Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Whether you will soon be entering college for the first time or you're heading back to school for another semester of learning, a student checking account could benefit you in several ways. Checking accounts (whether they're designed for students or not) can make it easier to manage your money and gain financial independence.

In many ways, student checking accounts mimic traditional checking accounts with similar features and capabilities. However, banks that offer student accounts may include key features that could be especially valuable to a young person who doesn't have a lot of experience managing a checking account.

Best Student Checking Accounts

Whether you're looking for a checking account with no fees, low minimum balance requirements, or bonuses and reward-earning opportunities, it's important to shop around. When you compare checking accounts you can find the bank that offers the best solution for your current needs at any stage of your life.

Below are some of the best checking accounts for students to help start your search.

SoFi® Checking and Savings

- Our Rating 5/5 How our ratings work

- APY0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

- Minimum

Deposit RequiredN/A -

Intro Bonus

$50-$300Expires January 31, 2026

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. SoFi members with Eligible Direct Deposit can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.80% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings boasts an impressive APY of up to 3.80% on savings balances for customers who set up direct deposit or who deposit at least $5,000 each month. Alternatively, customers can also unlock the top rate by paying the monthly SoFi Plus Subscription Fee. This account also offers 0.50% APY on checking balances. There are no monthly maintenance fees, and new customers can even earn a generous signup bonus worth up to $300. If you don’t care about physical bank locations, this is a great option.

Overview

SoFi Checking and Savings features remarkably strong interest rates for customers who meet one of several requirements, such as receiving recurring monthly direct deposit or depositing $5,000+ every 30 days. This account also doesn’t have any maintenance fees, overdraft fees or non-sufficient funds fees. To top it off, new customers can earn a signup bonus worth up to $300.

Pros

- Accounts with monthly direct deposit earn interest

- No minimum opening balance or minimum monthly balance

- No maintenance fees, non-sufficient fund fees or overdraft fees

- Access to Allpoint’s worldwide ATM network

- Get paid up to two days early

Cons

- No physical branch locations

SoFi is an online-only bank that makes handling financial transactions easy with its app and other digital tools. The bank offers a range of financial products, including loans and even a credit card, and it really shines with its FDIC-insured Checking and Savings Account, which offers competitive interest rates for those who set up direct deposit. SoFi's mobile app is also highly rated, and with this account, you'll have the ability to get your paycheck up to two days early with direct deposit.

How to Open an Account

You have to be 18 or older to open an account, and you can complete SoFi's application online in just a few minutes. There is no minimum deposit required to open this account and no direct deposit minimum, either. But keep in mind this account is likely best for students who do have direct deposit—if you set up direct deposit of any amount with this account, you'll qualify for stellar interest rates and may qualify for the sign-up bonus.

Fees

One of the best things about SoFi Checking and Savings is that you won't be hit with fees. This account has no account minimum fees, no overdraft fees and no monthly service fee. What's more, you'll have access to a network of more than 55,000 fee-free ATMs.

Sign-Up Bonus

This account offers new customers the chance to earn a bonus between $50-$300 when they open a new SoFi Checking and Savings account before December 31, 2023.

Here's how to qualify for the bonus:

- Open a new SoFi Checking and Savings Account.

- Receive at least $1,000 in qualifying direct deposits within a 25-day "Evaluation Period," which begins the day your first qualifying direct deposit is received.

- Hit the minimum requirement to earn a $50 cash bonus.

- Reach the next tier to earn you a $250 bonus.

Once you meet the direct deposit requirement, you'll receive your bonus within seven business days after the Evaluation Period.

Chase College Checking℠ Account

- Our Rating 4/5 How our ratings work

- APYN/A

- Minimum

Deposit RequiredN/A -

Intro Bonus

$100Expires October 18, 2023

New Chase College Checking customers can earn a $100 bonus when they complete 10 or more qualifying transactions within 60 days of account opening.

