Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

SoFi® Checking and Savings

- Our Rating 5/5 How our ratings work

- APY0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

- Minimum

Deposit RequiredN/A -

Intro Bonus

$50-$300Expires January 31, 2026

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. SoFi members with Eligible Direct Deposit can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.80% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

SoFi Checking and Savings boasts an impressive APY of up to 3.80% on savings balances for customers who set up direct deposit or who deposit at least $5,000 each month. Alternatively, customers can also unlock the top rate by paying the monthly SoFi Plus Subscription Fee. This account also offers 0.50% APY on checking balances. There are no monthly maintenance fees, and new customers can even earn a generous signup bonus worth up to $300. If you don’t care about physical bank locations, this is a great option.

SoFi Checking and Savings has a lot to offer, including no monthly maintenance or overdraft fees3, fee-free ATM access5 to a wide network nationwide and early direct deposit up to two days early. But it also comes with one big benefit—you can earn up to 3.80% APY2 on your savings balance, as well as 0.50% APY on your checking balance. New customers can also currently earn a generous sign-up bonus worth up to $300 just for opening a new SoFi Checking and Savings account and receiving qualifying direct deposits1.

Bonus Offer: Up to $300

It's pretty common for banks to offer a welcome bonus when you sign up and meet certain requirements, and the SoFi Checking and Savings account is no different.

New customers can currently earn a one-time bonus of up to $3001 when they open a new SoFi Checking and Savings account before January 31, 2026.

SoFi Checking and Savings Bonus Tiers

| Total Qualifying Direct Deposits | Cash Bonus |

|---|---|

|

$1,000 – $4,999.99 |

$50 |

|

$5,000+ |

$300 |

To qualify for the $300 SoFi Checking and Savings bonus:

- Open a new SoFi Checking and Savings Account.

- Receive at least $1,000 in qualifying direct deposits within a 25-day "Evaluation Period," which begins the day your first qualifying direct deposit is received.

- Hit the minimum requirement to earn a $50 cash bonus.

- Reach the next tier to earn you a $300 bonus.

Once you meet the direct deposit requirement, you'll receive your bonus within seven business days after the Evaluation Period.

If you're looking a new account with a higher sign-up bonus, there are several banks that have more enticing bank account bonus offers.

SoFi Direct Deposit Bonus Fine Print

- Deadline to open an account: To be eligible for the bonus, you'll need to open an account by January 31, 2026.

- Qualifying direct deposit: The deposit must come from your employer, payroll or benefits provider—such as a paycheck or government-issued benefits check.

- Bonuses are reported as taxable income: This bonus, like many bank bonuses, is considered miscellaneous income for tax purposes. You may receive a Form 1099-MISC (or Form 1042-S, if applicable) at the start of tax season, and you'll need to claim that income on your tax return, but the value of the bonus tends to outweigh the tax bill.

Related Article

Related Article

U.S. Bank Bonus Offers: Up to $1,200 for Opening New Accounts

APY: Earn Up to 3.80%

SoFi Checking and Savings isn't a high-yield savings account, but it offers a much higher annual percentage yield (APY) than the majority of checking accounts—and also many savings accounts on the market.

You won't have to jump through a lot of hoops to earn the highest APY. All you have to do is set up monthly direct deposits of your paycheck or government-issued benefits. You won't even have to receive a minimum direct deposit amount to earn the increased APY. If you don't receive monthly direct deposits, you can still earn the top savings rate by depositing $5,000 or more each month, or by paying the SoFi Plus subscription fee every 30 days.

You can earn a 3.80% APY2 interest rate on your SoFi savings account in one of three ways:

- Monthly direct deposit: Set up a recurring monthly direct deposit of your paycheck or benefits provider via ACH deposit.

- Qualifying deposits: SoFi defines qualifying direct deposits as transactions made from an enrolled member’s employer, payroll or benefits provider via ACH deposit. There's no minimum deposit required for this method.

- Deposit $5,000 each month: If you don't receive direct deposit, you can still earn the top interest rate by adding $5,000 or more in qualifying deposits every 30 days. This includes funds you add to both your checking and savings accounts.

