Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Vio Bank is a digi

If you're looking for a place to stash some cash for sho

Highlights

- The bank offers an APY of

up to 5. 00%, depending on which account you choose. - Minimum depo

sits are relativel y low. - All three accounts charge n

o monthly maintenanc e fee. - Interest is comp

ounded dai ly on all accounts. - CD terms range from si

x months to 10 ye ars.

Who Is Vio Bank Best For?

Vio Bank offers impressive interest rates on its money market account an

- You want a high-

yield money market account but don't need flexible acc ess to your funds. - You're

looking for a short-term CDwith a high interest rate. - You

want an extremely long CD term. - You don't want to de

al with high minimum deposit re quirements.

Vio Bank Online Savings Account

- Interest rate: 1.10% APY

- Minimum opening deposit: $100

- Minimum balance requirement: None

- Monthly maintenance fee: None

The Vio Bank Online Savings Account offers a hig

The account also has a minimu

The only way to access your fun

Related Article

Related Article

Are Online Banks Safe in 2026?

How Does Vio Bank Online Savings Compare?

| Vio Bank Online Savings | UFB Direct Portfolio Savings Account | CIT Bank Savings Connect | |

|---|---|---|---|

|

APY |

1.10% |

3.90% | 3.65% |

|

Minimum Opening Balance |

$100 |

N/A | $100 |

|

Access to Funds |

Bank transfer |

Bank transfer, ATM card |

Bank transfer |

Vio Bank Online Savings vs. UFB Direct Portfolio Savings Account

If you're looking to maximize your interest on a high-yield savings account, UFB Direct should be on your radar. The online bank offers on

While Vio Bank's $100 min

UFB Direct Portfolio Savings Account

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 5/5 How our ratings work

- APY3.90%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate.

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

The UFB High Yield Savings Account has one of the highest interest rates we’ve seen for a high-yield savings account at up to 3.90% APY. Plus, there are no monthly fees and no minimum balance to open.

Vio Bank Online Savings vs. CIT Bank Savings Connect

Like Vio Bank, CIT Ba

CIT Bank Savings Connect Account

- Our Rating 4.5/5 How our ratings work

- APY3.65%

APY — Annual Percentage Yield is accurate as of November 20, 2025. Interest Rates for the Savings Connect Account are variable and may change at any time without notice. The minimum to open a Savings Connect account is $100. Fees could reduce earnings on the account.

- Minimum

Deposit Required$100 - Intro Bonus N/A

CIT Bank's Savings Connect account is one of our top picks for high-yield savings accounts. Featuring a competitive flat APY on all balances, it can go head-to-head with most of the top savings accounts available. What's more, you don't have to do anything special to earn this high interest rate; many similar accounts (including some offered by CIT) only offer their highest interest rates to customers who complete certain requirements.

Vio Bank Cornerstone Money Market Savings

- Interest rate: 4.77% APY

- Minimum opening deposit: $100

- Minimum balance requirement: None

- Monthly maintenance fee: None

It's called a money market savings account, but the Cornerstone Money Market Savings Account a

That said, the account offers an incr

There's no mo

How Does the Vio Bank Cornerstone Money Market Savings Account Compare?

| Vio Bank Cornerstone Money Market Savings | UFB Direct High Yield Money Market Account | Discover Money Market Account | |

|---|---|---|---|

|

APY |

4.77% |

5.25% |

Up to 3.70% |

|

Minimum Opening Balance |

$100 |

$0 |

$2,500 |

|

Monthly Fee |

$0 |

$10 with options to waive |

$0 |

|

Access to Funds |

Bank transfer |

Debit card, bank transfer, ATM card, paper checks |

Debit card, bank transfer, ATM card, paper checks |

Vio Bank Cornerstone Money Market Savings vs.UFB Direct High Yield Money Market Account

The two banks offer comp

That said, while it doesn't have a minimum deposit requirement, you need to have a

UFB Direct High Yield Money Market Account

- Our Rating 4/5 How our ratings work

- APY5.25%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate.

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

The UFB High Yield Money Market account offers up to 5.25% APY on balances, which is competitive with the very best money market accounts. This account also doesn't feature a minimum opening balance requirement, which makes it a viable option regardless of how often you need to move your money around.

