Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

When was the last time you looked at your credit report? If the answer is “I don’t remember” or even worse, “never,” now could be the perfect time to review your credit. According to a study by the Federal Trade Commission, one in five consumers has an error on their credit report. Five percent of consumers have the kind of error that could lead to being turned down for a loan or requiring a higher interest rate if approved. Credit report errors could be a huge cost and you might not even know about it!

Follow these steps to review your credit report for errors, fix any problems you find and get the credit score you deserve.

What to Do When You Find a Credit Report Error

If you do find an error on your credit report, it’s up to you to get it fixed. The two main ways of doing this are contacting the lender that supplied the incorrect information or working with the credit bureaus to file a dispute.

Correct Credit Report Errors

Going through the bank or lender that made the error sometimes leads to a quick resolution. Once they update their records, your credit report should reflect the update within the next month or so. Credit bureaus update their records periodically, so you’ll have to wait for a refresh to see your credit report update.

Dispute Credit Report Errors

If you can’t get the lender to fix the error or prefer to go through the credit bureau, each one has its own process to file a dispute. The easiest way for most people to complete a dispute is online, though you may also be able to file one by snail mail or other means.

Here are links to file a dispute through Experian, TransUnion and Equifax.

Related Article

Related Article

4 Times You Should Request a Credit Line Increase

What You’ll Need Before Filing a Dispute

If you think something is wrong on your credit report, the credit bureaus and lenders won’t necessarily just take your word for it. You have to start by getting a copy of your credit report and gathering any supporting documents to prove the error.

Start by getting the latest copy of your credit report. You can get your credit report free from each of the three big credit reporting companies at least once per year by law. The government-mandated website for those free credit reports is AnnualCreditReport.com, but those credit reports don’t include a credit score and are only guaranteed to updated once per year.

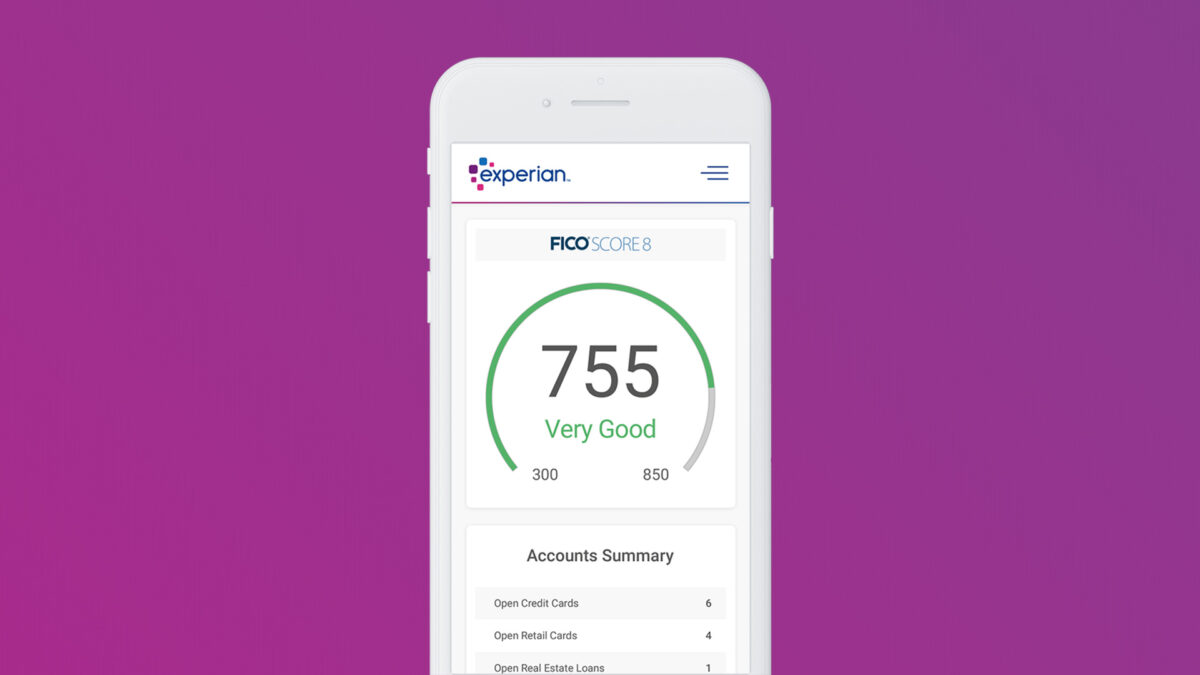

You may be better off using a free credit score service like Credit Karma or Experian where you can view your credit report and credit score with regular updates. They also give you tools to help you improve your credit score over time.

How to Initiate a Dispute With Each Credit Bureau

There are three main credit bureaus that track consumer information in the U.S. Those are Experian, TransUnion and Equifax. Each gives you options to dispute errors on your credit report online, by phone or by mail. If you’re anything like me, you will find the online option by far the fastest and easiest method to initiate a dispute.

