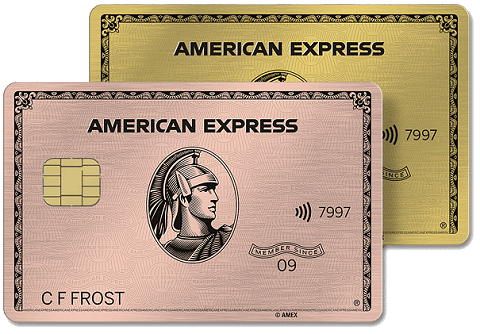

Best Credit Cards for Restaurants, Dining, Delivery and Takeout From Our Partners

Everyone has to eat. Whether you are going to a favorite restaurant, hitting up the drive-thru or enjoying a home-cooked meal, there is a cost involved somewhere along the way.

To help you get the best rewards for every dollar spent, we’ve gathered together the top credit cards offering accelerated dining rewards from our partners.

Methodology

At Slickdeals, we know a thing or two about what makes a good product or not. We are the largest and most trusted deal-sharing community on the web, and that extends to how we evaluate credit cards.

Every month, we review our best credit cards selections to make sure each card remains relevant and helpful to readers. That means if a perk, bonus or feature is removed or changed, we will carefully consider whether it belongs on each list. We also will do our best to replace it with a new card pick that meets similar needs.

While no single credit card can be all things to all people, we’ve divided our “best cards” lists into the following categories to more accurately compare cards that have similar criteria. For more information on our review process and how we make money, read our editorial policy.

How to Choose a Rewards Credit Card for Dining and Restaurants

With so many different reward cards and travel rewards cards out there, how do you know which is right for you? The easiest way to know which card is best is to evaluate your spending.

Where do you spend the most money? Once you know where your money is going, you can choose a card that will reward you the most in that category of spending.

It is also a good idea to consider how much time you want to invest in your reward card. Do you want to keep up with rotating category bonuses and make sure you are getting the best flight deals for your points? Or would you rather something easier like a card that earns a flat rate cash back or bonus points on eligible purchases?

There is no wrong answer, but you need to know these answers to understand which card will best benefit your lifestyle.

Tips on Maximizing Dining Rewards With Credit Cards

I have three cards on this list already. Because I pay off my balances in full every month before the due date, I’ve never paid a cent of credit card interest. I keep close tabs on my annual fees to ensure every card in my collection rewards me more than it costs.

Because you have to eat anyway, you may as well get rewarded for it with bonus points. With any of these great credit cards for foodies and dining in your wallet, you’ll get valuable cash-back or travel rewards with every restaurant or grocery store visit. That’s something anyone can enjoy.

Credit Cards for Restaurants and Dining FAQ

-

Yes, most credit card issuers include fast food purchases in the dining and restaurant category. However, sometimes fast food purchases at entertainment venues, sport arenas and airports do not code as dining. In these cases, you’ll earn rewards either in the entertainment category or your card’s base rewards rate.

-

Starbucks is usually counted as a dining or restaurant purchase. However, it depends on how the individual merchant codes itself. So if you find that a particular Starbucks did not award you the correct amount of rewards, then it most likely an issue with that specific Starbucks.

-

Yes. In most cases, credit card issuers like American Express and Bank of America will count purchases made in bars as a dining or restaurant expense. However, it will depend on the specific establishment’s merchant category code (MCC).

-

An annual fee is a set charge that occurs yearly. For credit cards with annual fees, the card issuer applies the charge to your account as soon as you are approved. You will see that same charge on your card anniversary. If you do not pay the annual fee, you will start to pay interest on it. Annual fees do not count for sign-up bonuses and they do not earn bonus points or cash back.