Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Managing your money isn't always easy, especially when you're first starting out. The world of personal finance is complex and confusing, but it's also extremely important and not something to ignore. At a time when roughly 58% of American's have less than $1000 in savings, it's crucial that young millennials have the tools they need to learn the personal finance basics.

Luckily, there are tons of personal finance apps on the market that have been designed with beginners in mind. These apps can help you with everything from budgeting to investments, and their straightforward interfaces aim to make the world of personal finance a little less intimidating. We're showcasing the best personal finance apps for people under 35, and hopefully they can help ease some of your financial stresses.

Keep reading for a list of the best personal finance apps for people under 35.

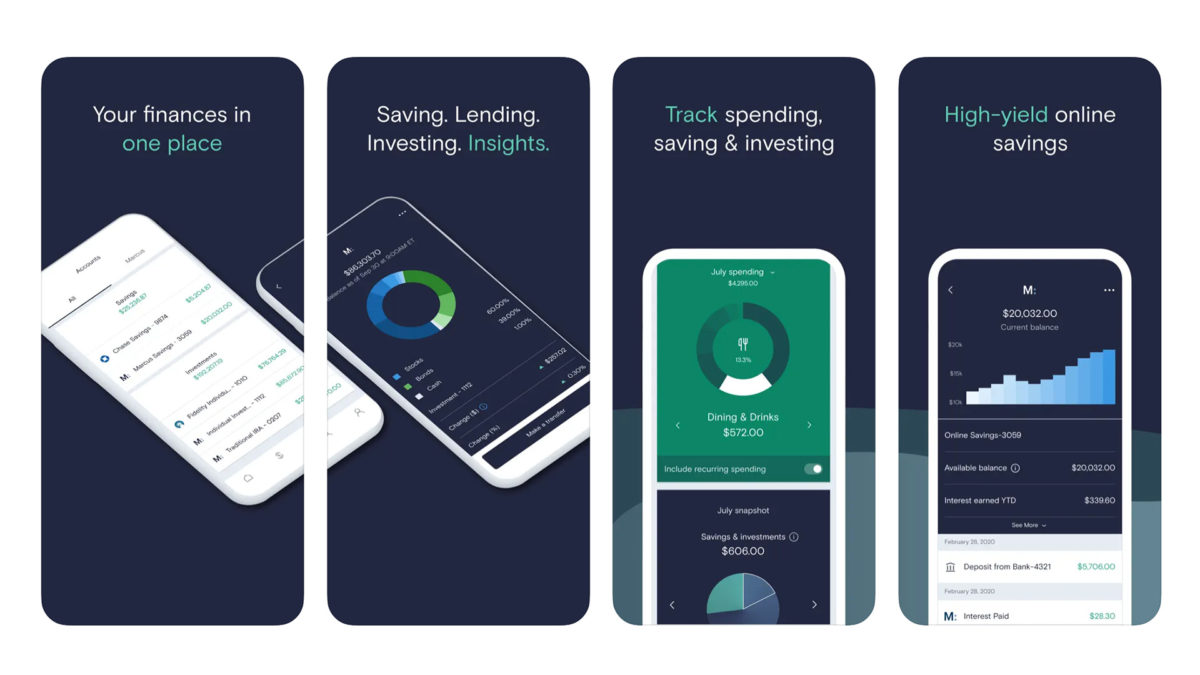

1. Marcus Insights

Best for: Savings and Money Management

If you're looking for a free personal finance app that can help you stay on top of multiple accounts, Marcus Insights might be right for you. This app allows you to view all your saving, investing and spending accounts together in one place — it even works for accounts held with institutions other than Marcus by Goldman Sachs. (Please note that Goldman Sachs is the majority owner of Slickdeals.)

Once you've linked all your accounts to the Marcus Insights app, you can easily track your expenses and visualize your financial habits via reports that cover data like spending by category and merchant, monthly cash flow and monthly contributions to investment and savings accounts.

