Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

When it comes to your credit, it's important to be proactive. Not checking your credit information could get you into trouble. Ideally, you should aim to review your three credit reports and scores at least once per month.

Of course, adding another task to your monthly to-do list might sound like the last thing you want to do. But before you start to feel overwhelmed, there’s good news. There are several fast, easy ways to review your credit information. And, if you use the resources below, you can even access your three credit reports and scores without paying a dime.

Free Credit Reports and Scores

1. Credit Karma

When you sign up for a Credit Karma account, some of the membership benefits you can enjoy include:

- Credit reports from Equifax and TransUnion each week

- Weekly access to your VantageScore 3.0 credit scores based on Equifax and TransUnion data

- Email alerts when certain information on your Equifax or TransUnion report changes

One of the most popular names in free credit scores is Credit Karma. The company, established in 2007, says almost one-third of Americans with credit profiles have accounts with the free credit score provider.

As mentioned above, Credit Karma gives you access to your VantageScore 3.0 credit scores. But most lenders use some version of a FICO Score to assess risk when you apply for financing. What this means is that the credit scores you receive from Credit Karma likely won’t match the scores a lender uses. On the other hand, lenders use different versions of FICO Scores. So, the odds of an exact credit score match are slim no matter which credit score you check online.

The credit scores you see in your Credit Karma account are directionally accurate. If you're working hard and you see your score trending upward on Credit Karma, your FICO Scores are likely climbing too. Good credit behaviors lead to good credit scores, regardless of which scoring models grade them.

Best Loans for Bad Credit

2. Experian

With a free Experian account, you can enjoy benefits like:

- Access to your Experian credit report once a month

- Monthly access to your FICO Score 8 based on Experian data

- Email alerts when key information on your Experian report changes

Experian — one of the three major credit bureaus — also offers free credit monitoring with no credit card required.

A free Experian credit monitoring account gives you monthly access to your FICO Score 8. This score still might not match what a lender uses when you apply for financing — especially if the lender checks your report and score from a different credit bureau. But since 90% of major U.S. lenders use FICO Scores, there’s a chance that lenders will at least use the same credit score brand you’re reviewing online.