- Qualifying deposits: In this case, qualifying deposits include ACH deposits, inbound wire transfers, cash or check deposits, peer-to-peer transfers such as PayPal or Venmo, instant funding to your SoFi debit card and push payments to your SoFi debit card.

- Pay the SoFi Plus Subscription Fee: If you don't think you can meet the previous two requirements, you can still unlock this account's top rate by paying the SoFi Plus Subscription Fee every 30 days.

While it's nice to have multiple ways to earn the top interest rate, the direct deposit method is the most straightforward, only because there's no minimum deposit requirement. Regardless if you get a $100 or $4,000 direct deposit from your employer each month, you'll earn 3.80% APY on your savings.

Limited-Time Offer: Boost Your Savings Rate by an Additional 0.20%

While SoFi's savings rates are already impressive, new customers have the chance to boost their rates even higher.

What APY Do You Earn if You Don't Qualify for 3.80%?

If you don't meet any of the requirements to earn 3.80% APY2, your APY will be a healthy 1.00% APY on your savings balance, which is still higher than rates offered by many traditional banks. Plus, you earn 0.50% APY on checking balances, regardless of whether you set up direct deposit.

Benefits of SoFi Checking and Savings

Until relatively recently, SoFi® was not officially a bank—although customer deposits were FDIC insured4. SoFi became an online bank in 2022 and can now offer traditional banking products. If you opened a SoFi Money account prior to the firm's incorporation as a bank, don't worry—you'll keep your benefits until your spending account is converted to the new Checking and Savings product.

- SoFi Checking and Savings Work Together: One thing to know is that you have to open both a checking account and savings account; you can't do solely one or the other. But remember, everyone who opens this account can get 0.50% APY on checking balances and 3.80% APY2 by meeting one of several requirements.

- No Account Fees3: You won't need to worry about overdraft fees3, monthly fees or punitive fees for not meeting a minimum balance requirement. Plus, you'll have fee-free access to the Allpoint ATM network5, which operates 55,000 cash points nationwide. Still, if you use a non-network ATM, you will incur third-party fees.

- Get Paid Up to Two Days Early6: When you set up direct deposit, you'll receive your paycheck up to two days earlier. This is based on the timing of when SoFi receives notice of impending payment from your employer or depositor. It's typically up to two days before the scheduled payment date, but your mileage may vary.

Useful Banking Tools

The SoFi Checking and Savings also comes with several useful tools to help you manage your finances.

- Vaults: SoFi Savings Vaults are extensions of your account, where you can earmark funds for certain goals. You can create up to 20 Vaults, and there are no fees or minimum balance requirements.

- Roundups: Every purchase you make with your debit card is rounded up to the nearest dollar. The difference is automatically transferred to one of your Vaults, which you can dedicate for that savings. Saving a few cents every time you swipe your card may not sound like a lot, but it can add up over time.

- Money transfers: The app lets you transfer money to anyone, similar to Venmo or Cash App. If they're a SoFi member, they'll receive the funds instantly. If not, they'll receive the cash within two to three business days after they submit their bank account information to get the funds.

- Mobile deposit: While you can't deposit cash into a SoFi account super easily, you can deposit checks via the mobile app.

Account Fees

While a big benefit of SoFi Checking and Savings is that you don't have to worry about account fees3, such as a monthly servicing fee, that doesn't mean SoFi Checking and Savings is completely fee free.

Here are some fees to watch out for with this account:

- Out-of-network ATM fees: You'll be charged a fee by the ATM owner, and SoFi won't reimburse that fee like some online banks do.

- Foreign currency conversion fee: You pay 0.2% if you use your debit card to make a purchase or ATM withdrawal in a foreign currency.

