Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Note: The Bilt Mastercard® is backed by Wells Fargo and the author, Julia Menez, is a senior advisor for Bilt Rewards.

Many landlords may not allow you to use a credit card to pay your rent. Or, if they do allow it, there may be an extra fee (usually around 3%) to pay your rent via credit card. However, the Bilt Mastercard has a way around this and earn point towards free travel and other perks.

If you pay rent and don’t have an easy way to earn points for all your rent payments, the Bilt World Elite Mastercard® can help you earn points on rent payments without incurring any additional fees. There is no annual fee to have the Bilt Mastercard to earn Bilt Rewards points, nor is there any fee to use it for paying rent.

According to its terms, “when BiltProtect is enabled, you can initiate a BiltProtect Rent ACH transaction to use your Bilt Mastercard to pay your monthly rent by transferring funds from a linked qualifying deposit account.”

That means that even if your landlord does not usually accept credit card payments for rent, Bilt can send an ACH payment on your behalf to pay your rent, and you will finally earn points for one of the biggest spends in your budget each month. Alternatively, Bilt can mail a physical check to your landlord on your behalf, and you will earn points that way as well.

Pay Your Rent and Make 5 Purchases Per Month for Points

When you pay your rent with the Bilt Mastercard, you will earn one point per dollar on rent, as long as you make five purchases per month on the card. I personally automate this by putting subscriptions, such as charity donations, or small Amazon reloads on my Bilt Mastercard to make sure I earn points on rent. The maximum number of points you can earn from rent payments in a year is 50,000.

In addition to earning points on rent, the Bilt Mastercard offers 3x points on dining, 2x points on travel purchases, and 1x points everywhere else. That is similar to the earning structure of the Chase Sapphire Preferred®, with the main differences (other than the ability to earn points on rent) being that the Chase Sapphire Preferred has an annual fee of $95 and a sign-up bonus, while the Bilt Mastercard does not.

Should You Use a Personal Loan to Pay Rent?

Earn Points Even If You Don't Pay Rent Using Bilt

Even without having the Bilt Mastercard, it is worth downloading the free Bilt Rewards app to earn free Bilt Points in other ways. Bilt currently partners with a variety of airline and hotel loyalty programs.

You can earn 100 points for each transfer partner simply by making a free Bilt Rewards account through the app, making a free loyalty account for each transfer partner, and connecting each loyalty account in the Bilt Rewards app. Bilt Rewards' transfer partners currently include:

- American Airlines AAdvantage®

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Asia Miles

- Emirates Skywards

- Hawaiian Airlines HawaiianMiles®

- IHG® One Rewards

- Turkish Airlines Miles&Smiles

- Virgin Atlantic Flying Club

- United MileagePlus®

- World of Hyatt®

Get the Highest Redemption Value (1:1) with Travel Partners

For each transfer partner, Bilt Points transfer at a 1:1 ratio. That can yield a variety of redemption sweet spots. For example, Hyatt free nights start at 3,500 points when redeemed for Category 1 hotels during off-peak dates.

Additionally, you can book a domestic flight anywhere in the United States (including Alaska and Hawaii) for only 7,500 points each way in economy with Turkish Airlines' Miles & Smiles program.

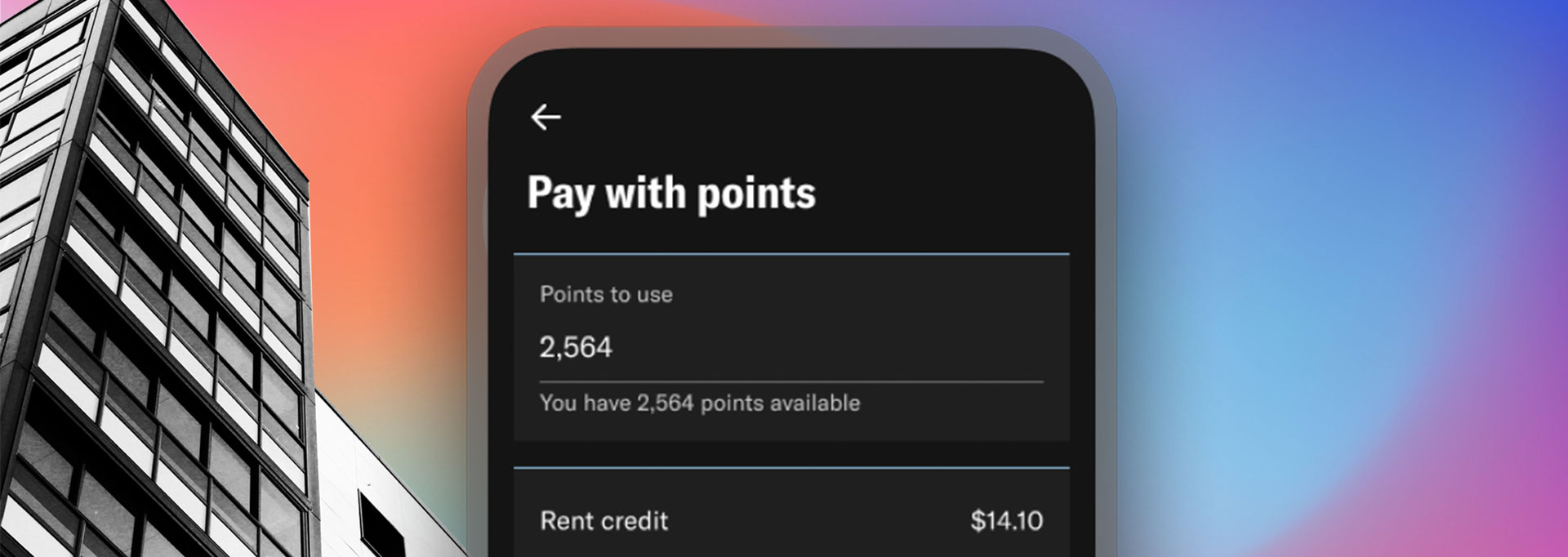

You’ll generally get the highest value out of your points redemptions when using them for travel, but Bilt Rewards offers many other redemption options as well for those who are not frequent flyers. For example, Bilt Points can be redeemed toward your monthly rent payment to lower the amount you pay in rent each month. However, this yields a low redemption value of 0.55 cents per point, whereas transferring points to programs such as World of Hyatt can usually result in a redemption value of around 2.0 cents per point.

Redeem Bilt Rewards for SoulCycle and Other Bilt Partners

Bilt Rewards can also be redeemed for art and home decor pieces from Bilt’s curated art collection if you prefer to redeem your points for art. If you are more of a fitness enthusiast than a travel enthusiast, you can redeem Bilt Points for fitness classes with various fitness partners, such as SoulCycle, Rumble, [solidcore], and Y7® Studio.

Unfortunately, the Bilt Mastercard does not currently offer a way to earn points by paying your mortgage or commercial rent with its program — the program is currently limited to residential rent payments where you have a valid lease.

Featured photo: Slickdeals/Bilt