Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

One of the largest banks in the world, Bank of America offers an array of financial products and services that may touch on every aspect of your financial plan. When it comes to banking, the financial institution's offerings are simple but effective.

What's more, the bank offers rewards for customers who build wealth with the bank and its investment arm,

Intro to Bank of America

Bank of America is the second-largest bank in the U.S. in terms of assets and the

In addition to banking products and services, Bank of America offers credit cards, home loans, auto loans, and investment services.

Bank of America Banking Products

Bank of America offers checking and

Personal Checking and Savings Accounts

The bank offers three personal checking accounts: Bank of America Advantage SafeBalance Banking®, which is designed for students, Bank of America Advantage Plus Banking®, and Bank of America Advantage Relationship Banking®. It also offers one savings account.

$200 Bonus Offer Information

Through January 31, 2024, new Bank of America checking customers have the opportunity to qualify for a $200 bonus offer.

To be eligible for this offer, customers must open a Bank of America Advantage Banking Account through the related promotional page, then set up and receive qualifying direct deposits totaling $2,000 or more within 90 days of account opening.

Once the above qualifications are met, Bank of America will attempt to pay the bonus within 60 days.

The $200 bonus offer is an online only offer and must be opened through the Bank of America promotional page.

Bank of America Advantage SafeBalance Banking®

The Bank of America SafeBalance Banking account is designed to help customers stay within their means. To this end, it features a slightly lower minimum opening deposit of $25 fee and no overdraft fees. While this account does include a $4.95 monthly maintenance fee, students under 25 and Preferred Rewards members qualify for a fee waiver.

It's worth noting that this account does not have check-writing privileges. While this is yet another feature designed to encourage responsible financial habits, if you care about having access to checks this may not be the best choice for you.

Bank of America Advantage Plus Banking®

- Our Rating 4/5 How our ratings work

- Minimum

Deposit Required$100 - Bonus Offer $200Expires January 31, 2024

If you're looking to open an account with Bank of America, the Bank of America Advantage Plus Banking® account may suite your needs well. This account offers helpful features such as check-writing and the option to add Balance Connect® for overdraft protection. And while it does feature a monthly maintenance fee, we appreciate that Bank of America provides customers with multiple ways to waive this fee. One of the biggest perks of this account Bank of America's vast ATM and branch network; if you prefer to bank in-person, you'll likely be able to find a Bank of America location close to you.

Bank of America Advantage Relationship Banking®

If you feel comfortable maintaining a higher account balance, you may want to consider the Bank of America Advantage Relationship Banking account. This premium account earns 0.01% - 0.02% APY (annual percentage yield), and features choice perks such as fee-free or discounted paper checks, no fees on select services and additional discounts.

This account carries a $25 monthly fee that's waivable if you maintain a combined balance of at least $10,000 in eligible linked accounts or are enrolled in Preferred Rewards.

Bank of America Advantage Savings

The Bank of America Advantage Savings account offers 0.01% - 0.04% APY on your balance. This account features a $100 minimum opening deposit requirement, as well as an $8 monthly maintenance fee. Luckily, this fee is waived for the first six months, and can be waivable after that if one of the following applies:

- Maintain a minimum daily balance of $500

- Link your savings account to an Advantage Relationship Banking® account

- Are a Preferred Rewards member

- Are under 1

8 yea rs old - Are under 25 years old and qualify as a student

Explore the Best Free Checking Accounts

Visit the Marketplace

Personal Certificates of Deposit

Bank of America offers certificates of deposit (CDs) with a variety of rates and terms, and you need a minimum deposit of $1,000 to get started. The bank's standard fixed-term CDs range from 28 days to 10 years, but their APY is a measly 0.03%. However, the bank offers a handful of options with its featured CD terms. Here's what to expect:

| Term | APY |

|---|---|

|

3 months (Fixed) |

4.50% |

|

7 months |

5.00% |

|

10 months |

0.05% |

|

13 months |

5.00% |

|

25 months |

3.00% |

|

37 months |

0.05% |

|

60 months (Fixed) |

0.03% |

All of the bank's CDs come with a penalty if you withdraw before your term ends.

Build your savings fasterExplore the Best CD Rates

Visit the Marketplace

Small Business Checking Accounts

Bank of America offers two business checking accounts. Here's a quick look at each of them:

Bank of America Business Advantage Fundamentals™ Banking

- Our Rating 4/5 How our ratings work

- APYN/A

- Minimum

Deposit Required$100 - Bonus Offer $200Expires December 31, 2023

Bank of America's Business Advantage Fundamentals™ Banking is a great option for smaller businesses, as you can open this account with as little as $100. Plus, there's no fee for the first 200 transactions each statement cycle, so if you don't envision your business exhausting this, it's certainly worth your consideration.

Bank of America Business Advantage Relationship Banking

- Our Rating 4/5 How our ratings work

- APYN/A

- Minimum

Deposit Required$100 - Bonus Offer $200Expires December 31, 2023

If you're confident you can maintain the required minimum balance to waive this account's monthly fee, you'll find a lot of value in Bank of America Business Advantage Relationship Banking. This account expands on all the best features from Bank of America's Business Advantage Fundamentals™ Banking; customers get fees waived for the first 500 transaction each statement cycle, as well as access to additional business checking and savings accounts without monthly fees. This account is a solid option for larger businesses that handle a lot of monthly transactions.