Chase College Checking℠ is one of our favorite student accounts on the market. There’s no minimum deposit to open, and there’s no maintenance fee until after you graduate or your account’s been open for five years (and even then, there are ways to waive the fee). Plus it usually offers a $100 sign-up bonus that’s relatively easy to earn, which is uncommon for student accounts.

Overview

Between the $100 signup bonus and the option for eligible students to waive fees for up to five years (or longer, if you can complete qualifying actions on a monthly basis), you’d be hard-pressed to find a better student account than Chase College Checking℠.

Pros

- No monthly fees before graduation (for up to 5 years)

- Signup bonus

- No minimum opening balance

Cons

- Account does not earn interest

- Account does not include free checks

Chase College Checking is one of the best student checking accounts on the market. The account features $0 in monthly service fees for eligible college students and comes with a $100 bonus opportunity for new account holders who complete 10 qualifying transactions within 60 days of account opening. Account holders can also use Zelle to send and receive funds after enrolling on their Chase Mobile App or Chase Online℠.

How to Open an Account

You can open a Chase College Checking account online or at a local Chase branch. You'll need to be between the ages of 17 and 24 years old and provide a valid student ID or proof of college acceptance or enrollment to be eligible for this type of account. But there is no minimum deposit requirement to meet.

Fees

One of the biggest perks of a Chase College Checking account is the fact that you don't have to worry about paying a monthly fee—at least not from the time you open the account until after your expected graduation date. However, the zero-fee time frame is only available for up to five years from the date of account opening.

The monthly service fee increases to $6 after your expected graduation date or five years passes—whichever happens first. Yet there are a few ways to qualify for a fee waiver even after the increase.

Sign-Up Bonus

As long as you're not already a Chase checking customer, you may be eligible to earn a $100 new account bonus when you open a Chase College Checking account. To qualify for the bonus, you will need to complete the following actions.

- Complete 10 or more qualifying transactions (e.g., debit card purchases, ACH credits, online bill pay, Zelle payments, etc.) within 60 days of account opening.

- Keep your account open and in good standing until after you receive the bonus (typically within 15 days of qualification).

Ally Interest Checking

A $0 monthly service fee is one of the best features many student checking accounts have to offer. So if you're a fan of free checking accounts, consider the Ally Interest Checking account. Perks include no minimum balance requirements to earn 0.25% APY—a rate that's higher than what many other banks offer. Plus, the account comes with a free Ally Bank Debit Mastercard® you can use to make purchases or withdraw funds free of charge at over 43,000 ATMs.

How to Open an Account

You need to be at least 18 years old to open an account with Ally Bank. That means the account won't be an option for younger teenagers. Additionally, Ally does not have brick-and-mortar branches. So, you must apply online to open an Ally Interest Checking account.

Fees

As mentioned, there are no monthly maintenance fees with the Ally Interest Checking account. Even cashier's checks are fee-free if you need them. The main fees you might have to pay on the account are as follows.

- $20 for Outgoing Domestic Wire

- $25 for Account Research

- $15 for Expedited Delivery

Sign-Up Bonus

There's no sign-up bonus available for opening a new Ally Interest Checking account.

Discover Cashback Debit Account

Discover is a household name when it comes to credit cards, but the bank also offers the Discover Cashback Debit account that could be worth considering for both students and others. This account doesn't charge a monthly maintenance fee, and there are no minimum deposit requirements. The bank also has a network of over 60,000 ATMs you can access for free. And, perhaps best of all, you have the opportunity to earn 1% cash back on any eligible purchases you make with the debit card attached to your checking account.

How to Open an Account

Discover is another bank that does not have physical branches. Therefore, the only way to open a new account is to fill out an application online.

You must be at least 18 years old to open a Discover Cashback Debit account. That makes the account a good option to consider for college students, but most high school students and younger teenagers won't be eligible.

Fees

The Discover Cashback Debit account is one of the most lenient checking accounts on our list when it comes to fees. If you open an account you won't have to worry about paying monthly fees, fees for insufficient funds, or fees for cashier's checks. Unless you send a wire transfer or use an ATM outside of Discover's network, you shouldn't have to pay any fees at all.