If you feel daunted by the prospect of manually tracking all your monthly expenses, Marcus Insights can help remove a lot of the most common pain points associated with money management. Plus, it's totally free to use, you don't even need to hold a Marcus loan, savings or CD account to access it.

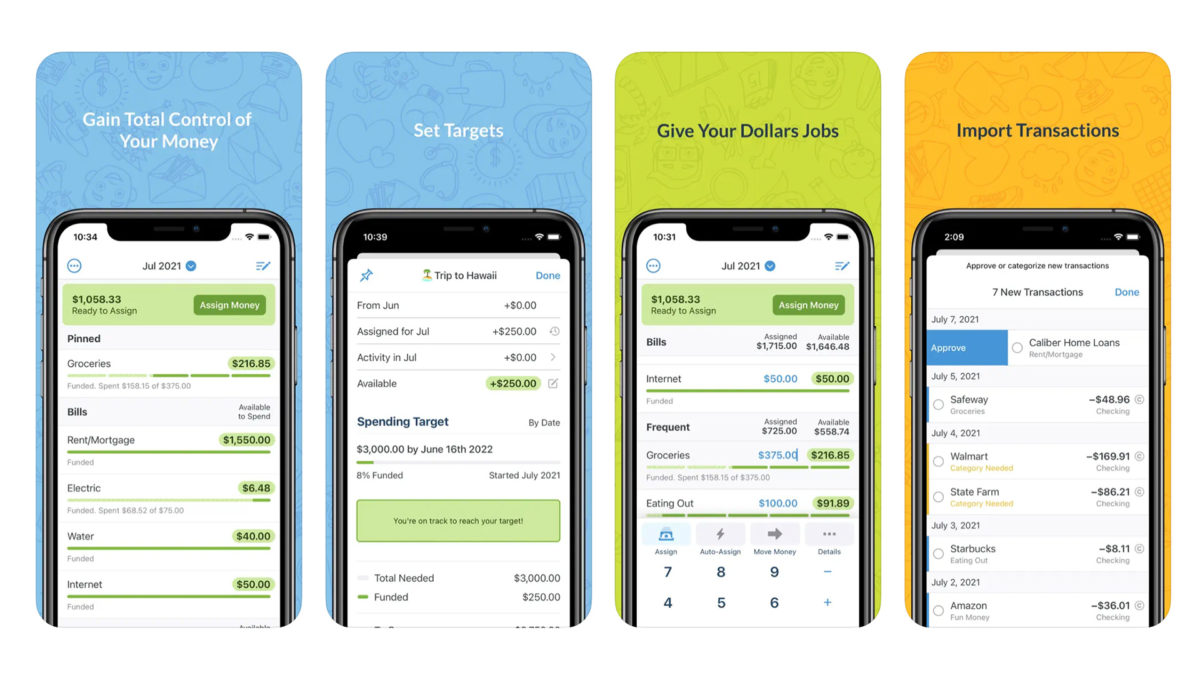

2. You Need A Budget

Best for: Budgeting

Budgeting is extremely important when you're first starting out, hence the name of this helpful app. You Need A Budget is a budgeting app that can get you on the path to becoming debt-free. By breaking down where your money goes, you can learn how to allocate your funds better to both pay off your past debts and start saving for the future.

You Need A Budget not only provides a robust bundle of budgeting tools, but it also educates users on how to best use them to maximize savings. In fact, the company behind the app claims new customers average $6,000 of savings in their first year. So this is definitely a worthwhile app for people struggling with reckless spending. You can try the app free for 34 days, after which the service costs $7 a month. That's $84 a year, which is a small price to pay for big savings.

