Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Opening a new bank account or credit card can be a great way to score valuable welcome bonuses and promotions. Yet before long, you could find yourself trying to keep up with several bank accounts and credit cards each month.

See Which Credit Cards Offer BonusesBest Credit Card Bonuses

Visit the Marketplace

Managing Your Credit How to Manage Multiple Bank Accounts and Credit Cards

Managing multiple bank accounts and credit cards can be simple with the right plan. Here are some tips to get started.

-

1

Start With a Budget

No matter how many bank accounts or credit cards you use, it's important to have a plan for how you want to spend your money—aka a budget.

-

2

Track Your Spending (And Make It Easy)

Once you have a financial plan in place, you'll need a system to stay on track. You can track spending on an excel worksheet, a notepad, or use a personal finance app.

-

3

Set Up Account Alerts and Automatic Drafts

Automate your recurring payments and set up account alerts for payment reminders, deadlines and overdrafts. Get alerted when you overspend or miss a payment.

1. Start With a Budget

A budget isn't about depriving yourself. Rather, it's a step-by-step guide for applying your hard-earned cash toward the goals that matter most to you. A budget is a system to help you avoid financial regrets.

Before creating your budget, write down the goals you want to achieve with you money. You'll need a plan to take care of your bills. Getting out of debt might also be high on your to-do list (especially with interest rates on the rise). But you should also add in big picture goals (like retirement) along with some fun (such as travel or entertainment) if you can.

If you can be frugal and save money in some areas, it could pay off. When you find extra money in your budget you can use it to reach more important financial goals faster. For example, years ago my husband and I cut our dining out and entertainment budget (among other expenses) and used the savings to pay off our credit card debt.

2. Track Your Spending (And Make It Easy)

Track your spending with a spreadsheet or even a notepad (digital or physical). But you might also want to consider using one of the personal finance apps below.

- Mint: Budgeting apps don't have to be expensive. In fact, one of the best personal finance apps available, Mint, is free to use. With Mint you can create a budget, access free credit scores, schedule bill reminders, and automatically track spending and balances on multiple credit cards and bank accounts.

- Qube Money: Another useful tool for fans of zero-based budgeting is Qube Money. Qube Money is a bank account that lets you set up multiple spending categories (aka Qubes) and divvy up your money among them. You must unlock a Qube before you spend money from it on the debit card that comes with your account. Or you can use the workaround I prefer and transfer money from a Qube to a "credit card spent fund" anytime you swipe your credit card for a purchase (like groceries or gas). A Qube Money account is $8 per month or $6.58 per month if you pay annually.

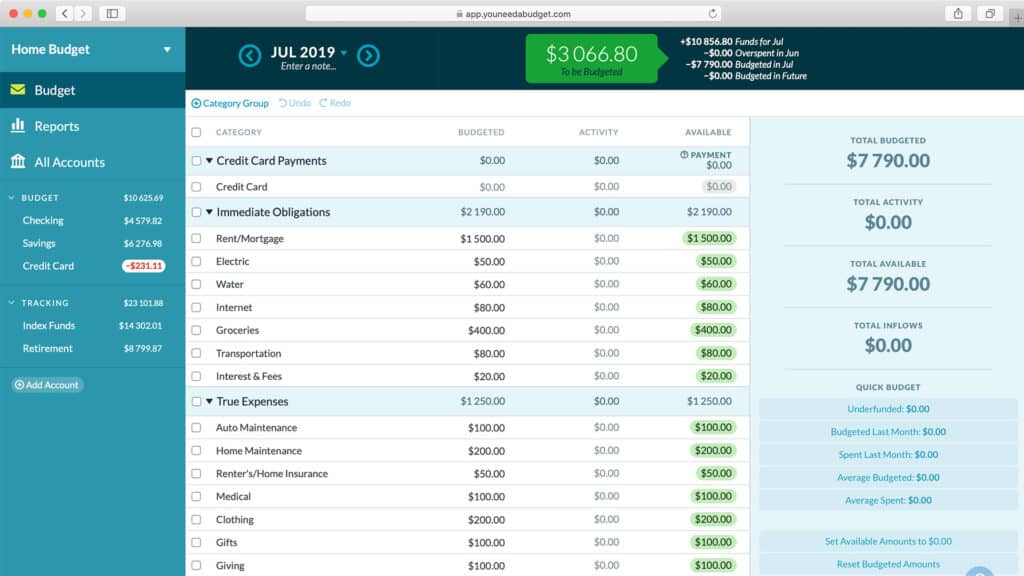

- YNAB: You Need a Budget, or YNAB, is another platform that lets you use a zero-based budgeting system. With zero-based budgeting, you give all of the money you earn a job (e.g,, pay recurring bills, grocery fund, savings or debt elimination). Best of all, you can set up your bank accounts and credit cards to automatically sync with your YNAB account—providing an overview of your checking account balances and debts in one convenient location. YNAB is free for 34 days then $14.99 per month or $98.99 annually.

Quick Tip

You can track your credit cards rewards too, and try to maximize the points, miles or cash back you earn.

3. Set Up Account Alerts and Automatic Drafts

Account Alerts

Many bank accounts (checking and savings) and credit cards have automatic alert features you can customize to keep you in the loop when activity happens on your account. For example, your bank might let you schedule email and text alerts in response to:

- A large transaction hitting your account (e.g., debit, ATM withdrawal or check).

- The receipt of a direct deposit.

- Your account balance falling below a certain amount.

- The creation of a new monthly statement.

Credit card companies may let you set up certain types of account alerts too, such as:

- Payment reminders

- Payment overdue notices

- Transactions over a certain amount

- Approaching credit limit

- Unusual account activity

Automatic Drafts

Automatic payments can also provide a good failsafe on credit card accounts. For example, I schedule automatic drafts for the minimum payment on a dozen credit cards. This lets me know that if I ever accidentally forget a due date, at least my account wouldn't incur a late fee and my credit history would be protected as well.

It's best to pay your credit card bill in full each month. Paying the full statement balance due helps you avoid interest fees. Your credit score could improve as well when you keep your credit utilization rate low.

Another useful way to use automatic drafts has to do with your savings goals. For example, you might open a high-yield savings account to save toward a downpayment on a home, an emergency fund, a vacation or something else. If you know how much money you plan to put toward your savings goal each month, you could schedule automatic transfers from your checking account to your savings.

Quick Tip

Consider opening a high-yield savings account with a separate bank to remove the temptation to spend.

Bottom Line

Having multiple credit cards and bank accounts could offer some unique benefits. From cash bonuses to credit card rewards you can redeem for free travel, there are several reasons you might want to consider a new bank account or credit card from time to time. Just be sure to put a good financial management strategy in place to avoid potential headaches.

Earn Cash for Your SpendingBest Cash Back Credit Cards

Visit the Marketplace