Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Every month, when your bills come in, are you taken aback by how much companies are charging you? Are you fed up with paying high interest rates on your credit card? Do you have recurring charges that you want to get rid of, but you just don't have the time?

Then the Trim app may be the solution for you. We're offering a full Trim app review, including its features, pros and cons and how much you can really save on your bills by using the app.

Trim App Review Summary

Pros

- Trim's negotiation feature will automatically take care of your bills, credit card interest, subscriptions are more

- All you need to do is download the app and let Trim do the work, meaning you don't have to spend hours on the phone with companies

- The platform is highly secure and will protect your financial information with multiple levels of encryption and security

Cons

- You have to pay Trim a 15% fee based off your yearly savings from a successfully bill

- Its negotiating tool is not designed for budgeting, saving and investing, so you'll also need to download better financial planning apps.

- Trim is an app that negotiates with companies to save you money on your bills and helps you lower your credit card APR

- It will analyze spending patterns and show you ways to cut back and save money

- Trim App uses 256-bit SSL encryption and two-factor authentication to ensure your banking data, credit card accounts and online service logins are safe

- Many of Trim's services are free, but it does charge a success fee of 15% of your annual savings when it successfully negotiates a lower bill. You are not charged if Trim's negotiation team does not save you money

What Is the Trim App and What Features Are Available?

Also known as Ask Trim, Trim App does just what it says: It trims your bills. Since 2015, the company has been helping users save big on their monthly bills for services, utilities and more.

It's basically a middleman that does the negotiating for you. Trim claims to save the average user about $626 a year.

Trim is now free to use. In the past, Trim offered both a free and premium version, but now its unlocked all features for all users.

Bill Negotiation Feature

For bill negotiation, you will send bill summaries to Trim, and then they will get in touch with the company. If Trim can help you, they will let you know, and then you can choose whether or not you want to move forward.

You'll only pay if you enroll in its Bill Negotiation feature, and if Trim's team then successfully negotiates a bill. When this happens, you'll pay 15% of the total first year of savings. Otherwise, you are not charged for Bill Negotiation. Neither will you pay for any of Trim's other free features.

Free Trim Features

In addition to paid Bill Negotiation, Trim offers a lineup of free tools and services to help you save money.

Find and cancel unwanted subscriptions: Trim will analyze your transactions to find your recurring subscriptions. You'll be able to see how much you're spending on these transactions, choose which ones you want to cancel and then wait for Trim to update you on the status of the cancellation.

Negotiate medical bills: Simply share bills for doctor's office visits, hospital stays and other medical services and Trim will work with your provider to possibly lower your bills, get better rates or, at least, an acceptable payment plan.

Lower credit card APRs and bank fees: Trim will work with your bank, credit union and credit card issuer of waive interest, lower APRs and get refunds for unfair bank fees.

Build your savings: You'll get access to Simple Savings, an automated savings account that gives you a 4% annual reward on your first $2,000, and then 0% for the rest of your money. You can set up automated weekly transfers from your checking account so you don't even have to think about it. Your deposits are FDIC insured, too, through Trim's banking partner, Evolve Bank.

Automatic credit card payments: TrimPay feature automates transfers toward your credit card to help pay down your balance faster. In order to do all of this, Trim will view your transactions from your linked credit card accounts and checking accounts to determine which transactions are recurring.

Financial Coach: You have unlimited access to Trim financial planners via email.

Personalized tools: You also get access to useful features such as a personalized financial dashboard, spending alerts and reminders, subscription and transaction monitoring, and a debt calculator.

How Trim's Negotiating Service Can Help You Save

Lower APR, Lower Interest Payments

Trim's negotiation service will work with your credit card providers to lower your APR, which is a huge benefit, as the average credit card APR is an astounding 16.01%.

Every month that you carry a credit card balance, you're paying huge amounts of interest – perhaps hundreds or even thousands of dollars in interest repayments. So negotiating a lower APR could have a significant impact on your debt.

Save on Bank Fees

The app's bank negotiation team will also help you save when it comes to unfair banking fees, like overdraft fees or non-sufficient funds fees. If you've accidentally spent more than what was in your account, you may have been charged an expensive fee around $33, which is about average for overdraft fees. You also might have spent hours on the phone with your bank to try to reverse those fees, to no avail. You can let Trim do the work for you and try to get back your money.

Negotiate to Lower Overall Bills

Trim can also negotiate charges from medical, cable, phone and internet service providers by contacting these companies and inquiring about lowering the costs of these services. If they achieve a successful negotiation, you'll pay Trim 15% of your yearly savings as a negotiation fee.

