Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Personal loans are the Swiss Army knife of the personal finance world. You can use them for just about anything, with a few exceptions. That makes personal loans a good lens to see trends in how people borrow money to fund their lives—the difficulties they face and their fears, but also their dreams.

That’s why Slickdeals partnered with market research firm Suzy to survey 1,219 participants online in March 2023 about how they use personal loans. The results show a clear trend in younger people borrowing larger amounts to cover basic necessities and new opportunities, while older generations rely on personal loans more frequently to consolidate debt and pay for home improvements. The data holds other surprises as well.

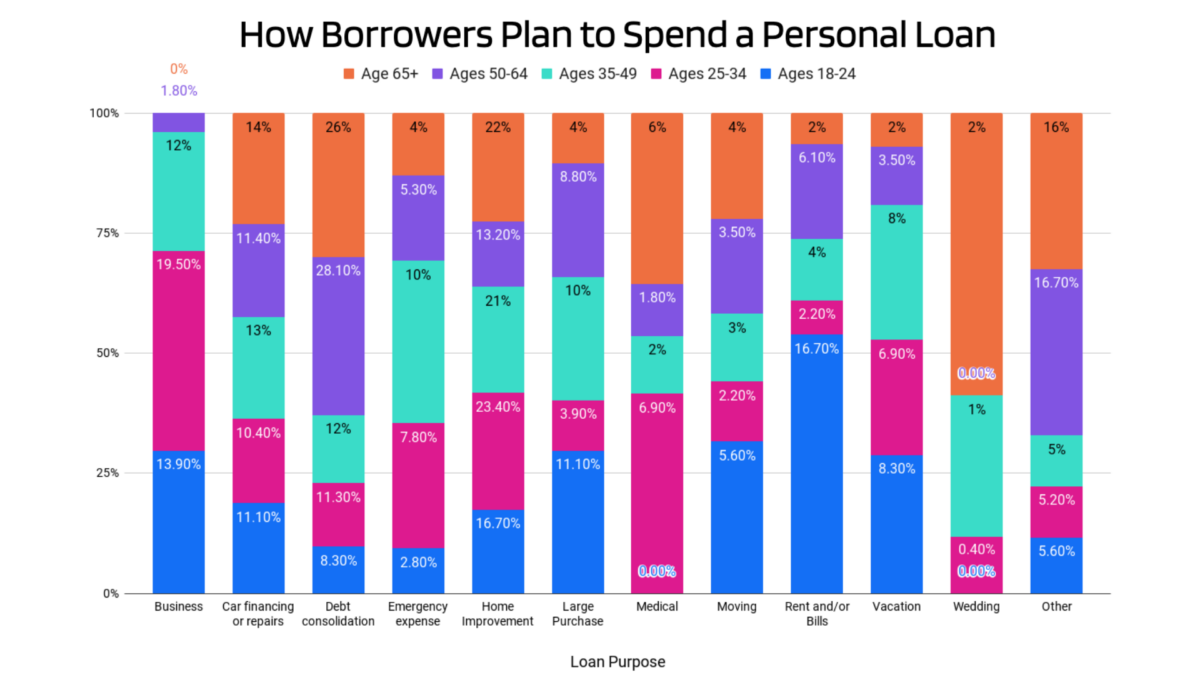

Gen Z More Likely to Borrow to Cover Rent, Bills and New Opportunities

Americans most commonly use personal loans to consolidate debt and pay for home improvements. However, younger borrowers were more likely to use their personal loans to cover rent and bills, especially compared to borrowers over 65.

Borrowers who would use a personal loan for rent and bills:

- Ages 18 and 24: 17%

- Those 65 and older: 2%

Borrowers between 18 and 24 were also more likely to use their loan to fund other activities:

- Vacations: 8%

- Move to a new home: 6%

- Fund a business: 14%

Compare that to the data for those 65 and older:

- Vacations: 2%

- Move to a new home: 4%

- Fund a business: 0%

While younger people used their loans more to get by with day-to-day expenses, older generations—more than any other group—tended to use their loans for debt consolidation and home improvement.

Percentage of generations using loans for debt consolidation:

- People 18 to 24: 8%

- Ages

50 to 64 : 28% - Those over 65: 26%

That makes sense, considering that older generations have had time to amass more debt and purchase a home.