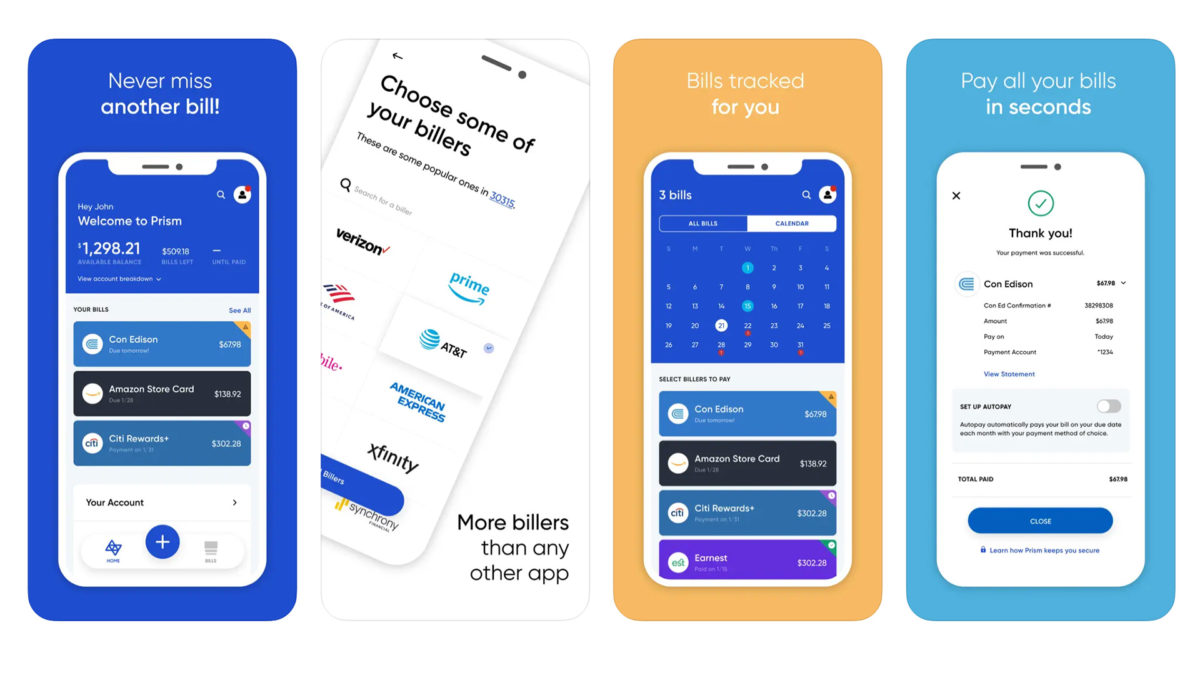

3. Prism

Best for: Paying Bills

Missing a bill payment can come with some serious financial consequences, which can get really scary when the late fees start to pile up. That's where Prism comes in. It's a free-to-use app designed to help you better track billing, so you don't get surprised when they eventually land in your mailbox. You can even pay your bills from the app.

Prism tracks all of your bills and sets up automatic reminders, making accidental late fees a thing of the past. The app also allows you to quickly check all of your account balances in one place, from your electric bill to your Netflix subscription.