Alternatives to SoFi Checking and Savings

If you're not quite sure that a SoFi Checking and Savings is the right choice for you, here are a few alternatives to consider:

Recommended High-Yield Savings Accounts

| Bank Account | APY | Features | Learn More |

|---|---|---|---|

UFB Direct Portfolio Savings Account |

3.90%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate. |

No minimum deposit |

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer. |

|

Member FDIC |

0.50% - 3.80%

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus. |

No minimum deposit |

Open Account |

|

|

3.75%

Platinum Savings is a tiered interest rate account. Interest is paid on the entire account balance based on the interest rate and APY in effect that day for the balance tier associated with the end-of day account balance. *APYs — Annual Percentage Yields are accurate as of November 20, 2025: 0.25% APY on balances of $0.01 to $4,999.99; 3.75% APY on balances of $5,000.00 or more. Interest Rates for the Platinum Savings account are variable and may change at any time without notice. The minimum to open a Platinum Savings account is $100. |

$100 minimum deposit |

Open Account |

|

|

3.65%

APY — Annual Percentage Yield is accurate as of November 20, 2025. Interest Rates for the Savings Connect Account are variable and may change at any time without notice. The minimum to open a Savings Connect account is $100. Fees could reduce earnings on the account. |

$100 minimum deposit |

Open Account |

How to Maximize SoFi Checking and Savings

SoFi Checking and Savings offers a lot of features you can't get with a traditional checking or savings account. And because it's partnered with SoFi Invest, it makes it easier to transfer funds between its banking and investment accounts, if that's something you want to do.

Here's how to maximize the value you can get from SoFi Checking and Savings:

- Read the fine print on the sign-up bonus to make sure you receive the full amount.

- Meet the monthly requirements to qualify for the higher APY.

- Check your mobile app regularly for the latest limited-time cash-back offers.

- Take advantage of your Vaults to establish and track savings goals.

- Turn on the Roundup feature so you can save every time you use your debit card.

Is a SoFi Checking and Savings Account Right for You?

SoFi isn't right for everyone. If you like in-person service or deal with a lot of cash, using SoFi may be more trouble than it's worth. But if you don't use cash regularly and prefer an online banking setup, it's one of the better banking options out there. Plus, the bonus for new account holders gives you a great excuse to test drive membership.

That said, take some time to compare SoFi Checking and Savings with checking accounts and high-yield savings accounts, and compare rates and other features to find the right fit for you.

Ready to Open a SoFi Checking and Savings Account? Start Here

Disclosures

1. Up to $300 Bonus Tiered Disclosure

New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus of either $50 (with at least $1,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period) OR $300 (with at least $5,000 total Eligible Direct Deposits received during the Direct Deposit Bonus Period). Cash bonus will be based on the total amount of Eligible Direct Deposit. If you have satisfied the Eligible Direct Deposit requirements but have not received a cash bonus in your Checking account, please contact us at 855-456-7634 with the details of your Eligible Direct Deposit. Direct Deposit Promotion begins on 12/7/2023 and will be available through 1/31/2026. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC. SoFi members with Eligible Direct Deposit can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the 3.80% APY for savings (including Vaults). Members without Eligible Direct Deposit will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

2. APY disclosures

SoFi members who enroll in SoFi Plus with Eligible Direct Deposit or by paying the SoFi Plus Subscription Fee every 30 days or SoFi members with $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 3.80% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Eligible Direct Deposit amount required to qualify for the stated interest rate. Members without either SoFi Plus or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.00% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Interest rates are variable and subject to change at any time. These rates are current as of 1/24/25. There is no minimum balance requirement. If you have satisfied Eligible Direct Deposit requirements for our highest APY but do not see 3.80% APY on your APY Details page the day after your Eligible Direct Deposit arrives, please contact us at 855-456-7634. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet. See the SoFi Plus Terms and Conditions at https://www.sofi.com/terms-of-use/#plus.

3. Fee Policy

We do not charge any account, service or maintenance fees for SoFi Checking and Savings. We do charge a transaction fee to process each outgoing wire transfer. SoFi does not charge a fee

for incoming wire transfers, however the sending bank may charge a fee. Our fee policy is subject to change at any time. See the SoFi Checking & Savings Fee Sheet for details at

sofi.com/legal/banking-fees/.

4. Additional FDIC Insurance

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per depositor per legal category of account ownership, as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $3M through participation in the program. See full terms at SoFi.com/banking/fdic/sidpterms. See list of participating banks at SoFi.com/banking/fdic/participatingbanks.

