Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Inflation has improved some but is still affecting many Americans, so managing your money so it goes further is critical right now to hold on to more of your cash and income. One way you can do that is by becoming more frugal.

If you want to get your finances in shape, here are some ways you can be more frugal and start saving money. With these 11 tips, you’ll be in a much better position with your finances now and in the future.

Personal Finance 101 How to Save Money Every Day

These tips can help you become a frugal expert

-

1

Create a Budget

Setting a budget may not be fun, but the benefits you will reap are worth it. And thankfully, with the best budgeting apps, it’s easier than ever to create your plan.

-

2

Use Coupons When You Can

You can be frugal and start saving money by using coupons when you can.

-

3

Save on Groceries

You can save on groceries by skipping delivery fees, cooking meals with more inexpensive ingredients like rice and quinoa, and planning your meals before going to the grocery store to make sure you don't end up wasting food. Consider throwing away food like throwing away real dollar bills.

-

4

Reduce Monthly Bills

Look for any ways you can cut down your bills. If your phone or internet bill is too high, consider shopping around. Also, watch out for wasting on electricity, and never leave on lights, TVs or other electronics you aren't using.

-

5

Cancel Streaming Accounts You Don't Use

Look for services that are paired with your phone bill, too. Make sure you're not paying for any streaming accounts you currently aren't using.

-

6

Reduce How Much You Dine Out

Prepare your meals at home, even if it's just a few more times a week or month, especially if you commute to work. You can cut out a lot of spending on dining out for lunch or dinner by eating at home instead. A nice meal at home can be a great way to spend time with people.

-

7

Stop Paying to Work Out

Find activities and exercises that are free to get in your steps. There are tons of options for working out at home or outside without having to pay for it. Cut out gym memberships and activities that require expensive equipment. You can find workouts on YouTube, free yoga classes in your community, join a running group or just walk a hiking trail.

-

8

Buy Used Items

this is not only frugal, but also green! Buy products or clothing used from sites like eBay, Craigslist or Facebook Marketplace. You can also find garage sales around the community, shop at thrift stores for clothing or furnish your home from consignment stores. The savings are huge!

-

9

Share and Swap With Friends

If you are tired of your clothes, but they're still good, try swapping with friends. You can also swap many other things, like sports equipment, furniture, even houses.

-

10

Look for Cash Back Rewards

Get a reliable cash-back credit cars with easy redemptions. You can use your rewards to pay your credit card or funnel into a savings account.

-

11

Use your Local Library

You can borrow tons of things from public libraries, and books are just the beginning. Check out your local library to borrow movies and audio books too. Some innovative libraries even let you check out tools, activity kits or musical instruments. Ask your neighborhood librarian to help you get started.

1. Use Apps and Budgeting Methods

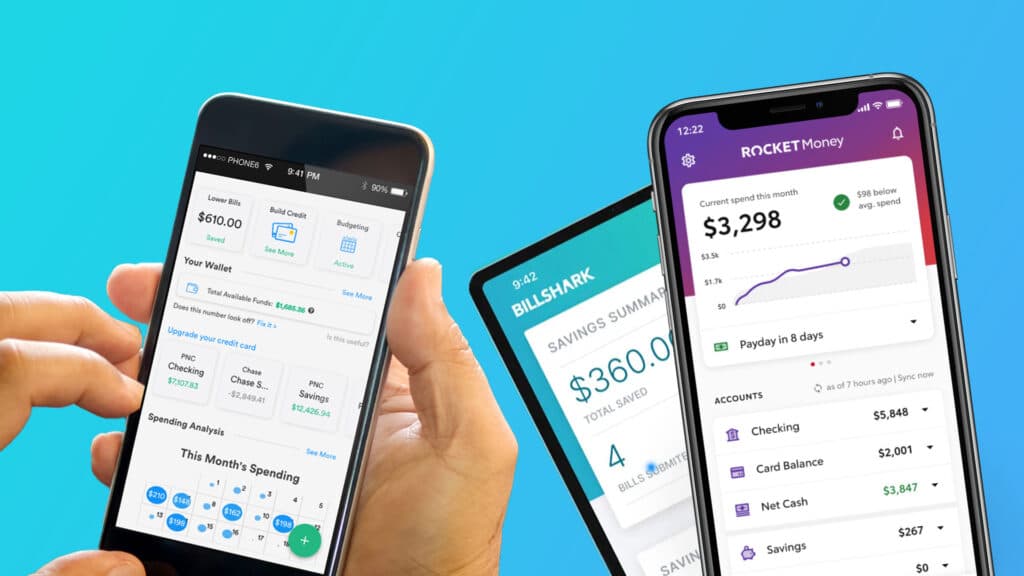

Apps like Intuit Mint and YNAB will connect to your bank, credit card and loan accounts, monitor your spending, and help you generate a budget—all from the comfort of your smartphone.

You can also utilize a smart budgeting method, such as:

50/30/20 Budget Method

An easy way to budget is by allocating 50% of your money to your needs, 30% to wants and 20% to savings and debt repayment. Simply figure out how much you make after taxes and then determine how to spend your paycheck when it comes in.

Zero-Based Budget Method

Another way to budget is by using zero-based budgeting, where you need to justify all of your expenses for the month and allocate all of your money to categories to reach $0. You can't spend $1 without knowing where it’s going, and if you have money left at the end of the month, you must put it somewhere, such as in an emergency fund or toward debt repayment.