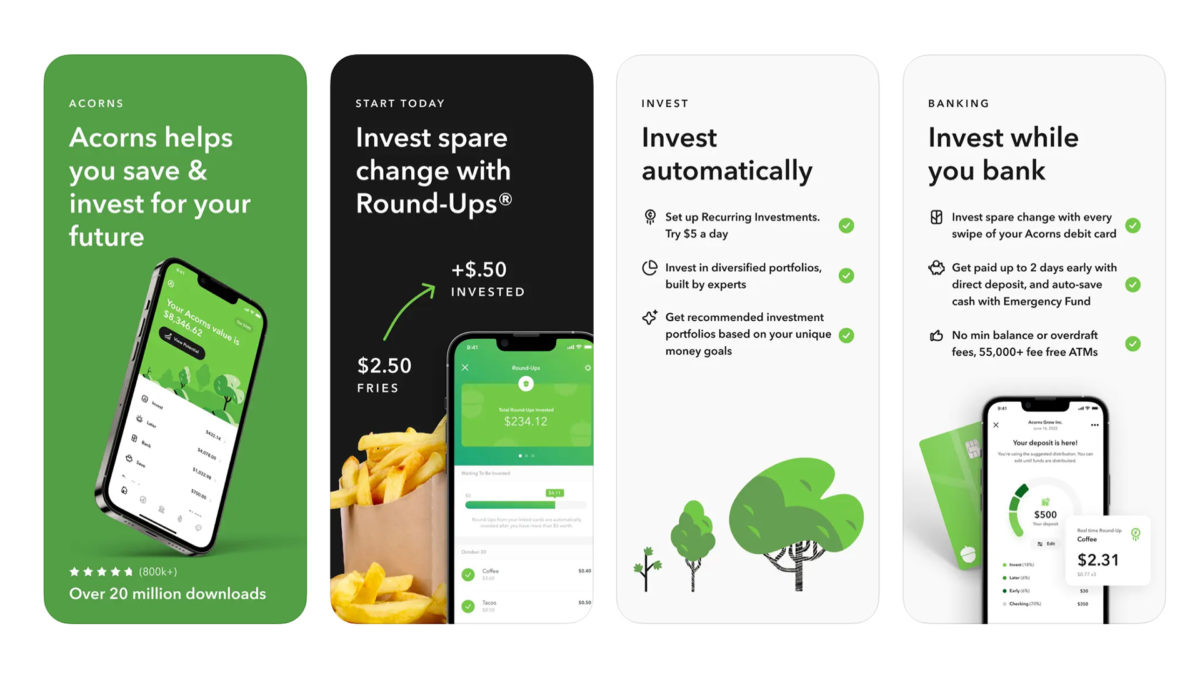

4. Acorns

Best for: Investing

Getting into the world of investing is intimidating for many, but taking baby steps can help. Acorns is an easy investment app that helps you build a portfolio out of nothing but your spare change. Once you sign up with Acorns, they'll send you a debit card that automatically saves and invests every time you make a purchase. It does this by rounding up the price to the nearest dollar on all of your Acorn card purchases, and then investing that extra change.

This is great for people who have trouble saving, as it basically takes the decision out of your hands. The Acorns debit card can save you money in other ways, too. There are no ATM or overdraft fees, and the card does not have a minimum balance requirement.

Acorns cost $3 or $5 a month depending on which tier you select. Acorns Personal is the cheapest option and grants you access to all the basic features. The $5 tier is the Family package which includes extra tools to help you save for retirement and additional exclusive features.

