Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

If you're interested in building your savings, few savings vehicles compare with high-yield savings accounts (HYSAs). High-yield savings accounts are typically offered through online banks and financial institutions, which may offer more competitive rates than traditional savings accounts available through local and national banks.

The following high-yield savings accou

UFB Direct High Yield Savings Account: 5.25% APY

UFB Direct is a division of Axos Ba

UFB Direct High Yield Savings Account offers o

UFB Direct High Yield Savings Account

- Our Rating 5/5 How our ratings work

- APY5.25%

UFB Direct breaks balances into five tiers, but, currently, there is only one interest rate.

- Minimum

Deposit RequiredN/A - Intro Bonus N/A

The UFB High Yield Savings Account has one of the highest interest rates we’ve seen for a high-yield savings account at up to 5.25% APY. Plus, there are no monthly fees and no minimum balance to open.

Overview

With one of the strongest high-yield savings interest rates on the market, as well as no monthly fees or minimum opening deposit, UFB Direct’s High Yield Savings Account is an extremely attractive package.

Pros

- Strong interest rate

- No maintenance fees or minimum monthly balances

- Free complimentary ATM card

- Mobile app and SMS banking

Cons

- No signup bonus

- No associated checking account

Top Features

- No monthly maintenance fee

- No minimum opening deposit

- Easy-to-use digital banking features

- Complimentary ATM card plus access to 91,000 fee-free ATMs across the country.

Drawbacks

- Lack of in-person support options

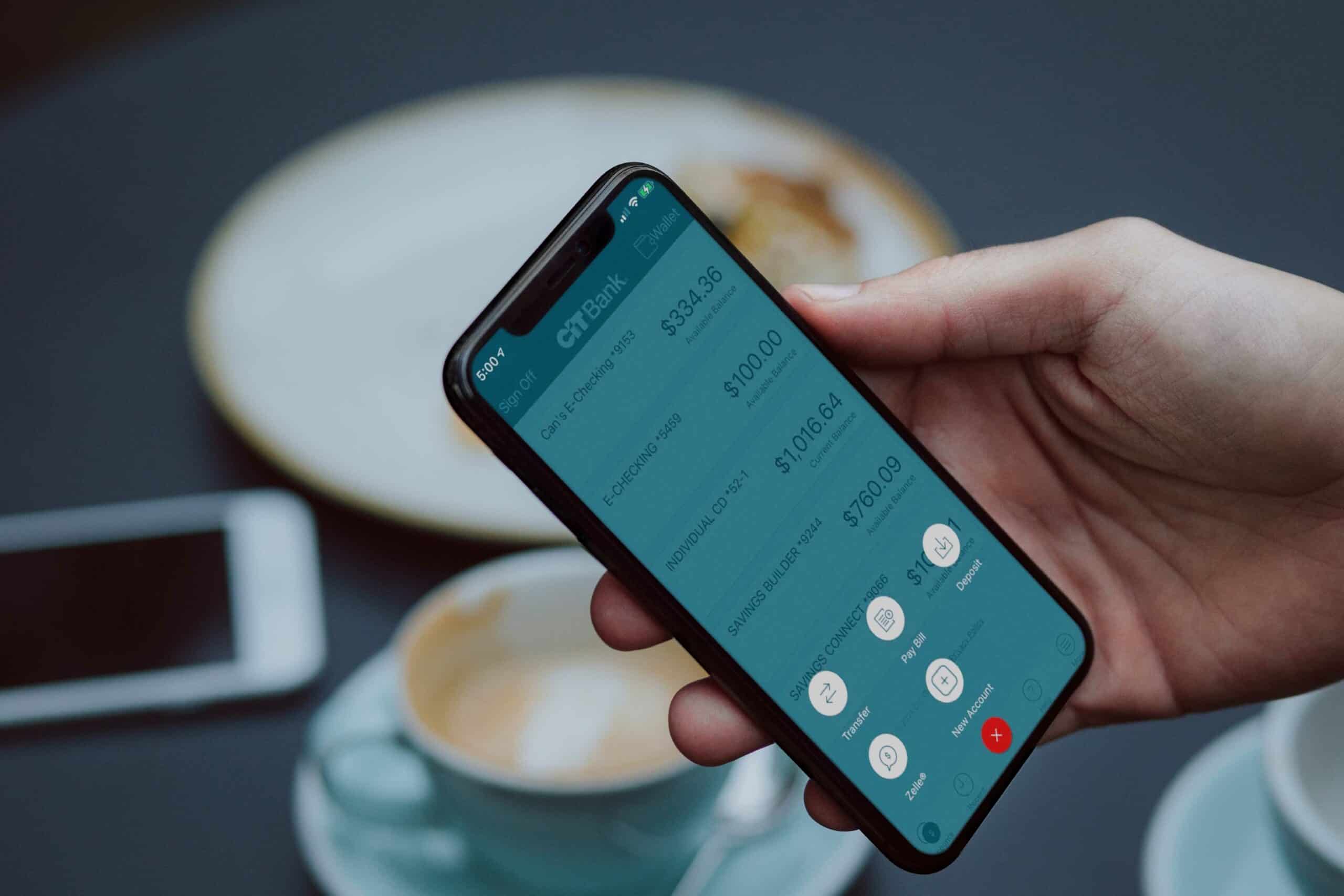

CIT Bank Platinum Savings Account: 4.30% APY

CIT, as part of First-Citizens Bank & Trust Company, is one of the biggest banks in the country. CIT Bank's deposit accounts are FDIC insured up to $250,000 per account, per depositor (Certificate #11063).