2. Find Online Coupons

An even easier way to find coupons is to use Slickdeals’ browser extension, which automatically finds you coupons while you shop so you don’t have to spend time searching. You can download the Slickdeals browser extension for free and start saving today.

3. Cut Costs on Groceries

Food has become very expensive, but there are many ways you can be frugal while grocery shopping. For instance, if you have food in your fridge or pantry, don’t get rid of it just because you haven’t eaten it by the expiration date. Nutrition expert and cookbook author Toby Amidor says that baby food, baby formula and milk are the only three food products with true expiration dates. That said, you probably want to exercise caution and common sense when it comes to perishable foods, like meat and poultry.

"Use By" Dates Are Not Safety Dates

The “use by” date that you see is about the quality of the food, not the safety of it (except for baby food, baby formula and milk as mentioned above). If you examine the food and it seems fine, you should still be able to consume it in many cases. For instance, if beef is still bright red (unless it’s been vacuum packed) or you use raw eggs within three to five weeks of purchasing them, you should be fine. You can often sauté wilted vegetables and eat pasta, rice and canned goods several months after the “use by” date. Just make sure you store these dry goods in a cool and dark place so they last longer.

Skip Grocery Delivery Services

If you use grocery delivery services, you can compare how much the service fees are for different companies and look at how much they charge for the food itself. For example, Instacart sometimes marks up items 15% to 24%. One option for saving money on grocery delivery if you need this convenience is to sign up for Walmart+, which charges a flat rate for unlimited deliveries per year.

Capital One Walmart Rewards Card Review: Earn Generous Rewards on Walmart Purchases

Buy Generic Brands

You’ll also save money by buying store or generic brands instead of brand-name items and buying in bulk when possible, or consider joining a warehouse club like Sam's or Costco.

4. Lower Your Monthly Bills

Your bills may cost you hundreds or thousands each month, but there are little tricks you can use to lower your costs. You could raise the temperature of your refrigerator, install a Nest device in your home, use dimmer switches for lights, turn off your coffee maker when you’re not using it, install solar panels, turn lights off when you leave a room and run appliances like your dishwasher and washer and dryer later at night or in the morning to save on your electric bill.

When it comes to your internet bill, you could ask your provider if you can take advantage of a current promotion or switch to a provider that’s offering one. For your auto, home or renter’s insurance, compare quotes from multiple providers and ask if they are offering discounts for good drivers or for customers who bundle their insurance policies.

5. Cut Down on Subscriptions

You may be spending hundreds every month on recurring subscriptions like Netflix, Spotify, subscription boxes and meal delivery services. You can determine which subscriptions you really need, and cut the ones you don’t. If you aren’t sure how many subscriptions you have, you could sign up for Rocket Money, a service that connects to your bank account, monitors where and when you spend money, and can cancel unwanted subscriptions for you.

3 Apps That Will Automatically Save You Money and Lower Bills Each Month

6. Meal Prep at Home

When you go out to eat, you could easily spend $20 per meal, if not more. Add in delivery costs and fees, and you could double the cost of your meal. You’ll be much less likely to eat out if you know there is food in the fridge for you to eat when you’re too tired to cook. You could pick a day of the week and then spend a few hours preparing meals to store for the rest of the week.

An easy way to meal prep is to make food from all the food groups like grains, vegetables, fruits and protein and keep them in separate containers in the refrigerator. Then, you can grab them and create different meals for each day of the week. This will help you avoid getting bored of what you’ve made.

7. Find Free Activities

Going to the movies or out to a restaurant is fun, but it can be quite expensive. Instead, look up free activities you can partake in around town. That could include going to museums on free days, checking out local parks, beaches and hikes, and walking around botanical gardens.

8. Buy Used Clothes, Furniture or Sporting Goods

You don’t need to buy everything new. For instance, instead of buying new clothes, you can find plenty of decent pieces for your wardrobe at your local thrift store or Goodwill, or on used clothing sites like Poshmark or thredUP. If you need some furniture, check out Facebook Marketplace, Craigslist, and OfferUp. You can find more unique used items like memorabilia and jewelry on sites like Etsy and eBay, and tons of quality sporting goods (and even cars!) for sale on apps like Mercari and OfferUp.

9. Swap With Friends

If you need to buy something, you could always post on social media or reach out to friends who may be willing to swap with you or give you something for free. For instance, if you’re looking for baby goods, your friends who are not having more children would likely be happy to give you things like strollers and toys. If you have things you’re not using anymore, then you could swap for their stuff.

10. Use Cash-Back Rewards Credit Cards

If you have a rewards credit card, you could get cash back every time you make certain purchases. You could get a percentage back on groceries, travel, dining out and more. Some cards have rotating categories, while others will offer a flat cash-back rate on several categories so you don’t have to track your spending. Once you get your cash back, don’t spend it. Instead, apply it to your bill to lower your monthly payment.

Get The Most Bang for Your Buck with RewardsBest Rewards Credit Cards

Visit the Marketplace

11. Go to the Library

While it’s easy to order books on Amazon, the library is a completely free option where you can probably find what you want. The library also has magazines, comic books and DVDs and much more (you might be surprised what they have these days!), so you can save money on all of these things as well.

Bottom Line

You can be frugal and start saving money by using all of these suggestions. Though it can be tough to form new habits, you'll thank yourself for taking some steps to getting your personal finances in order.