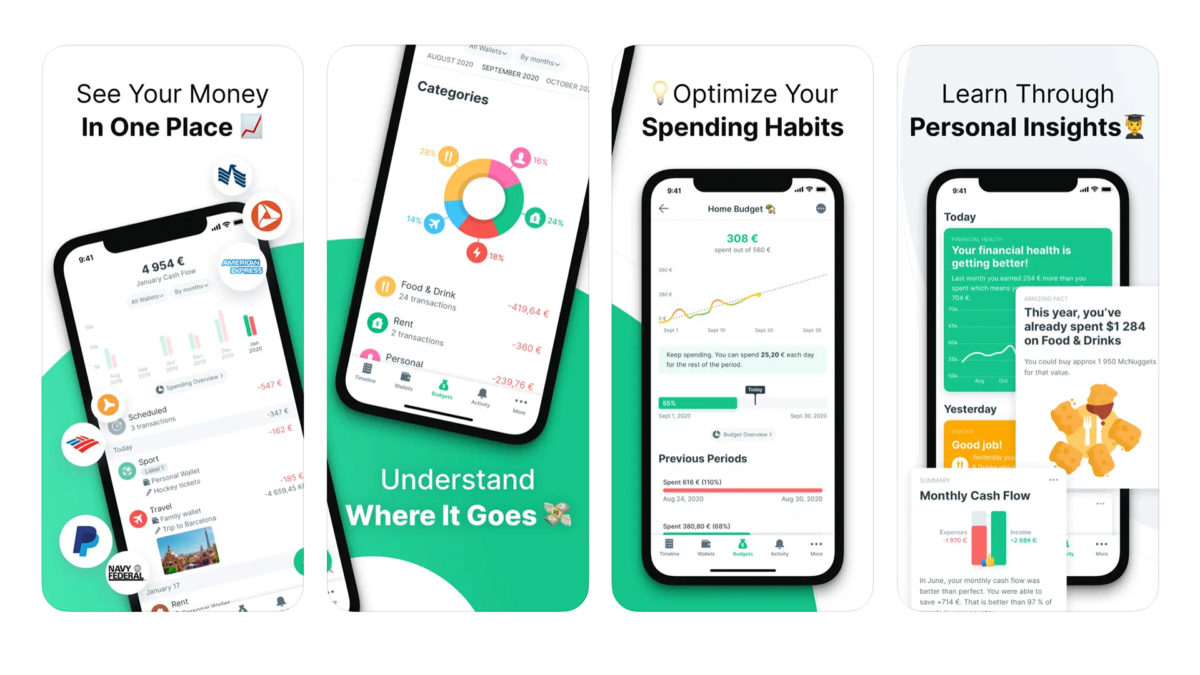

5. Spendee

Best for: Tracking Expenses

Spendee is an app for compulsive spenders that helps break down monthly expenses. It's part budgeting app and part accountability workshop. Use it to track your income and expenses, create budgets, and better understand where all of your money is going.

This free app also has a bunch of other useful features as well, including shared wallets for couples and people living with roommates. Spendee is also great for wandering souls who spend a lot of time traveling, as it can easily convert your finances into different international currencies.

Spendee Basic is free with two paid plans beginning at $1.99 per month.