The CIT Bank Platinum Savings Account currently offers a very competitive APY on balances of $5,000 or more. There are no monthly maintenance fees to worry about, but you do need at least $100 to get started. CIT Bank is online-only, so you won't find brick-and-mortar locations with this account.

CIT Bank Platinum Savings Account

- Our Rating 4.5/5 How our ratings work

- APY4.30%

Earn 4.30% APY on balances over $5,000. Balances of less than $5,000 earn 0.25% APY. Annual Percentage Yield is accurate as of February 5, 2025. Interest rates for the Platinum Savings account are variable and subject to change at any time without notice.

- Minimum

Deposit Required$100 -

Intro Bonus

Up to $300

Open a new Platinum Savings account with promo code PS2025 to earn a bonus worth up to $300. Within 30 days from the account open date, transfer a one-time deposit of $25,000 -$49,999.99 for a bonus of $225, or transfer a one-time deposit of $50,000+ for a bonus of $300. The bonus will be fulfilled within 60-days from the funding date.

The CIT Bank Platinum Savings account offers one of the top APYs on the market right now, and CIT's flexible transfer options make it easy to access your money. So long as you're able to consistently maintain an account balance of $5,000 (the minimum amount required to earn this account's top APY) you'll likely find a lot of value in this account.

Overview

With the CIT Bank Platinum Savings Account, customers earn 4.30% APY on balances over $5,000. However, for accounts with less than $5,000, the APY falls to 0.25%. This account features a minimum opening deposit requirement of $100 and does not charge monthly maintenance fees. Accountholders also get free transfers to and from connected bank accounts, which even extends to non-CIT accounts.

Pros

- Strong APY for balances over $5,000

- No monthly service fee

- Unlimited withdrawals (uncommon perk of savings accounts)

- Free electronic bank transfers to checking accounts (even if it isn't a CIT checking account)

Cons

- APY on lower balances is unimpressive

- No fee-free ATM network

- Minimum opening deposit required

- No physical branches

Top Features

- No monthly maintenance fees

- Minimum opening deposit is relatively low

- Helpful mobile app and tools for remote deposits

Drawbacks

- $5,000 balance required for highest APY

- Minimum deposit required to open account

- No physical branches

Related Article

Related Article

4 Warning Signs You Need to Get a New Bank Account

Newtek Bank® Personal High Yield Savings: 5.00% APY

Deposits to Newtek Bank accounts are FDIC insured up to the maximum allowance limit (C

Newtek Bank is a publicly traded online bank offering per

Top Features

- No minimum opening or ongoing deposit requirements

- No monthly service fees

Drawbacks

- No physical branch locations

- Account does not include debit card or ATM access.

DollarSavingsDirect™ Dollar Savings Account™: 5.00% APY

DollarSavingsDirect deposits are FDIC insured under Emigrant Bank up to the maximum allowance lim

DollarSavingsDirect is an o

Top Features

- No monthly service fee (or other bank fees)

- No minimum deposit requirements

Drawbacks

- Limited digital access to funds

- Initial deposit delayed by 5-10 business days for security reasons

Varo Bank High-Yield Savings Account: Up to 5.00% APY

In 2020, Varo Ba

To qualify for 5.00% APY, yo

Top Features

- No monthly maintenance fee

- Includes automatic saving tools like round-ups

Drawbacks

- No standalone savings option (requires checking account to open)

- Direct deposit required to earn top APY

- Lower APY on balances above $5,000

Explore the Best Bank Bonuses Currently Available

Visit the Marketplace

M1 High-Yield Savings Account: 5.00% APY

M1 is a technol

M1 savings account deposits are FDI

Top Features

- No minimum deposit requirement

Drawbacks

- Top APY requires paid M1 Plus membership

Salem Five Direct eOne Savings: 5.01% APY

Salem Five bank's history dates b

Salem Five Direct deposits are FDIC insured up to the maximum allowable limits (Cert

Top Features

- Low minimum opening deposit

- No monthly fees

Drawbacks

- Limited eligibility

- Requires new funds to open account

How To Choose a High-Yield Savings Account

High-yield savings accounts are a great vehicle for

APY

The best high-yield savings acco

Fees

Bank fees cu

Accessibility

Even if you're socking away savings for the future, it's good to know those funds are available when you need them. Comp

Related Article

Related Article

5 Low-Risk Ways to Earn More Money On Savings

Features

Some high-yield savings accounts come with

Customer Service

Customer service op