As an example, if Trim App saves you $10 a month for 12 months, they will take an $18 fee ($10 * 12 = $120 - %15).

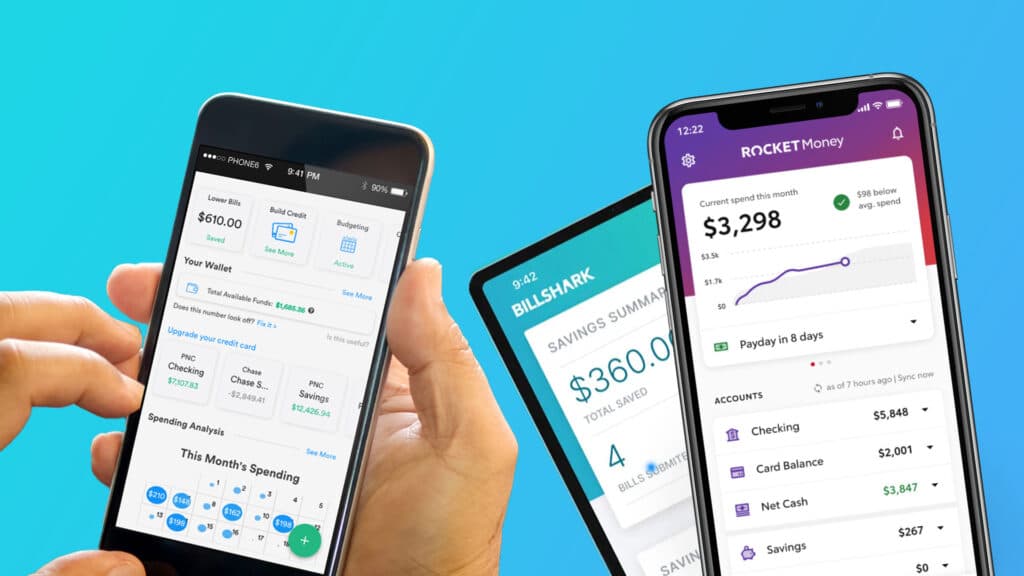

3 Apps That Will Automatically Save You Money and Lower Bills Each Month

Trim Helps You Cancel Bills for Unused Subscriptions

Let's say you signed up for a one-month free trial for a product, but you had to provide your credit card information. If you forget to cancel the subscription, you'll still get charged month after month.

Perhaps you signed up for a service that claimed it would cancel your subscription automatically after a certain period of time, but continued to charge you without your permission.

Trim can help you address these issues and cancel any bills for products and unused subscriptions that you no longer need.

In some cases, you may not even be aware of these recurring charges. The app will point them out to you, and you can decide whether to leave them alone or have Trim step in.

How Much You Can Save With Trim

If you have high-interest credit cards, pay multiple monthly subscription fees, are dealing with medical or credit card debt and have overdraft fees from your bank, Trim could save you hundreds or thousands of dollars per year.

But your mileage will vary based on your financial situation, as well as your service providers. However, for a (mostly) free service, the potential for savings is promising.

Once you create a free Trim account and link your other deposit and credit accounts, you should be able to determine if you'll see real savings or not.

Trim App FAQ

-

While Trim does not provide a complete list of internet service providers that is negotiates with, it claims to work with Comcast, Time Warner, Verizon and most other providers to successfully negotiate lower monthly bills and refunds for other fees and charges.

-

For the most part, Trim is a free service. The only time you’ll pay is after a successful negotiation lowers your premiums or bills. In these cases, Trim charges a success fee of 15% of your total yearly savings. You are not charged if Trim does not save you money. Its other services like canceling unwanted subscriptions, negotiating your credit card APR and medical expenses are offered at no cost to you.

-

Yes, by connecting your various service provider accounts, Trim’s negotiation team can attempt to save money on both one-time payments and recurring monthly costs. Additionally, when you connect bank accounts and credit card accounts, Trim’s algorithm will identify subscription charges and manage them for you. Generally, you will see savings from successful negotiations reflected on your account within 1-2 billing cycles.

-

Trim App, also known as Ask Trim, does not currently offer a mobile app for either Android or iPhone. But according to its customer service team, Chrome is the best browser to use. To get started, visit asktrim.com and create a free account using your Facebook or Google account or an email address. Once logged into your new Trim account, simply link your SMS, connect a bank and then start saving money.