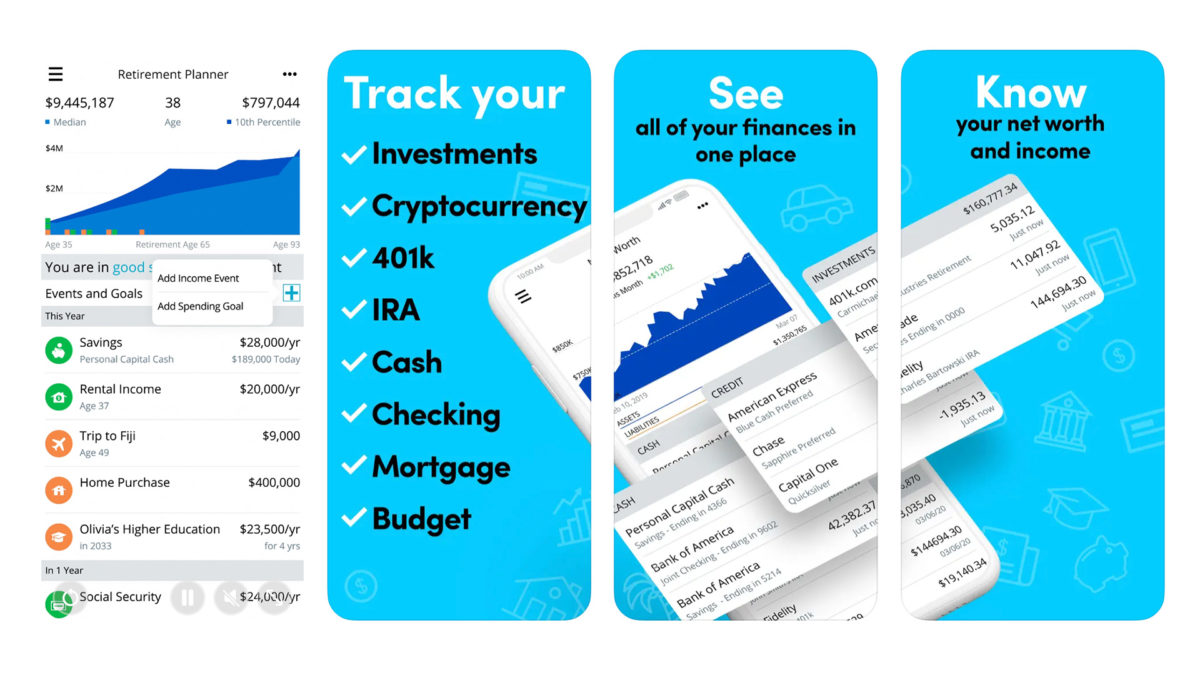

6. Personal Capital

Best for: Long-Term Money Management

Personal Capital is a free money managing app that allows you set financial goals, analyze any investments you may have, and keep track of all of your finances and bills. This app is particularly useful for making projections about future financial decisions.

The software can also help you plan for retirement, calculate the long-term costs of big purchases, and provide answers for possible "what if" scenarios that could affect your financial stability. It's a great choice for young people who want to get a sense of what their finances could look like over long periods of time.

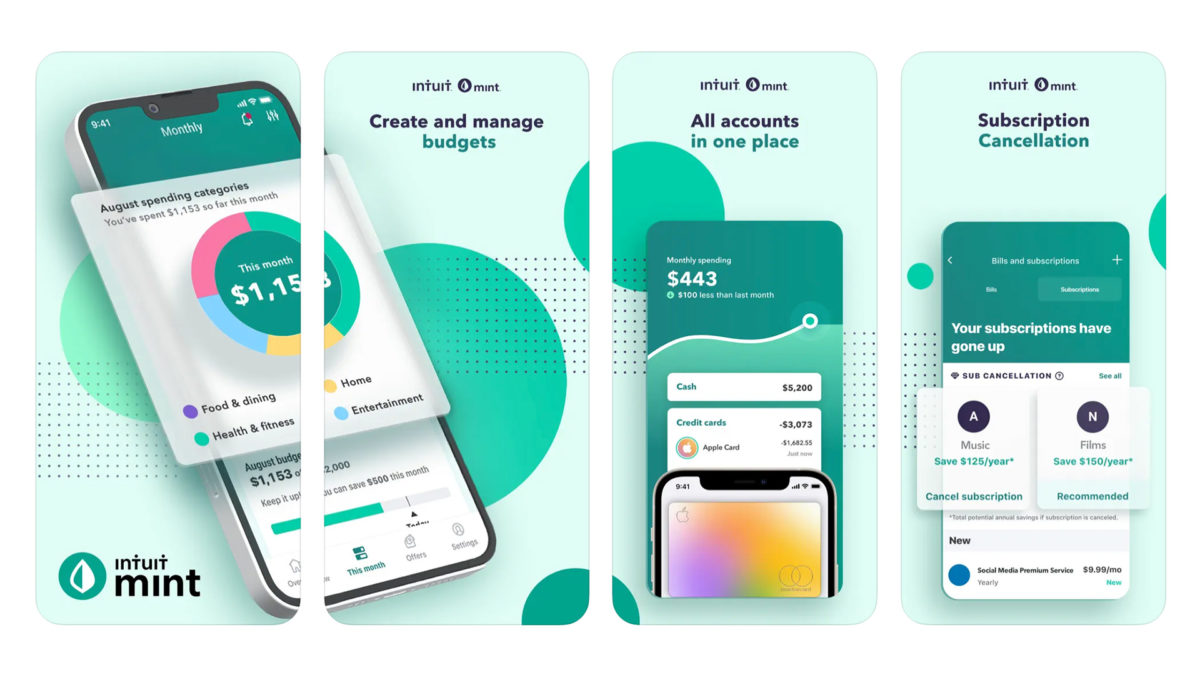

7. Mint

Best for: Budgeting and Money Management

Mint is a free all-in-one financial services app from Intuit with a focus on budgeting and money management. It allows you to keep all your bank accounts, credit cards and billing information in one place. It also offers tips on ways to better manage your money. Mint really is a jack-of-all-trades app, allowing you to create budgets, access free credit scores, and set up bill reminders. It will even warn you if your funds start getting a little too low.