If you find an error on your credit report, it’s a good idea to look at your other credit reports too. The error might show up on all three!

Experian

With Experian, you can initiate your dispute through the mail, by phone or online. The phone number isn’t published but is available on your credit report. The general number for Experian is 888-397-3742. By mail, you would send information to: Experian, P.O. Box 4500, Allen, TX 75013. You can start a dispute online and track the progress at the Experian dispute webpage.

After phone or mail-in disputes, you can follow up and track the results online using your credit report number and dispute ID. If you start the dispute online, you can log back in any time to view the current status and add any required information.

Even if you don’t have any problems, it’s a good idea to sign up for a free Experian account to check in on your credit at least a few times per year.

TransUnion

TransUnion also gives you mail, phone and online dispute options. Online is the easiest and fastest way to start and track your dispute. To file a dispute by phone, call 833-395-6941. For mail, send your dispute to: TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000.

For other dispute-related information for your TransUnion credit report, head to the TransUnion website section where you can manage your information. Most disputes are completed in about two weeks but some take a month to resolve.

Equifax

Equifax is most famous for leaking all of our personal information in a massive data breach in 2017. If you need to file a dispute with Equifax, you have familiar mail, phone and online options.

You can start an Equifax dispute online here. For phone disputes, call Equifax at 866-349-5191. Follow the menu to speak with an agent to start a dispute. If you want to wait for the mailperson to deliver your dispute, send to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374-0256.

Related Article

Related Article

Here’s How Netflix Can Now Improve Your Credit Score

What You Can Dispute

I’m sorry the be the bearer of bad news. You can’t dispute a bad credit score. However, if there are mistakes on your credit report, you can dispute those. Disputing and removing negative information should have the effect of increasing your credit score.

According to the Consumer Financial Protection Bureau (CFPB), these are among the most common types of errors found on consumer credit reports.

| Error Type | Example |

|---|---|

|

Personal information

|

Your name, address, phone number and related information are used for verification and other purposes. The CFPB says that many accounts have this information wrong or show information belonging to someone with a similar name. |

|

Account status

|

Some credit report errors show an account as open that’s been closed, or vice versa. An account could show an inaccurate late or missed payment. It could even show you as an account owner where you’re actually just an authorized user. That may sound small, but it could be a big factor in approval for a new credit card or other loans. |

|

Balance errors

|

The wrong balance or the wrong credit limit could be reported in a way that seriously harms your credit, as credit utilization is one of the biggest factors in your credit report. |

|

Data errors

|

Credit reports are maintained by large companies that get massive quantities of data from banks, credit card companies and other lenders. This can lead to duplicate accounts, accounts showing with multiple creditors or failed information updates. |

While fixing a wrong address or incorrect personal information may not help your credit score, it’s important that this information is accurate so you have an easy time applying for new loans or rewards credit cards in the future. If you fix anything related to balances, late payments or incorrect data, your credit score may go up immediately when the dispute is resolved.

What Happens After You Dispute

I’ve done a few online disputes in the past and each worked in a similar way. Here are the general steps to expect after you start a dispute:

- Credit bureau verifies information with the lender: After you submit a dispute, someone at the credit bureau with reach out to the lender or company that reported the incorrect information to verify your dispute.

- Followup or respond if needed: Depending on what the lender says, you may have to follow up or provide additional information to prove you are right and the bank or lender is wrong.

- Credit bureau informs you of resolution: Once they have all of the information, the credit bureau makes a decision and informs you of the result.

- Credit report is updated: If you were successful, your credit report should be updated shortly.

For disputes, the credit bureau has the powerful role of judge and jury. If your dispute is rejected, you typically have an option to appeal the result. That’s essentially a higher-level dispute that gets a little more attention.

You can’t have negative information removed from a credit report through a dispute if the information is correct. Disputes only work for errors and incorrect information. If you don’t like what a lender reported but it’s accurate, you may be able to convince them to remove it, but it may not happen.

Where to Get Your Credit Report for Free

Because your credit report is so important, the government passed a law mandating the three major credit reporting bureaus, Experian, TransUnion and Equifax, to give you a copy of your credit report annually for free. You can get your government-mandated free credit report at annualcreditreport.com.

You can also retrieve full copies of your credit report and your credit score from free apps from Credit Karma and Experian. Both are free and filled with valuable information about your credit and how to improve your credit score.

Credit Karma

- Free TransUnion Credit Report

- Free Equifax Credit Report

Experian

- Free Experian Credit Report

- Free Experian Boost

Bottom Line

If you plan to buy a home in the future, a good credit score could save you tens of thousands of dollars or more on your mortgage. It could be the difference between getting approved for a sweet new rewards card or getting turned down.

To maintain your credit, it’s a good idea to review your full credit report at least every year, if not more often. If your credit score is low due to an error, you should certainly take the time and effort to have it corrected.