5. ATM Access

We’ve partnered with Allpoint to provide you with ATM access at any of the 55,000+ ATMs within the Allpoint network. You will not be charged a fee when using an in-network ATM, however, third-party fees incurred when using out-of-network ATMs are not subject to reimbursement. SoFi’s ATM policies are subject to change at our discretion at any time.

6. Early Access to Direct Deposit Funds

Early access to direct deposit funds is based on the timing in which we receive notice of impending payment from the Federal Reserve, which is typically up to two days before the scheduled payment date, but may vary.

7. Overdraft Coverage

Overdraft Coverage is limited to $50 on debit card purchases only and is an account benefit available to customers with Eligible Direct Deposits of $1,000 or more during the current 30-day Evaluation Period as determined by SoFi Bank, N.A. The 30-Day Evaluation Period refers to the “Start Date” and “End Date” set forth on the APY Details page of your account, which comprises a period of 30 calendar days (the “30-Day Evaluation Period”). You can access the APY Details page at any time by logging into your SoFi account on the SoFi mobile app or SoFi website and selecting either (i) Banking > Savings > Current APY or (ii) Banking > Checking > Current APY. Members with a prior history of non-repayment of negative balances are ineligible for Overdraft Coverage.

8. 0.20% Savings APY Boost

Earn up to 4.00% Annual Percentage Yield (APY) on SoFi Savings with a 0.20% APY Boost (added to the 3.80% APY as of 6/10/25) for up to 6 months. Open a new SoFi Checking & Savings account and enroll in SoFi Plus by 6/24/25. Rates variable, subject to change. Terms apply at sofi.com/banking#2. SoFi Bank, N.A. Member FDIC.

FAQs

-

When you set up a Vault, purchases made with a SoFi debit card are automatically rounded up to the nearest dollar and deposited into the Vault. For example, if you spend $2.75 on a cup of coffee, SoFi debits your account $3 and deposits the extra $0.25 into your Vault. Periodically, SoFi offers roundup bonuses where members can earn an additional cash just for using the roundup feature.

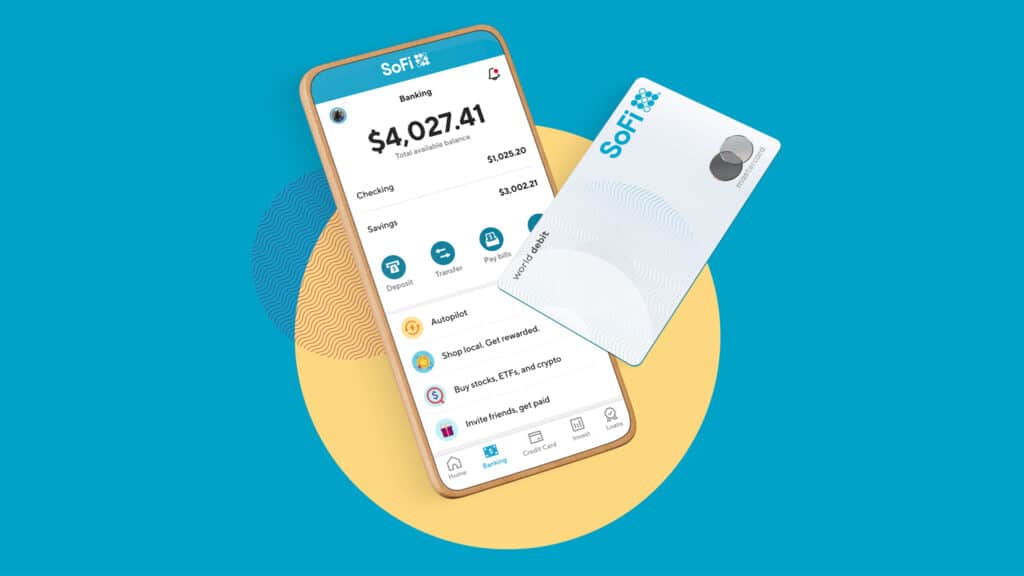

Featured photo courtesy of SoFi