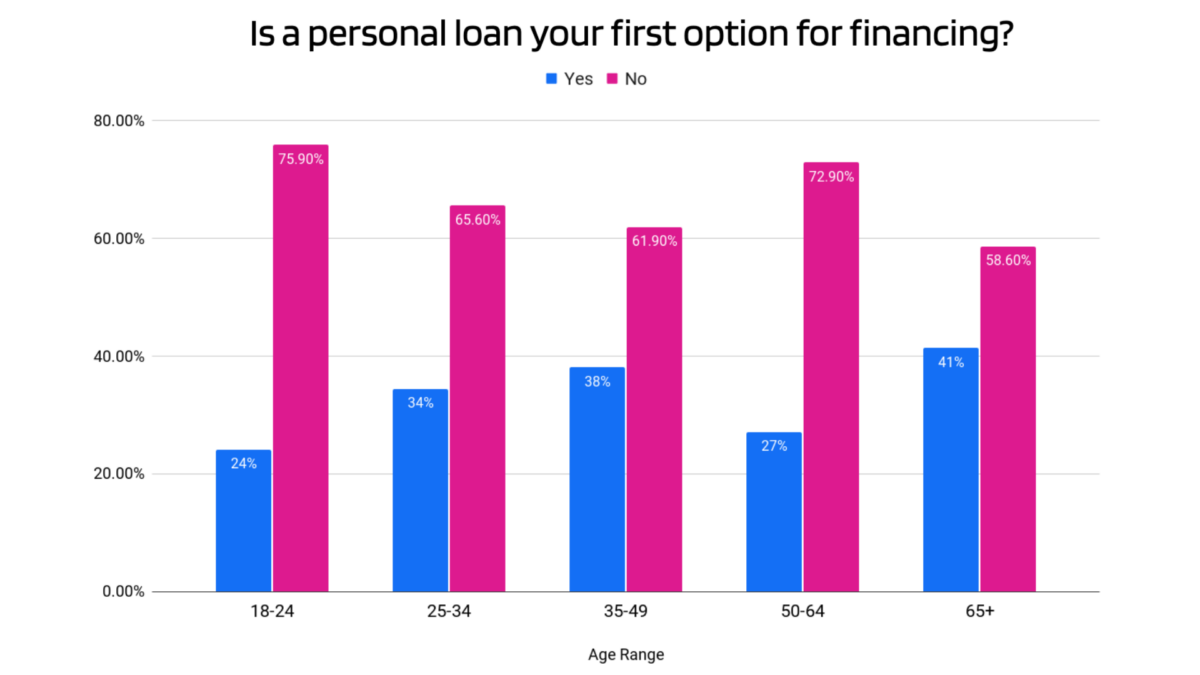

People 65 and Up Prefer Personal Loans, But Also Rely on Home Equity and Lines of Credit

Older generations are more likely than younger generations to turn to personal loans when they need to borrow money:

- People over 65: 41% of people over 65 would choose a personal loan as a first option for financing.

- People ages 18-24: This is in comparison to only 24% of those 18-24 who would consider a personal loan their first option.

