Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

The Bilt Mastercard® is one of the best new credit cards to hit the market in the past few years. This no-annual-fee credit card offers stellar value for renters who frequently travel and dine out, earning 3 points per dollar on dining and 2 points per dollar on travel expenses.

Here’s why we believe this credit card belongs in your wallet.

Bilt Mastercard® Overview

The Bilt Mastercard is a relative newcomer to the world of credit cards. Backed by Wells Fargo, this card is best known for offering customers the ability to pay rent without being charged a credit card transaction fee. Furthermore, the card offers bonus points per dollar spent on restaurants and travel, with a slew of valuable ways to redeem earned rewards.

Here’s what you should know about the Bilt Mastercard at a quick glance:

|

Annual Fee |

$0 |

|

Foreign Transaction Fee |

0% |

|

Rewards Currency |

Bilt Rewards |

|

Rewards Rate |

|

|

Rent Day Rewards (When you spend on the |

|

|

Earning Requirements |

Must use the card five or more times per statement period |

|

Included Benefits |

|

|

Airline Transfer Partners |

|

|

Hotel Transfer Partners |

|

For more in-depth insight, read our review of the Bilt Mastercard.

5 Reasons to Have a Bilt Mastercard in Your Wallet

Now for the good stuff: Here are the top five reasons why this credit card makes sense for renters today.

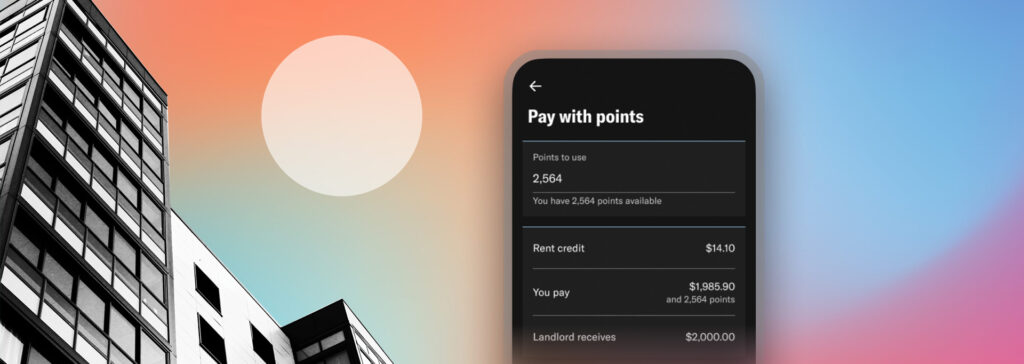

1. Earn Rewards for Paying Rent (Without Transaction Fees)

The Bilt Mastercard is one of the best ways to pay rent on your credit card without incurring a credit card transaction fee. Bilt works with more than 2 million rental properties across the United States.

Here's how it works:

- Pay rent with your card: You can pay rent using your credit card or using the Bilt Rewards app. You won't be charged a transaction fee as a Bilt cardholder.

- Earn rewards: When you use the card 5 times each statement period, you're eligible to earn points on rent and other qualifying purchases.

- Bilt can send your landlord a check: Even if your landlord only accepts checks, Bilt will either cut a check to your landlord on your behalf or issue you a virtual checking and routing number to use for your rent payment.

- Maximum rewards you can earn: You can earn up to 100,000 Bilt Rewards points per year on rent for a single home at an earnings rate of 1 point per dollar.

As of 2023, the average U.S. household pays $1,320 monthly rent. If you pay this using the Bilt Mastercard®, you would earn 15,840 Bilt Rewards points each year that are worth at least $198 toward travel.

If your landlord charges $35 per credit card transaction, paying rent with the Bilt Mastercard would save you $420 in transaction fees per year, rewarding customers for their largest monthly bill.

2. Earn Miles That Transfer to Major Airlines and Hotels

Bilt Rewards are worth a flat rate of 1.25 cents apiece if you use them to pay for travel expenses through the Bilt Travel Portal. However, you can also transfer these points to hotel and airline partners for outsized value.