Vio Bank Cornerstone Money Market Savings vs. Discover Money Market

Like UFB Direct, Discover offers mo

Vio Bank Online CD

- Interest rate: 2.75% – 5.00% APY

- Minimum opening deposit: $500

- Term lengths: 6 – 120 months

- Early withdrawal fee: 1% or 3%, depending on term, plus $25

Vio Bank's Online CD is a stand

Here's a quick look at what the bank offers:

| Term | APY |

|---|---|

|

6 months |

5.00% |

|

9 months |

4.75% |

|

12 months |

4.65% |

|

18 months |

4.50% |

|

24 months |

3.50% |

|

36 months |

3.50% |

|

48 months |

2.75% |

|

60 months |

2.75% |

|

84 months |

2.75% |

|

120 months |

2.75% |

There is a $5

Banking Experience

If you choose to go with Vio Bank, here's what you can expect from your experience:

- How to withdraw and deposit funds: The bank only all

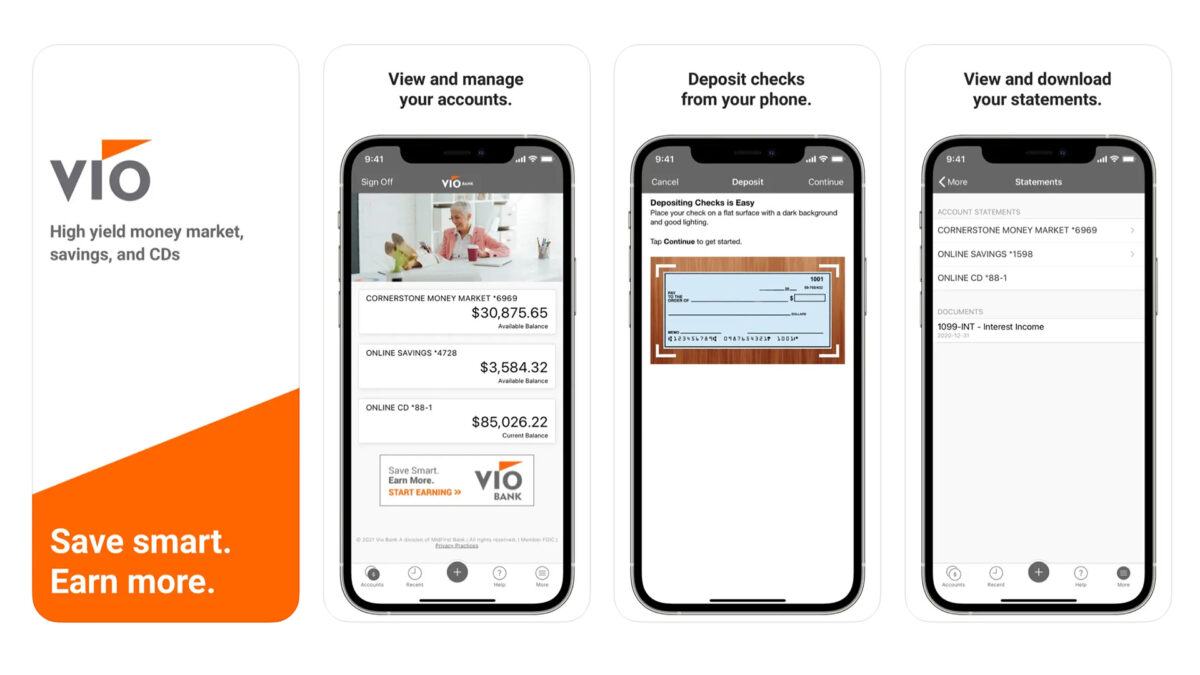

ows you to withdraw money through a transfer with an external bank, but you can deposit funds via bank transfers, wire transfers, and mobile check de posits. - Mobile app experience: Vio Bank's mobile app has a solid 4.

6-star rating on the Apple App Store, but its Google Play Store rating is just 3.2 sta rs. You can use the app to check your balance, view statements, make check de posits, and more. - Customer service: The bank offers limit

ed customer support for an onl ine bank, with 24/7 access limited only to its automated information line. You can also submita request online through a form on the ban k's website, request a callback, or chat online.

Drawbacks

Before you open an account with Vio Bank, here are some of the main downsides to consider:

- Limited access to funds: As mentioned above, you'll have limited access to your money, and bank transfers t

o an external account can take sev eral days to complete. - No cash deposits: Like most online banks, Vio doesn

't accept cash deposits, making it less appealing for people who prefer to u se cash. - No checking account: Many other online banks offer both saving

s and checking products, making it easier to manage your money with one financial institution. Unfortunately, Vio Bank isn' t one of them.

Explore the Best Free Checking Accounts

Visit the Marketplace

How to Open an Account

It only takes about five minutes to open an account with Vio Bank. You need your Social Security num

About Vio Bank

Vio Bank is a division of Mid

Is Vio Bank Worth It?

Depending on the type of account you want, Vio Bank may or may not be worth it to you. In particular, consider the bank if you just want a hi

You may also think the bank is worth your business if you want a hig

That said, if you

Frequently Asked Questions

-

Vio Bank is headquartered in Oklahoma, which is where its parent company MidFirst Bank operates.

-

You can contact the bank's customer service team at 888-999-9170. Representatives are available from Monday to Friday from 7:00 a.m. to 9:00 p.m. Central time, Saturday from 8:00 a.m. to 6:00 p.m. Central time, and Sunday from 12:00 p.m. to 4:00 p.m. Central time.

-

If you're transferring money between two Vio Bank accounts, the transfer time is immediate. However, transfers to external banks can take up to five business days to process.