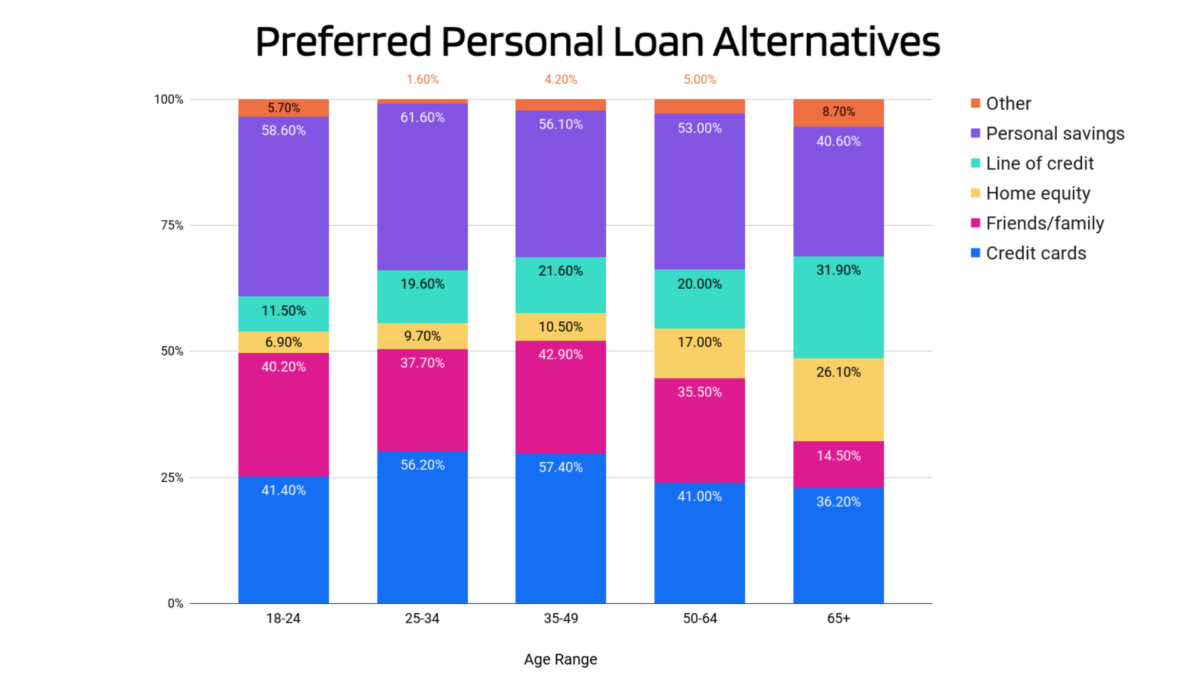

However, if personal loans aren’t an option or aren’t preferred, older generations over 65 rely more on home equity and lines of credit compared to younger folks.

Preferred alternatives to personal loans for those over 65:

- Home equity: 26% of those over 65 would choose a home equity loan as their first choice.

- Lines of credit: 32% of those over 65 prefer a line of credit over a personal loan.

Alternatives to personal loans for those 18 to 24:

- Home equity: Only 7% of those in the 18 to 24 age group preferred home equity loans.

- Lines of credit: 12% of those ages 18 to 14 would choose a line of credit over a personal loan.

Again, this makes sense because younger generations haven’t had as much time to build up equity in a home, let alone purchase one. Instead, younger people tend to rely more on community support from family and friends.

Borrowing from friends and family:

- People 18 to 24: 40% would turn to family and friends for a loan first.

- Those over 65: Only 15% would look to family or friends when they need a loan.

One positive note: Using personal savings in lieu of financing was the preferred option of nearly every group except for folks between 35 and 49 (57% of that age group preferred to use credit cards instead of cash).

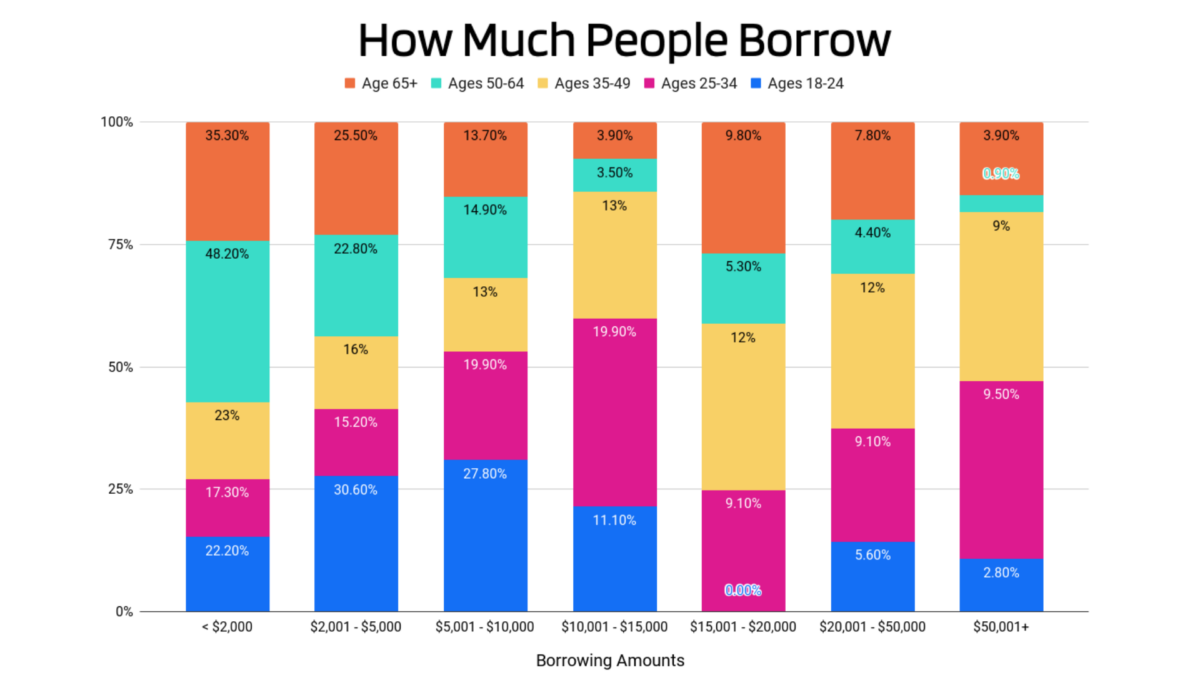

Those Under 35 Tend to Borrow Larger Amounts

Most people prefer smaller loans less than $2,000. That’s mostly due to older generations, however, preferring these smaller-dollar loans for home improvement and debt consolidation.