Sign-Up Bonus

Discover doesn't offer a sign-up bonus for new customers at this time, but the cash back offer below helps to make up for this.

Cash Back

When you open a Discover Cashback Debit account, you have the opportunity to earn 1% cash back on up to $3,000 worth of eligible debit card purchase each month. ATM transactions, loan payments, peer-to-peer payments (like Apple Pay Cash) and other transactions aren't eligible to earn cash back.

What to Look for in a Student Checking Account

Checking accounts, whether they're online or from a local bank or credit union, are a tool that most adults in the United States use to help manage their money. According to a 2021 study by the FDIC, nearly 95% of U.S. households have a checking or savings account.

When you're in the market for a student checking account—either for yourself or your child—you'll want to look for accounts with features that matter most to you. The "perfect" student checking account doesn't exist. But it may be possible to find an account that's the best fit for you.

Here are some of the features and benefits you might want to look for in a new student checking account:

- Zero or low monthly fees

- No or low minimum deposit requirements

- Large ATM network

- ATM fee reimbursement

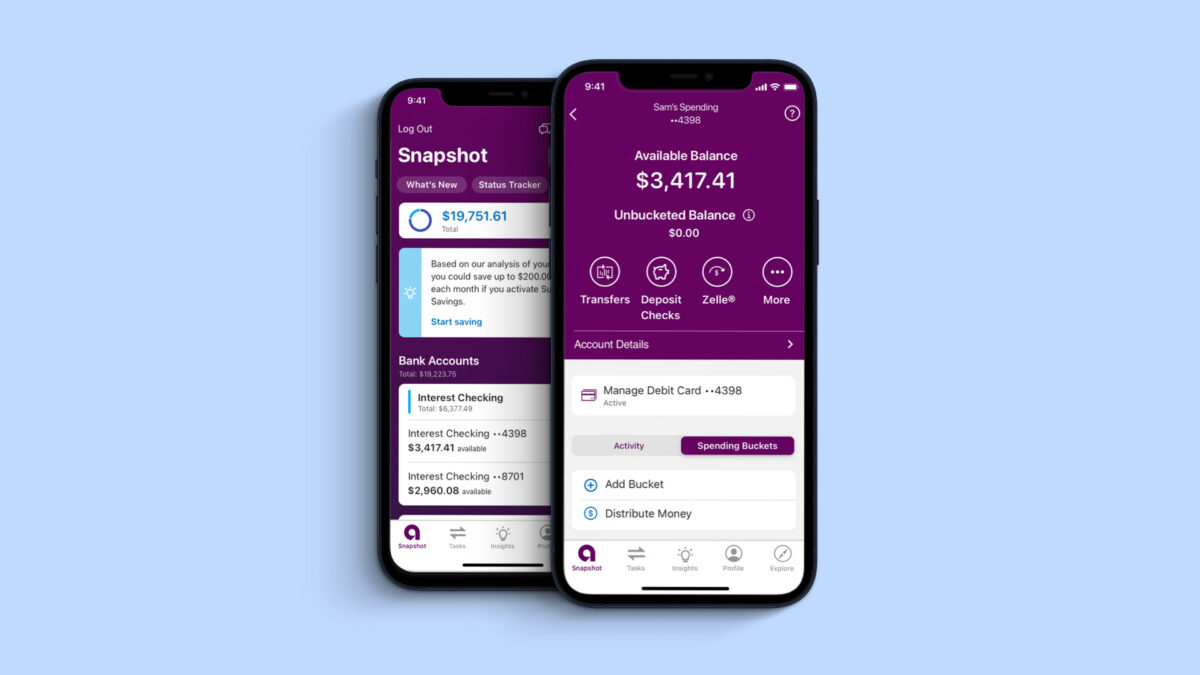

- User-friendly banking apps

- Competitive annual percentage yield (APY)

- Generous sign-up bonus or cash back rewards

You can't go wrong with any of these safest banks when researching student accounts, but double-check to make sure that you can meet all of the requirements to avoid excessive fees.