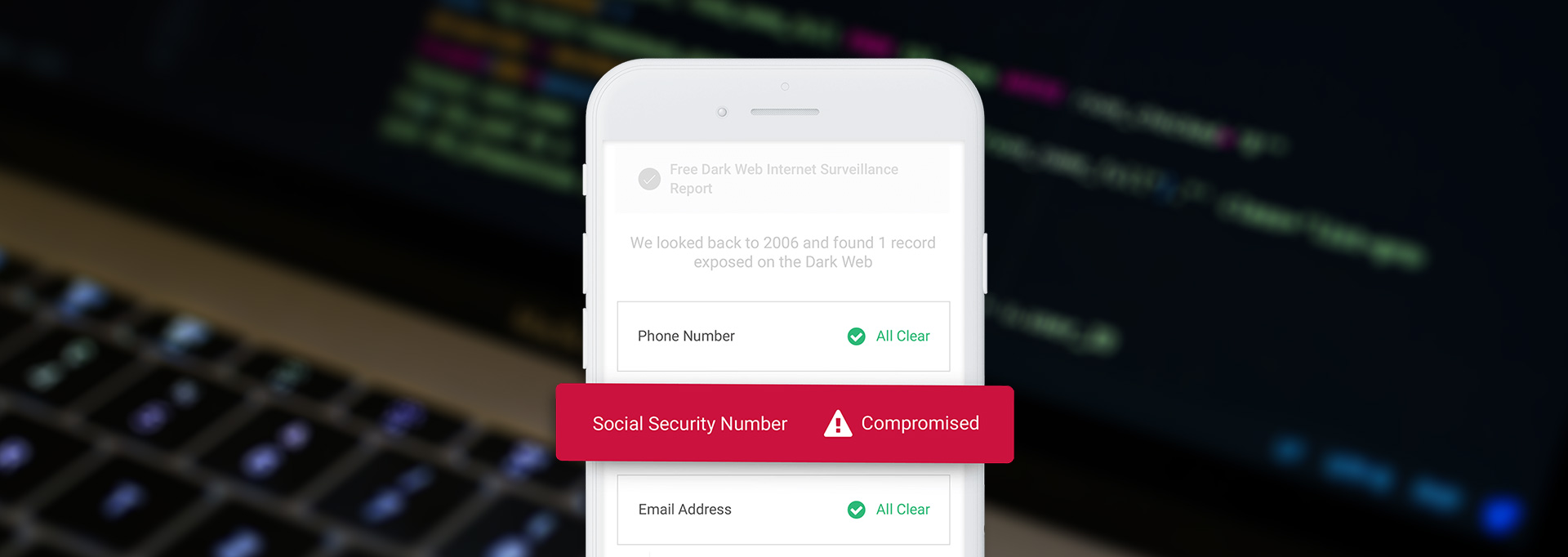

Experian also offers a paid credit monitoring program called Experian IdentityWorks. After a free 30-day trial, an IdentityWorks membership costs between $9.99–$19.99 per month, plus tax. IdentityWorks comes with some added features you might appreciate, like up to $1 million in identity theft insurance. But if you prefer free credit monitoring options at this time, be careful not to sign up for this offer.

3. AnnualCreditReport.com

With AnnualCreditReport.com, you can claim a free Equifax, TransUnion and Experian credit report once every 12 months.

AnnualCreditReport.com is another helpful tool you can use to self monitor your credit reports.

The credit bureaus are required to give you access to these freebies thanks to the Fair Credit Reporting Act (FCRA). Note that the FCRA does not give you free credit score access. However, federal law may entitle you to a free credit score under other circumstances, like when you’re turned down for a loan because of your score.

How Multiple Credit Card Payments a Month Can Boost Your Credit Score

How Do Free Credit Monitoring Services Make Money?

Since Credit Karma and Experian both offer free ways to access your credit information, you may wonder how these companies make money. It's a fair question.

In exchange for the free benefits that Credit Karma and Experian offer their members, the companies will advertise financial products and services to you. For example, the website may show you personal loans that you’re pre-qualified for based on your credit information. If you sign up for a product or service, Credit Karma or Experian will receive a commission for the referral.

With Experian, the company also offers fee-based credit monitoring and identity theft services. If you upgrade to a premium membership, Experian earns additional income.

Why Should You Monitor Your Credit Reports and Scores — And What’s the Difference?

Your credit reports and scores have the potential to make your financial life easier or harder. Credit can affect you when you apply for credit cards and loans. Good credit might also lower your insurance premiums, help you lease an apartment and sometimes even improve your employment prospects.

Understanding the difference between credit reports and scores will help you see why it’s important to monitor all of this information.

What Is a Credit Report?

A credit report is a record of how you’re managing your current debts and how you’ve managed certain accounts in the past. It may contain details about your current and closed loans, credit cards, lines of credit and more. If you have any negative credit history (late payments, charge offs, collection accounts, bankruptcies, foreclosures, repossessions, etc.), these details may show up on your credit report too.

In the United States, there are three major credit bureaus: Equifax, TransUnion and Experian. If you have established accounts that creditors report to the credit bureaus, you should have a credit report with each of these agencies.

What Is a Credit Score?

A credit score is an add-on product that lenders can purchase alongside your credit report. It’s a three-digit number that helps lenders figure out the risk of doing business with you. Specifically, a credit score predicts the likelihood that you’ll fall 90 days or more behind on a credit obligation within the next 24 months.

The most common credit score range is 300–850. If you have a bad credit score that falls on the low end of the numerical scale, your risk of default is higher. A good credit score, by comparison, means you're less likely to pay a bill 90 days (or worse) late in the next two years.

With a good credit score, lenders will be more likely to approve your applications. Good scores may also help you save money by securing lower interest rates and better terms on financing.

Want to improve your credit score? This credit card strategy might help you.

Next Steps

You usually don’t know in advance which credit report or score a lender will review when you apply for financing. It's critical to monitor all three of your reports and scores to make sure they stay in the best shape possible.

If you don’t already have a credit monitoring strategy in place, consider signing up for a free account with both Credit Karma and Experian. The combination of these two services gives you a free way to monitor all three of your credit reports and scores at least once a month.

Looking for additional credit monitoring features or better identity theft protection coverage? You can always consider upgrading to a paid credit monitoring service that offers more bells and whistles.