Percent of people who prefer loans less than $2,000:

- People 50 to 64: 48%

- Those 65 and up: 35%

When younger generations do borrow money, they typically borrow larger amounts:

- 58% of borrowers ages 18 to 24 take out loans between $2,001 and $10,000 when they do borrow personal loans

As younger generations age and their income grows, they tend to borrow even more still:

- 40% of borrowers between 25 and 34 take out loans of $5,001 to $15,000.

It’s not until age 35 that smaller loans under $2,000 are preferred.

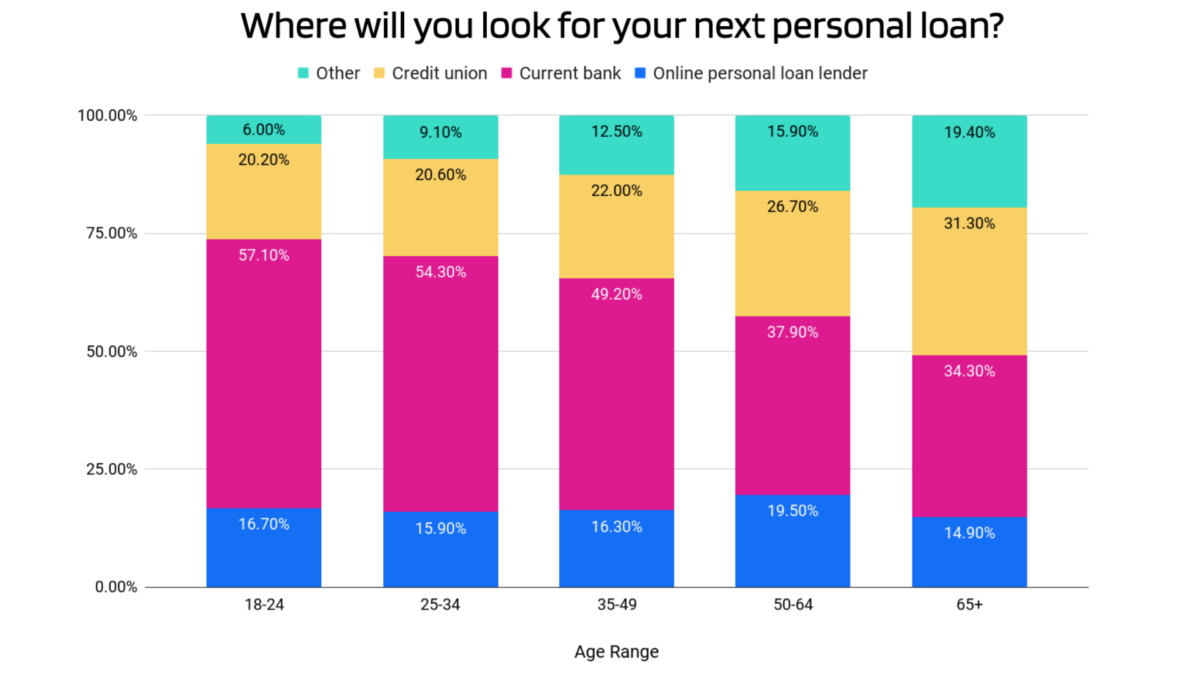

Borrowers Over 50 More Likely to Opt for Credit Unions as a Backup Lender

The devil you know is better than the one you don’t, and sticking with your current bank was the most popular choice of all age groups when thinking about where to get their next personal loan.

If they needed to stray, however, there were clear differences in where people preferred to go. Credit unions were the preferred backup for folks in older generations compared to younger demographics.

Percent of people by age group who prefer credit unions for personal loans:

- Ages 18 to 24: 20%

- Ages 25 to 35: 21%

- Ages 35 to 49: 22%

- Ages 50 to 64: 27%

- People over 65: 31%

This might reflect the differences in visibility, as credit unions typically operate in a more hyperlocal area and with a smaller marketing budget than big banks. However, credit unions frequently offer lower interest rates on loans. The average credit union charged an interest rate of 10.02% on a three-year personal loan in December 2022, for example, compared to 10.75% at banks.