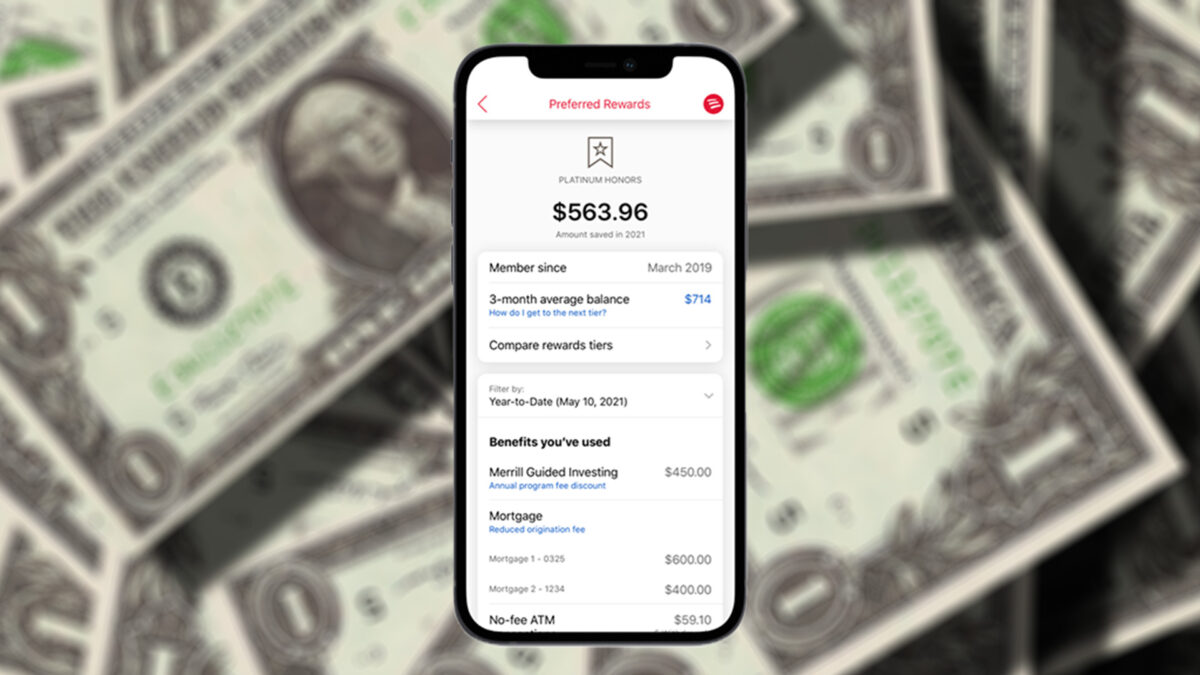

Bank of America Preferred Rewards Program

Bank of America is relatively

Once you have a

| Gold | Platinum | Platinum Honors | Diamond | |

|---|---|---|---|---|

|

Balance Requirement |

$20,000 |

$50,000 |

$100,000 |

$1 million |

|

Rewards Bonus on Eligible Credit Cards |

25% |

50% |

75% |

75% |

|

Interest Rate Booster on Your Savings |

5% |

10% |

20% |

20% |

|

Banking |

No fees on select services, no monthly fees on up to four checking and four savings accounts |

No fees on select services, no monthly fees on up to four checking and four savings accounts, one fee-free out-of-network U.S. ATM withdrawal each month |

No fees on select services, no monthly fees on up to four checking and four savings accounts, unlimited fee-free out-of-network ATM withdrawals in the U.S. |

No fees on select services, no monthly fees on all checking and savings accounts, unlimited fee-free out-of-network domestic and international ATM withdrawals |

|

Mortgage |

$200 origination fee discount |

$400 origination fee discount |

$600 origination fee discount |

0.25% interest rate reduction with PayPlan |

|

Home Equity |

0.125% interest rate discount |

0.250% interest rate discount |

0.375% interest rate discount |

0.625% interest rate discount |

|

Auto Loan |

0.25% interest rate discount |

0.35% interest rate discount |

0.50% interest rate discount |

0.50% interest rate discount |

|

Foreign Currency |

1% exchange rate discount on mobile and online orders; free shipping |

1.5% exchange rate discount on mobile and online orders; free shipping |

2% exchange rate discount on mobile and online orders; free shipping |

2% exchange rate discount on mobile and online orders; free shipping |

|

Merrill Guided Investing |

0.05% annual program discount fee |

0.10% annual program discount fee |

0.15% annual program discount fee |

0.15% annual program discount fee |

|

International Travel |

N/A |

N/A |

N/A |

No international transaction or ATM fees |

|

Lifestyle |

N/A |

N/A |

N/A |

Access to unique experiences and premium offers |

The Bottom Line: Is Bank of America Right for You?

Bank of America offers standard banking products and services, and for many consumers, they don't stack up well against other valuable options, such as rewards checking accounts and high-yield savings accounts offered by other banks.

However, if you have eno

As with any financial decision, take some time to think about what you want in a bank and research several options to ensure you find the best fit.