Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

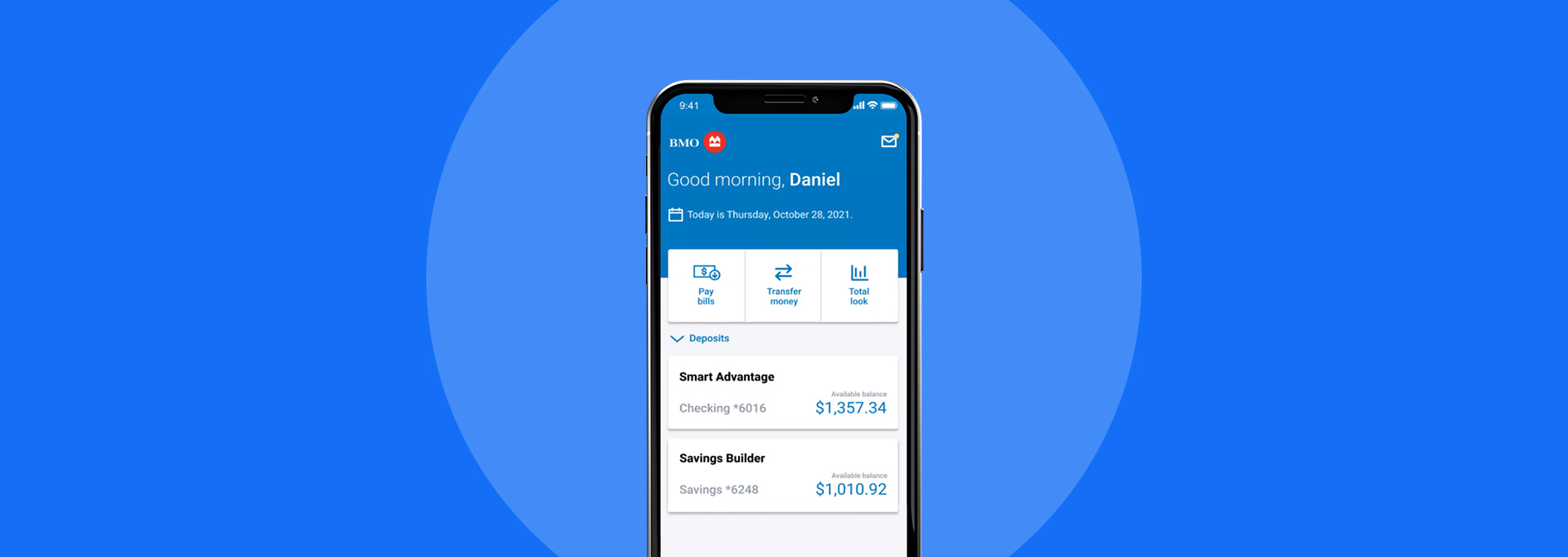

Are you in search of ways to give your savings a boost? BMO has an exciting opportunity for those looking to grow their finances. With the potential to earn $300 in cash bonuses across multiple accounts, BMO offers customers several avenues for financial growth.

To secure your new customer bonus, simply open a qualifying account by February 3, 2025, then receive at least $4,000 in qualifying direct deposits within 90 days of account opening.

It's a straightforward offer that's competitive with the best bank bonuses currently available. This bonus could help you save up for a big purchase or pay down existing debts, all while enjoying the benefits of a BMO checking account.

Currently, there are two BMO checking accounts that feature new customer bonuses, though the requirements to earn the bonus are the same for both.

BMO Checking Accounts

| Account | Intro Bonus | Monthly maintenance fee | Learn More |

|---|---|---|---|

|

|

$300Expires February 3, 2025

$300 Cash Bonus when you have $4,000 in direct deposits within 90 days of opening between 11/1/24 – 2/3/25. Conditions Apply. BMO Bank N.A. Member FDIC |

$0 | Open Account |

|

|

$300Expires February 3, 2025

$300 Cash Bonus when you have $4,000 in direct deposits within 90 days of opening between 11/1/24 – 2/3/25. Conditions Apply. BMO Bank N.A. Member FDIC |

$5 with option to waive

Customers under the age of 25 are not required to pay this account's $5 monthly maintenance fee. |

Open Account |

Regardless of which bonus you're interested in, you have until February 3, 2025 to take advantage of the offer. It's also worth noting that BMO defines qualifying direct deposits as salary deposits or other personal income electronically deposited into your account from an employer or similar third party. Debit card credits or transfers via Account to Account or Peer to Peer services like Zelle® or Venmo do not qualify.

Bottom Line

Unlocking bonuses with BMO's checking accounts opens doors to financial rewards. Make the most of this opportunity by familiarizing yourself with the terms and conditions, meeting eligibility criteria, and taking proactive steps to secure your cash bonuses. Visit BMO online or in-person to embark on your journey towards financial prosperity.

Remember, financial decisions should align with your long-term goals and financial well-being. Stay informed, explore your options, and make empowered choices on your financial journey.