Online lenders were equally popular with all groups. However, 19% of borrowers over 65 reported turning to “Other” sources for personal loans, which could include things like other types of banks or nontraditional lenders—more than any other group.

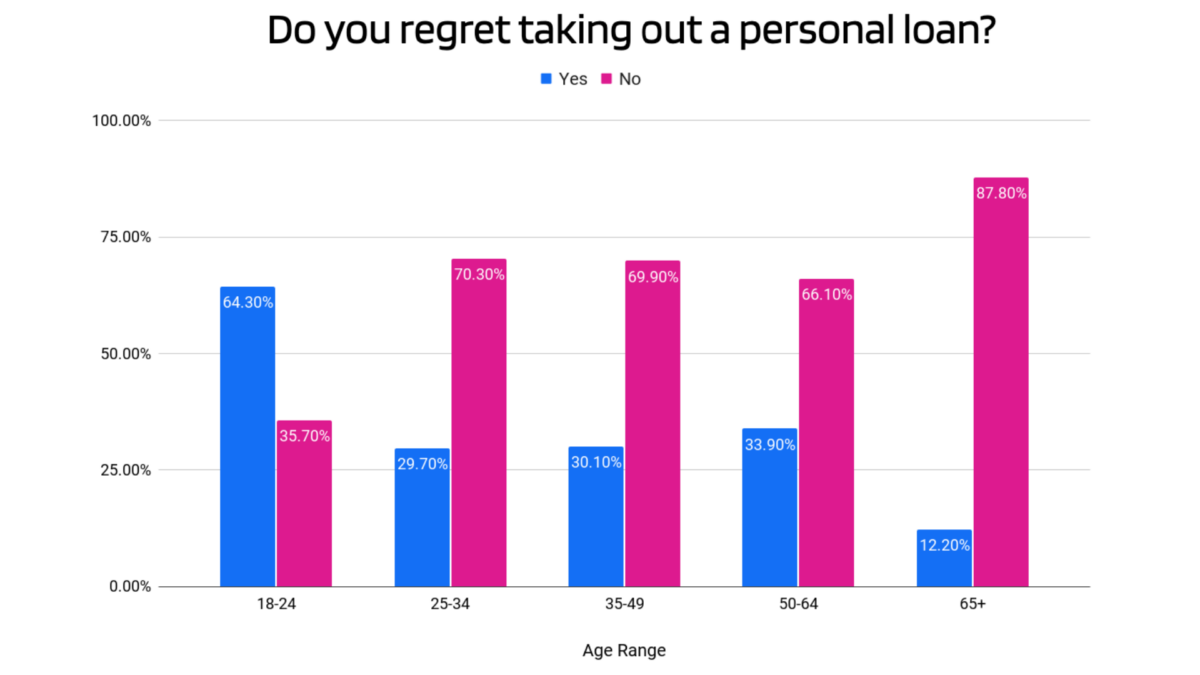

Younger People More Likely to Regret Their Personal Loans

Roughly two out of every three borrowers are happy with their personal loans—a good thing since that’s the majority of people, but also concerning because one out of every three borrowers does regret their decision. Those differences are mostly being driven by younger people.

Percent of people who regret taking out a personal loan:

- People 18 to 24: 64% of borrowers ages 18 to 24 do regret taking out a personal loan.

- Borrowers over 65: Only 12% of people over 65 regretted their personal loans.

Note that people over 65 were the least likely to regret taking out a personal loan.

These differences are probably driven by what different generations use their loan funds for and the size of those loans. Older folks are using smaller loans to pay down debt and better their financial position or to upgrade their homes to something nicer. Younger people are borrowing more money just to get by, or to pay for things that may not work out long-term like businesses or moving to a new location. It’s not as much fun to borrow money to avoid being evicted as it is to pick out a new hot tub, after all.

The Best Personal Loans of February 2026

Bottom Line

Personal loans can help alleviate your immediate financial pressures no matter your age, but they’re not a cure-all and they do have their pros and cons. As our data shows, not everyone is satisfied with the outcome of their personal loans, especially if you need to borrow large amounts of money for dicey prospects like starting a business or even just to cover basic necessities.

The solution here is both external and internal. By pushing for social and policy change so young people don’t have to borrow such large sums to cover basic living expenses, we can boost people’s overall happiness—with or without personal loans. And by focusing on things within your control, like budgeting and saving, you can also reduce the need for personal loans so you’re better placed to take them out on your terms, when (and if) you’re ready.