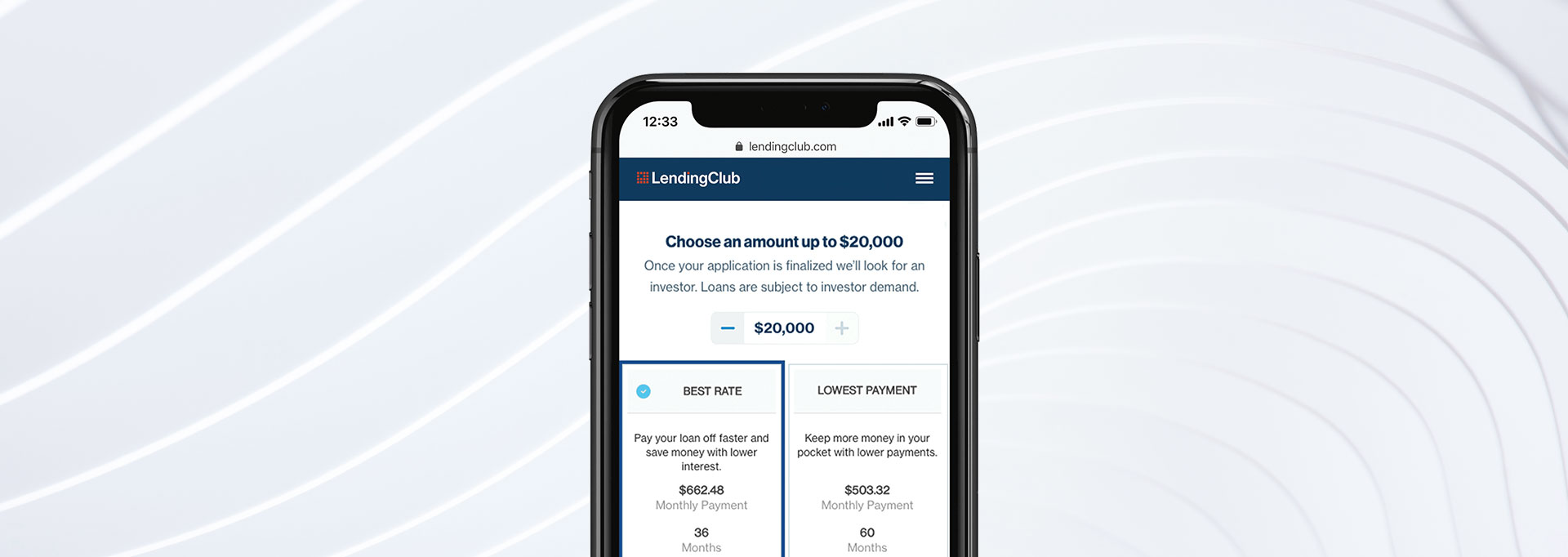

Best for Small Borrowing Amounts: LendingClub

LendingClub offers low borrowing amounts, which can be a boon to freelancers and other self-employed workers who get paid inconsistently. Those looking to cover short-term expenses like a rent payment or a few months' worth of groceries might put a small loan to good use.

LendingClub

- Loan Amounts$1,000 – $40,000

- Loan Terms24 – 60 months

- APR Range9.57% – 35.99%

- Minimum

Credit Score600 or aboveA credit score is used to indicate the creditworthiness of an applicant, but it is only one of several factors considered for approval. These credit scores alone are not guarantees for approval and should only be used as guidelines.

Borrowers in the fair credit range who need a small loan can appreciate LendingClub's quick funding and option for direct payments to creditors with debt consolidation loans.

Overview

LendingClub can be a good fit for those looking to consolidate high-interest debt, as they offer the ability to pay your creditors directly from your loan. You can also use LendingClub loans for almost any purpose, from home improvements to medical bills. Eligible borrowers who need some assistance qualifying can apply for a joint loan, and borrowers can expect to receive funding as soon as 24 hours after approval. However, APRs do start at relatively higher rates than some competitors.

Pros

- Low minimum loan amount

- Fast funding for personal loans (receive funds as little as 24 hours after approval)

- Joint loans allowed

- Direct payment to creditors

- Check rates without a hard credit inquiry

Cons

- Has origination fees

- No physical branches

- Lower maximum loan amount than some lenders

Tips to Improve Your Chances of Approval

Here are some other tips on how you can boost your odds of getting approved for a loan:

- Be prepared to provide other financial documents. Instead of paychecks or W-2 forms, you can show tax documents or bank statements to prove income. It's a good idea to gather this beforehand.

- Find lenders that look at other criteria. Again, lenders don't only look at your income. Some lenders might weigh more heavily on other factors, such as your debt load, education and credit score.

- Maintain a strong credit score. The higher your credit score, the more attractive you'll be to lenders. If you're rebuilding your credit while in credit purgatory, stay on top of payments, maintain a mix of credit and keep an eye on the length of your credit lines.

- Keep a low debt-to-income ratio. Lenders also consider your debt loan when reviewing your loan application. The higher your debt load, the greater the financial risk—in the eyes of the lender, that is.

- Consider getting a co-signer. If your credit score isn't as high as you would like it to be, consider applying with a co-signer or co-borrower. You might have an easier time qualifying (with more favorable terms) if you link up with someone with a high credit score.

Personal Loans When You're Self-Employed: Pros and Cons

Let's look at the advantages and disadvantages of taking out a personal loan when you work for yourself:

Pros

- Don't need to provide collateral

- Flexible use

- Flexible repayment plan

- Fast funding times

Cons

- Can't always use them for business

- Another debt obligation

- Potentially high interest rates and fees

Pros

- Don't need to provide collateral. Many personal loans are unsecured, meaning you don't have to provide an asset in the event you can’t keep up with payments.