What Do You Need to Open a Student Checking Account?

Each bank has its own requirements, but to open a student checking account, you’ll typically need:

- Proof of identification, such as a driver’s license and Social Security number

- Proof of enrollment (especially for college checking accounts), such as a student ID or transcript

- Residential mailing address

- Initial deposit, if the bank requires one

- Parent or guardian, if under 18

Many types of schooling often count for student checking accounts. Check the bank's specifics, but enrollment in high schools, colleges and vocational schools often meet eligibility requirements.

Pros and Cons of Student Checking Accounts

Pros

- Few or no fees

- Flexible and low maintenance

- Relatively easy to open

Cons

- Fewer features and perks

- Low or no interest earned

- May have to switch accounts after graduation

Pros of Student Checking Accounts

Student bank accounts can offer a lot for people juggling school and finances. Here are a few benefits to know:

- Have few or no fees: Most student checking accounts have few fees and some have no fees at all because banks know students are just getting started with managing finances or are balancing classes with other financial responsibilities.

- Flexible and low maintenance: These accounts are designed for young adults, so they tend to have user-friendly apps, easy access to ATMs and few details to worry about.

- Relatively easy to open: Many student accounts can be opened online in minutes, a perk for busy college kids. (Note that minors may have to go in to a branch with a parent or guardian to open a joint account.)

Cons of Student Checking Accounts

Before you sign up for a new bank account, consider the drawbacks of student checking accounts as well:

- Fewer features and perks: These accounts tend to be fairly simple, without a lot of bells and whistles, which works for many students. But if you’re looking for extra features, like a high APY or bigger sign-up bonus, you may want to explore other options.

- Low or no interest earned: Traditional checking accounts don’t earn much interest, if they earn any at all, but there are some high-yield checking account options these days. It’s rare to find a competitive APY on a student account, however.

- May have to switch accounts after graduation: You’ll want to check the fine print to know what happens to your account when you graduate or reach a certain age. Some banks may let you keep the account active for a few years and others could require you to switch to a different account right away.

Who Qualifies for a Student Checking Account?

It depends on the bank, but most students over 16 qualify for student checking accounts (though they need to apply with a parent or guardian). Some banks require students to be 18, especially for college student accounts, but you can usually verify this quickly on the bank’s website.

Most student checking accounts require proof of enrollment in a school. This could be a high school, four-year college or vocational school. Some require full-time enrollment and some don't, so you'll want to check the requirements of any account you're considering before applying.

Is a Student Checking Account Worth It?

A student checking account is worth it if you’re looking for a simple and straightforward account to get started managing your money and don’t want to pay a lot of fees or deal with much extra hassle. Most student checking accounts do come with nice perks such as few or waived fees and lower minimum balance requirements, which makes them worth considering.

Here are some things to look for when deciding if a student checking account is worthwhile:

- No monthly maintenance fee or it can be easily waived

- Wide access to fee-free ATMs

- Overdraft protection

- Earns a bit of interest or has other features you like

Explore the Best Free Checking Accounts

Visit the Marketplace

FAQs

-

Typically, your student checking account will automatically convert to a regular checking account at your bank at some point after you graduate. It could be right away or it could be a few years down the road. The new account might be similar to your student one, but it may have different requirements, like a minimum balance or a monthly maintenance fee, so you’ll want to check how the accounts differ to make sure it’s still a good fit for you. It’s normal to switch accounts (or even banks) as your financial needs and goals change over time, so feel free to explore your options.

-

Most student checking accounts don’t charge a monthly maintenance fee and some may be totally free. Check if the account charges other fees, though, for things like overdrafting the account or sending wire transfers, to know for sure whether your new account is truly fee free.

-

Opening a student bank account will typically not affect your credit score. Banks usually only do a soft credit check (which doesn't ding your credit). However, if you overdraft your account and don’t pay the fees and other amounts you owe, your bill could be reported to a collection agency. If that happens, your overdue payments can affect your credit score. As long as you pay any owed amounts promptly, your account shouldn’t affect your score.