Here are a few examples of what that could look like:

- If you book a Hyatt luxury resort that costs more than $1,000 per night using rewards, you can transfer Bilt Rewards points to the World of Hyatt® rewards program at a 1:1 ratio, often for a value beyond 1.25 cents per point.

- The Grand Hyatt Kauai Resort and Spa costs anywhere from $730 to $3,000 per night, depending on demand. However, rooms can be booked through the World of Hyatt rewards program for as low as 30,000 Hyatt points per night, depending on availability. If you were able to score a $2,539-night room for just 30,000 World of Hyatt points, that would mean your points were worth 8.46 cents apiece.

- You can do the same with airfare. If you fly business class one-way from Miami to Helsinki, that will cost you around $2,500. But if you book it with Bilt points transferred to American Airlines, you can book that same flight for just 57,500 miles plus around $23 in taxes, giving your Bilt points a value of more than 4.3 cents apiece.

3. Earn Free Points and Double Rewards Each Month

Rent often comprises the average consumer’s most expensive monthly expense, and most people pay rent at the beginning of each month. To make paying the bills more fun, Bilt periodically offers special bonuses that allow you to earn additional rewards.

On the first day of each month, Bilt doubles all points earnings on all spending categories excluding rent:

- 6x on dining

- 4x on travel

- 2x on everything else, excluding rent

Furthermore, Bilt offers free trivia games and other interactive events each month that allow you to earn up to $2,500 that can go towards rent.

4. Earn Benefits That Go Toward Buying Your Own Home

Buying a home can be daunting even before factoring in the financial challenges. But if you’re renting until you can afford to buy, Bilt has your back.

Here's how Bilt can help renters become homeowners down the line:

- Build credit history with Bilt: First of all, you’ll need a strong credit history to qualify for a home loan. But Bilt helps you build up your credit profile by reporting your monthly rent payments to all three major credit bureaus.

- Convert Bilt rewards points into a cash down payment: Saving enough money for a down payment can also be difficult, especially if you live in an area with a higher cost of living. But Bilt allows you to convert your Bilt points into cash for a down payment at a generous rate of 1.5 cents apiece.

To redeem your Bilt points towards a down payment, all you have to do is email homeownership@biltrewards.com with the sales contract from your home purchase and let them know how many points you'd like to redeem toward the expense. Learn more on the Bilt website.

5. Utilize Premium Credit Card Perks with No Annual Fee

Beyond the rewards, Bilt offers great “soft” benefits for cardholders. These include cell phone protection, travel delay, cancellation and interruption insurance, rental car damage collision waiver, free Lyft credit each month after you complete three rides, monthly DoorDash credits, purchase protection, and ShopRunner membership. All of this comes as a part of the card perks with no annual fees.

Save More With A No Annual Fee OfferBest No Annual Fee Credit Cards

Visit the Marketplace

Is the Bilt Mastercard Worth It?

The Bilt Mastercard is worth it for those who enjoy traveling and dining out because you'll be able to take advantage of its strong rewards-earning structure and redeem it for great travel perks. If you fit this profile, the Bilt Mastercard absolutely deserves a slot in your wallet, even if you don’t pay rent or already have other travel credit cards on hand. And if you are a credit card veteran who’s wondering if the Bilt Mastercard is worth one of your precious 5/24 spots, the answer is “yes.”

As a credit card with no annual fee, Bilt Mastercard is one of the most valuable newcomers in the world of personal finance. Not only does the card come with a slew of benefits, travel options, and generous earning options, it does so for free and even rewards you for making it the daily driver in your wallet.

Frequently Asked Questions

-

Yes, you can use the Bilt Mastercard to pay your monthly rent expense without incurring a transaction fee.

-

The Bilt Mastercard is issued through Wells Fargo.

-

The Bilt Mastercard can be used worldwide and does not charge foreign transaction fees.