Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

As young adults become more financially independent and take on larger expenses they often turn to credit cards as a means of payment. This trend has led to the emergence of credit card companies specifically targeting Gen Z and millennial interests.

Specifically, young adults are increasingly entertaining the idea of paying their rent with a credit card. As outlandish as it seems, the big credit card companies are on board. But is this actually a good idea?

Credit Cards Designed for Paying Rent

Historically, paying rent with a credit card was often a bad idea, as it could lead to an excess of fees that outweigh any points earned. However, new credit cards are poised to change that.

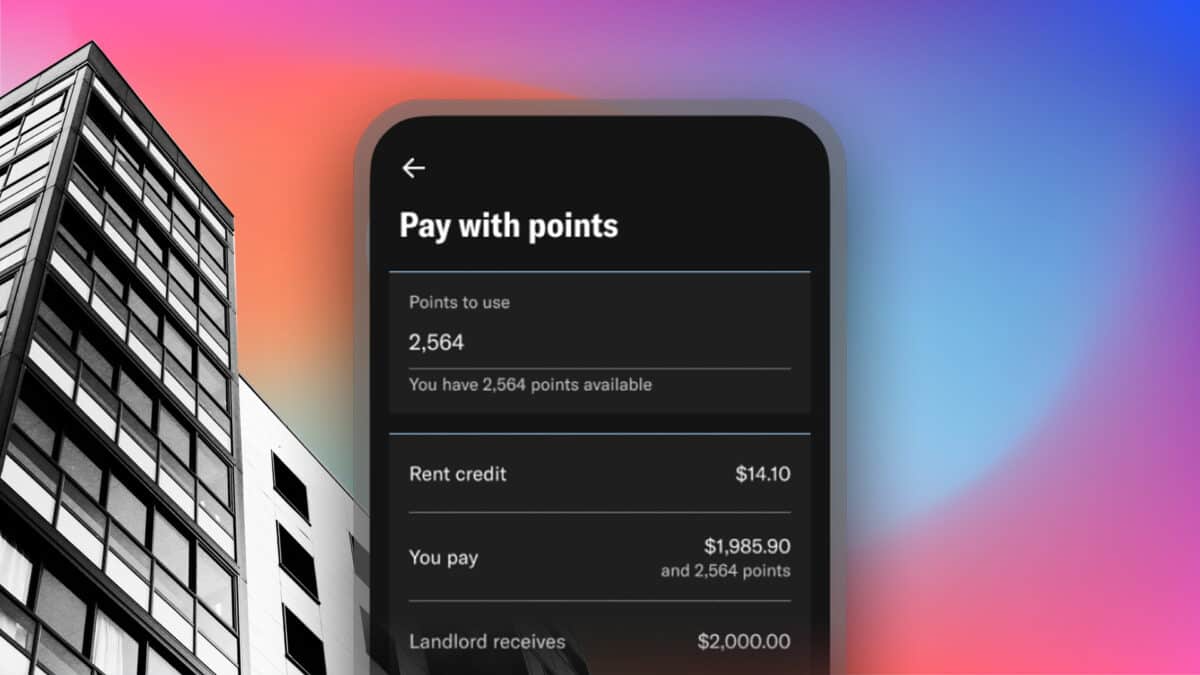

Take Bilt, a credit card company that encourages users to put their rent on their credit card. They process over $5 billion in rent annually, with most of its users being Gen Z and millennials.

The company's Bilt Mastercard® offers the chance to earn rewards points that can be used for things like travel, shopping or future housing payments. However, like most credit cards, cardholders are still expected to pay interest on balances, which could easily become costly if not monitored.

Debt Dangers

As of April 2023, the average credit card interest rate is currently at 23.65%, which is a high rate to pay if the balance is not paid in full every month. Couple this with the average credit card debt among Gen Z consumers ($2,854 as of last year) and there’s a strong indication that many young adults are already struggling with credit card debt.

Caution is Encouraged

While paying rent with a credit card may seem like a good idea, some people aren’t totally convinced – and for good reason. As it stands, Americans are already struggling to pay off debt, and charging big recurring purchases like monthly housing costs could easily exacerbate problems.

The problem many people run into is unpredictable life events. For example, you could put your big expenses on a credit card with every intention of paying your balance off in full each month, only to have an injury, major car trouble or other unexpected setback throw off your plan.

Before you know it you’re stuck paying for the initial charge, the unexpected expense, and any interest incurred for not paying both off immediately. By paying for necessities like rent with cash, you're less likely to spend outside your means and won't be stuck with extra debt in an emergency.

The Bilt Mastercard® is best for people who have experience using credit cards in a calculated way to earn rewards. It offers valuable ways to redeem your points, and if you use it to pay rent then immediately pay that charge off, you can earn a lot of points with relatively little added risk. However, young people who have less experience managing credit card debt should take care when considering this option. If you're not confident you can pay off your balance in full each month, this may not be the best option for you, as you could end up having to pay a lot of unexpected interest charges.

The Bottom Line

Paying rent with a credit card can be a convenient way to earn rewards points, but it can also cause a financial shortfall for those who cannot pay their balance off in full. Credit card companies make money off of those who do not pay their bills on time, and with average interest rates hovering near 24%, it is easy to see how quickly debt can pile up.

If your main reason for paying rent with a credit card is convenience, it is advisable to explore other payment options, like direct debit or money transfer, which do not carry high-interest rates. Ultimately, the decision on whether or not to pay rent with a credit card should be left up to the individual, but caution is always encouraged when it comes to credit card use.