Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

As someone who’s been working since before I could drive, taxes have become a part of everyday life. I never felt comfortable filing my own taxes, though. It seemed intimidating. I didn’t want to mess anything up and have the IRS come looking for me.

While my fears weren’t very rational, many people share similar thoughts, which meant going through a local tax professional to file.

According to a recent survey by the National Society of Accountants (NSA), the average cost of professional tax preparation is around $220. This is around what most tax preparers charge you for a 1040 tax form with itemized deductions and a state tax return.

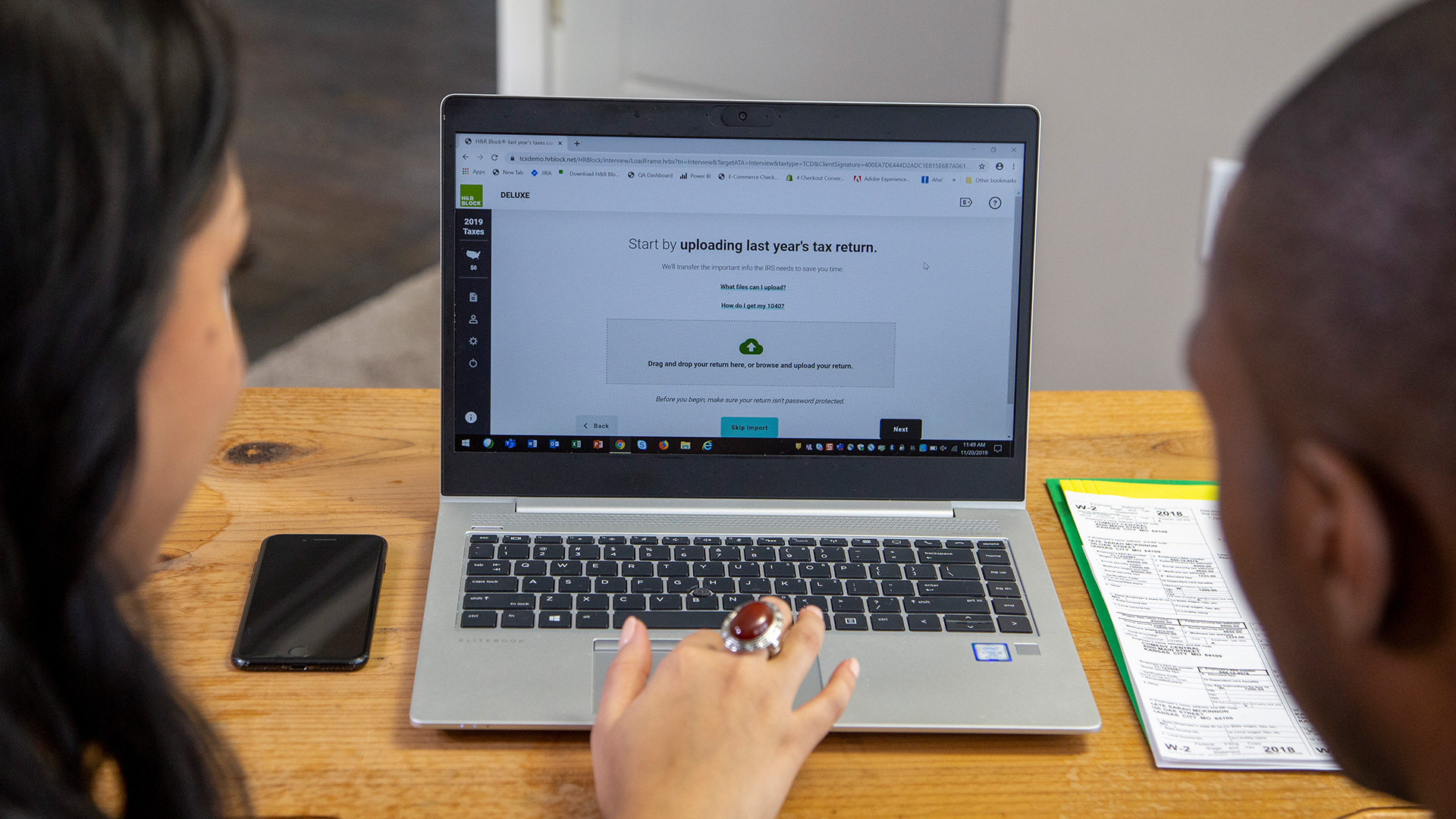

Today, with online tax software more popular than ever, it’s not a huge ordeal to tackle your own taxes. Based on my years of working with tax software, below are the best online tax services I’ve come across.