- Flexible use. You can use the funds for a variety of purposes—think debt consolidation, home improvement, living expenses or wedding costs. In some cases, you might be able to use a loan to grow your business (more on this below).

- Flexible repayment plan. Some lenders are more flexible than others regarding payment plans, such as the due date and the length of the loan. This could help you juggle other financial obligations as you run your business.

- Fast funding times. Depending on the lender, you can receive the cash within a few business days after approval. This can be a lifeline for emergency or sudden expenses. Along the same lines, you might be able to apply entirely online.

Cons

- Can't always use them for business. Personal loans are intended for personal matters, and while some lenders allow you to use the funds to support your business, others don’t. If you need financing for your business, look elsewhere for higher borrowing limits and cheaper rates. For instance, an SBA 7(a) loan, a business line of credit, crowdfunding, a business credit card, or friends and family might be smarter financial decisions.

- Another debt obligation. If you're prone to gaps in cash flow and inconsistent income, adding another debt load to your money mix can be tough.

- Higher interest rates and fees. While a personal loan can be quicker to obtain, it might come with higher rates than other lending alternatives. Plus, additional fees might apply, such as an origination fee, which can be anywhere from 1% to 10% of the loan, or a prepayment penalty if you pay off your loan early.

How to Qualify for a Loan When You're Self-Employed

Getting approved for a loan when you're self-employed really isn't that much different than if you had a 9-to-5. You'll need to provide basic personal and financial information, such as:

- Birthdate

- Social Security number

- Contact information (home address, email, phone number)

- Annual income

- Sources of income

- Monthly expenses

- Debt load

- Employment status and current employer

- How much you'd like to borrow

Lenders typically ask for proof of income through W-2 forms or employment stubs. And as you might not have these readily available as a self-employed person, you can provide these forms of documentation instead:

- Bank statements

- 1099 forms

- Tax returns from the last two years

Related Article

Related Article

Tax Guide & Tips for the Self-Employed & Independent Contractors

How to Choose a Personal Loan

Here are some quick tips to keep in mind when shopping around for a loan:

- The rates and terms will have the biggest impact on the overall cost of the loan.

- Research offers from several lenders and compare them.

- Look for lenders who make the loan approval process easy. If you prefer to do as much as possible online, opt for lenders with online applications or mobile apps. If you’d rather discuss your options with a human, look for lenders with nationwide branch locations to apply in person.

- Read the fine print for any added personal loan fees or terms that could increase your borrowing costs.

It's a good idea to prequalify with several lenders so you can compare rates and terms to find the loan with the right fit for you. Most lenders can do a soft credit pull when you prequalify, so your credit score won't get dinged.

Related Article

Related Article

How to Prequalify for a Personal Loan, and Why It Can Be a Good Idea

Alternatives to a Personal Loan

If you've run the numbers and a personal loan isn't the right fit, there may be other financing options that make more sense. Here are a few to consider.

Business Credit Card

Those who need funds for business expenses in particular may want to research business credit cards. Many people can use a business credit card, including freelancers and small business owners. These cards often come with useful perks, too, like cash back and other benefits.

Earn More on Your Business PurchasesBest Business Credit Cards

Visit the Marketplace

0% APR Credit Card

A 0% APR credit card is a good choice for a lot of people looking to cover personal expenses because it offers a long interest-free time period. The gist is that you can charge your expenses and then will have a while, often 18-21 months, to pay back your bill before you get hit with any interest charges. The trick is to be sure you can pay back what you owe before that intro period kicks in, because if you don't, you'll typically have to pay a high interest rate.

Savings Account

Setting up a high-yield savings account for a specific goal can be helpful if you have time to build up the fund—and the best part is that those funds are yours, no interest owed. You'll actually earn a little more interest this way than with traditional savings accounts. If you know you can set aside a small amount each month, you can even put the whole process on autopilot by having funds transferred from your checking to savings on a regular schedule.

Grant Money

Grant funds aren't the right fit for everyone, and finding a grant can take a little legwork. But if you're looking for business funds, it might be worth researching local or federal grant options. A few types of grants you might find include:

- Federal grants for small business owners

- Startup grants

- Funds for women- or minority-owned businesses

- Grants for artists and other creatives

Grant applications can take a lot of work, but if grants fit your business model, they can be great because they don't need to be paid back (though you may owe taxes, depending on the situation.)

FAQs

-

Not necessarily. Some business owners might find it hard to show a steady proof of income, but several lenders lean more heavily on other criteria, such as your credit score, debt load and education.

-

Many people can. Some lenders extend loans to self-employed folks with not-so-great credit. That being said, be prepared to pay more in interest and fees.

-

Freelancers can qualify for a loan, but they must provide proof of steady income. Typically, they'll need to provide either the last two years of tax returns, bank statements or 1099 forms.

-

It largely depends on your financial situation and personal needs for the funds. Sometimes it makes more sense to use a loan for personal expenses, like home improvements or debt consolidation, but that's not always the case.

If you have larger startup costs, for example, and can qualify for a low interest rate, a loan could be a good choice. It's especially important to calculate how much you need to borrow and to shop around with lenders so you can figure out how much you'd need to pay each month and for how long to see if it's worth it. Also be sure to look at lenders' fees to see if that will cut into the amount you intend to borrow.

-

If a personal loan doesn't work for your situation, you can consider these other options:

- A 0% balance transfer card: You'll have an interest-free period, often 18-21 months, to pay your bill before you'll be charged the regular interest rate

- Business credit card: A nice option if you're looking to cover business expenses specifically

- Savings account: This is a worthwhile choice if you have time to save up and can set aside a little each month

- Grants: Local or federal money is sometimes available for small business owners, but it can take a bit of research to find