Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

In the United States, the COVID-19 state of emergency ended in May 2023, leading to an increased number of people feeling comfortable shopping in person at retailers. So why, then, did we see such a sharp decline in impulse spending in 20

Between the war in Ukraine, supply chain issues and environmental disasters continuing to harm our planet, it's possible that some feel now is not the time for unnecessary spending. In fact, spontaneous purchases, or “impulse buys,” are down 48% in 2023 compared to 2022, according to a new p

Commissioned by Slickdeals and conducted by OnePoll, this 2023 survey suggests that more shoppers are looking to make “wiser” purchases as belts tighten across 99% of income earners. Using this random double-opt-in survey of 2,000 American consumers, we found that nearly four out of ten (38%) of those polled have decreased the amount of impulse spending this year, as compared to 14% in 2022 and 16% in 20

Is Inflation the Culprit?

According to the survey, inflation had a staggering impact on what people spend their money on. Of those polled, 72% said inflation was a factor in what they chose to shop for, whereas in 2022 only 68% shared the same sentiment.

Similarly, 77% have been conscientious about their budget this year because of inflation—39% said they make more impulse purchases on necessities than luxuries (19%).

“With shoppers stating that they are more likely to make impulse purchases on necessities than luxuries, while simultaneously reporting a decrease in impulse spending, we may be seeing a shift in how consumers define an impulse purchase,” said Vitaly Pecharsky, head of deals for Slickdeals. “Shopping opportunistically when there’s a sale on something you need like toilet paper or pantry snacks can ultimately save you money in the long run.”

Interestingly, the inflation rate in 2022 was 6.5%, a full 2.5% higher than the 4% inflation rate we've seen in 2023. However, it remains possible that the shift in consumer thinking is the result of cumulative interest. In other words, people have had to spend more on the basics for an extended period of time, which has gradually altered their perception of the market.

Another factor may be how people are shopping. In 2023, nearly half (48%) of those polled said they shop the most from their phones (up from 33% in 2022). That said, only 43% of respondents are more likely to shop impulsively while lying in bed — a sharp decrease from 71% in 2022.

Related Article

Related Article

8 Things that Are the Most Affected by Inflation

Impulse Shopping Down Across Most Metrics

Over the past year, we’ve seen the percentage of people thinking about inflation increase, while the overall number of dollars spent on spontaneous purchases decrease. The average respondent made just six impulse purchases per month in 2023. That number is down from 12 purchases per month both in 2022 and 2021 — a full 50% decrease.

Of course, you might be saying to yourself, “

Additionally, impulse buys make up a lower percentage of purchases in 2022 than

So, what are the results of this decrease in impulse buy

The Less You Spend, the More You Save

Consider those earlier spending numbers — $151 in spontaneous purchases per month in 2023 against $314 per month in 2022. Over the course of a year, that’s a $1,956 difference in spending.

While it may make sense to assume shoppers' surplus funds are going towards the increased price of everyday essentials like groceries, a full 7 in 10 consumers surveyed have saved money as a result of holding back on their impulse shopping habits. That’s a stark increase from 2022 when our study showed only 58% of those polled saving money.

With financial uncertainty (and, frankly, instability) increasingly becoming the norm for many Americans, this study suggests that more people feel safer saving their money than spending

Related Article

Related Article

5 Low-Risk Ways to Earn More Money On Savings

A New Kind of “Impulse” Shopping

In 2022, 67% of those surveyed said they made impulse purchases to avoid the feeling of FOMO. This makes sense—if all your friends get the new iPhone, you’re more likely to want one as well.

However, in 2023 we saw a steep decrease in that kind of thinking. Just over a third (35%) said they made purchases to be part of the “in” crowd. Apparently, people concerned

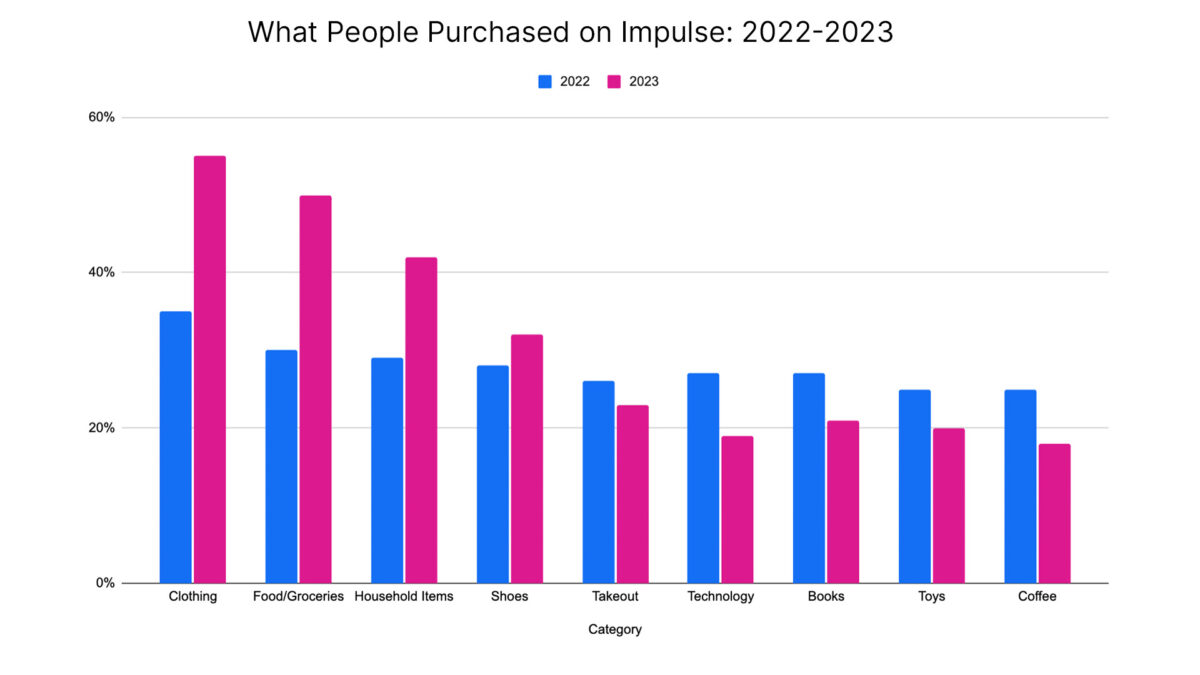

The numbers bear this out. As more consumers focus on necessary purchases over FOMO buys, the most common impulse shopping categories this year have shifted dramatically compared to 2022.

Technology and coffee saw sharp decreases in spending as consumers focused more on groceries and clothing. Comparing 2022 and 2023, it appears that people are more concerned with limiting their spontaneous purchases to the basic

How To Maximize Your Impulse Shopping

Frankly, it’s unrealistic to expect people to stop impulse shopping altogether. While hypothetically, the equation “no impulse shopping = the most savings” makes sense, we all need an occasional treat to escape the grind from time to time. Those small moments of joy help a lot of people get through the day. The trick, in these times of financial uncertainty, is to maximize the value of your impulse buy.

In 2022, just 32% of those polled reported they would only make impulsive purchases if an item was on sale. In 2023, 58% made the same claim. And over half (53%) always or often look for deals or coupons before making a purchase. People are shopping smarter than ever, and Slickdeals can help take some of the work that goes along with that off your plat

Pecharsky added, “Budgeting for impulse purchases may seem counterintuitive, but by shopping when there’s a sale on something that you need, you are spending less on items that you likely would have purchased anyway. By tapping into a community like ours, shoppers can ensure they’re getting the best products at the best prices.”