Summary of Best Tax Software:

- Best Value: TaxSlayer

- Best Simple Returns: Jackson Hewitt

- Best for Complex Returns: TurboTax

- Best Accuracy Guarantee: TaxAct

- Best for Live Support: H&R Block

- Best Free Option: FreeTaxUSA

- Best Free Audit Support: Cash App Taxes

- Best for Experienced Tax Filers: Liberty Tax

- Honorable Mention: e-file.com

Comparing Tax Software Costs

| Tax Service | Pricing | Free Version? |

|---|---|---|

|

$0-$48.71 (plus $39.95 per state) |

Yes, basic 1040 for federal and state |

|

|

$25 flat fee |

No |

|

|

$69-$129 ($59 per state) |

Yes, basic 1040 for federal and state (For simple returns only. Not all taxpayers qualify.) |

|

|

$24.95-$64.95 ($44.95 per state) |

Yes, basic 1040 for federal |

|

|

$35-$84 ($37 per state) |

Yes, basic 1040 for federal and state |

|

|

free fed ($14.99 per state) |

Yes, all federal returns |

|

|

Free |

Yes, basic 1040 for federal and state |

|

|

$45.95-$85.95 ($36.95 per state) |

No |

|

|

$20.99-$37.49 ($22.49 per state) |

Yes, basic federal return |

Recommended Credit Cards

| Credit Card | Name | Rewards Rate | Annual Fee | Sign-Up Bonus | Apply |

|---|---|---|---|---|---|

|

Chase Sapphire Preferred® |

1x- 5x points Earn 5x points per dollar on travel booked through Chase Ultimate Rewards, 3x on dining, and 3x on select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs). Earn 2x on other travel spending and 1x everywhere else. |

$95 |

60,000 bonus points Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. |

Apply |

|

Wells Fargo Active Cash® Card

|

2% cash back Earn unlimited 2% cash rewards on purchases. |

$0 |

$200 Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months. |

Apply |

|

Citi Custom Cash® Card

|

1%-5% cash back Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases. |

$0 |

$200 Earn $200 in cash back after you spend $1500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® points, which can be redeemed for $200 cash back. |

Apply |

|

Citi® Double Cash Card

|

2% cash back Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. |

$0 |

N/A |

Apply |

|

|

card_name |

2X-5X Points |

$0 |

bonus_miles |

Learn More |

1. Best Value: TaxSlayer

Pricing ($0-$49):

Right now, you can go to TaxSlayer and get 25% off your federal return:

- Simply Free: $0 (state included)

- Classic: $26.21 sale price ($34.95 regular) plus state

- Premium: $41.21 sale price ($54.95 regular) plus state

- Self-Employed: $48.71 sale price ($64.95 regular) plus state

Supported tax forms: All tax situations

Free features: Free federal tax return and state return filing, active military federal filing, free tax tools

For those looking for value, top to bottom, TaxSlayer is our choice for overall value in tax software. It offers an easy-to-use interface that makes filing taxes online a breeze.

TaxSlayer has a Simply Free version that handles most simple federal tax situations and includes state filing too. It also offers a Classic version, which adds access to credit, deductions and all income types.

TaxSlayer Premium takes it a step further, with live chat support and priority phone and email support as well. For active members of the military, TaxSlayer allows you to file federal returns for free. This includes all tax situations and forms.

Customers can prepare and file online or through TaxSlayer’s sleek mobile app. Download the app to set up tax return status notifications and other updates.

TaxSlayer guarantees you’ll get the maximum return possible, as well as 100% accuracy. You will be hard-pressed to find a better value than what’s offered by TaxSlayer.

2. Best for Simple Returns: Jackson Hewitt

Pricing: $25

- Pricing: $25 for both federal and unlimited state

Supported tax forms: All tax situations

One of the oldest tax services in America, Jackson Hewitt doesn’t just offer help at brick-and-mortar office locations and inside Walmart stores. It also provides online filing.

Jackson Hewitt's online tax prep service recently reinvented itself by providing customers a flat fee of $25 to file both state and federal taxes, "no matter what."

While it doesn't offer a free filing option, Jackson Hewitt has easy pricing that includes perks such as live-chat support.

The service makes it easy to download your W-2, and there is a 100% accuracy guarantee. The step-by-step process keeps it simple, perfect for those just starting to DIY taxes online.

Related Article

Related Article

3 Things to Know Before Paying for a Tax Preparation Service

3. Best for Complex Returns: TurboTax

Pricing ($0-$129):

- Free Edition: $0, both federal and state (For simple returns only. Not all taxpayers qualify.)

- Deluxe Edition: $69, plus state

- Premier Edition: $99, plus state

- Self-Employed: $129, plus state

- State: $59 per state ($0 for simple return)

Supported tax forms: All tax situations

Free features: Free federal tax and state return filing for simple returns only, not all taxpayers qualify; free tax tools.

TurboTax is one of the most recognizable online tax software companies in America. They’ve been providing service online for a long time, and it shows.

Filing your taxes is simple with TurboTax, which allows you to snap a photo of your W-2 using a mobile app. The Free Edition includes free federal and state filing. (For simple returns only Not all taxpayers qualify).

Where TurboTax shines is with customers who have more complex tax returns. The Deluxe Edition helps maximize tax deductions and credits, while the Premier Edition includes investments and rental properties. Cryptocurrency and robo-investing are even covered with its Premier offering. Plus, you can easily import your investment income automatically with TurboTax.

Both premium versions and the Self-Employed version come with on-demand one-on-one support from tax specialists. Customers also get personalized tax tips based on how they answer questions through the filing process.

Before you file, TurboTax always runs a comprehensive review of your return, ensuring nothing gets missed. For complete and quality service, TurboTax has you covered.

*For simple returns only. Not all taxpayers qualify.

4. Best Accuracy Guarantee: TaxAct

Pricing ($0-$64.95):

- Simple Returns: $0, plus state

- Deluxe: $24.95, plus state

- Premier: $34.95, plus state

- Self-Employed: $64.95, plus state

- State: $39.95 per state for simple returns, $44.95 per state for all other tiers

Supported tax forms: All tax situations

Free features: Free federal tax and state return filing, free access to tax experts through TaxAct Xpert Assist

TaxAct has you covered, no matter your tax situation. There’s a free version that includes simple returns and premium offerings for those with more complex tax situations, from credits and deductions to investments and rental properties. There’s even a self-employed version for freelancers and independent contractors.

You can’t talk about TaxAct without mentioning its $100K Accuracy Guarantee. Most online tax software services have guarantees, but not to this extent. TaxAct guarantees their software is 100% accurate and will calculate the maximum possible refund for customers.

If there’s an error in the tax software that causes you to receive a smaller refund or larger tax liability than you get from another tax service, TaxAct will pay you the difference, up to $100,000. You’ll also receive any fees paid to TaxAct for filing services.

If you are audited by the IRS and end up paying penalties or interest because of a software error, TaxAct reimburses any penalties and most audit costs, up to $100,000, plus TaxAct software fees. Certain limitations apply, but it’s great to know that TaxAct stands behind their product like this. You can file taxes with confidence, knowing that TaxAct has your back.

Another standout feature of TaxAct is its free Xpert Assist offering, which gives all filers unlimited access to tax experts at no additional charge. Experts include CPAs and EAs who are ready to answer questions when needed. Filers can connect directly one-on-one to talk through their questions and even request an expert to review their return before they file.

Read our in-depth TaxAct review.

5. Best for Live Support: H&R Block

Pricing ($0-$85):

- Simple Returns: $0

- Deluxe: $35

- Premium: $55

- Self-Employed: $85

- State: $37 per state ($0 for simple returns)

Supported tax forms: All tax situations

Free features: Free federal and state filing, free tax tools

H&R Block is one of the oldest tax preparation services, founded in 1955. Over the past 60+ years, it’s developed into a world leader in the industry.

Besides visiting a local H&R Block tax professional, you can also file your tax return online with H&R Block. With several different options and price points, H&R Block has something for every person, no matter their tax situation.

On top of free and Premium tax filing services, customers can receive online support from a tax specialist through Online Assist. This could be help from a tax expert, enrolled agent, or a CPA. Online Assist is available as an add-on to every filing option. There is a fee for adding this extra support, but it’s perfect for people who need extra help as they work through their tax return.

Online Assist provides unlimited expert one-on-one help, simplifying the process. You can confidently file your tax return, knowing everything is accurate, and every possible deduction was included.

6. Best Free Option: FreeTaxUSA

Pricing ($0-$14.99):

- Federal: $0

- Form 1099: $0, plus state

- Deluxe Edition: $7.99, plus state

- State: $14.99 for each state

Supported tax forms: All common tax forms and many less-used tax forms

Free option: Free federal tax filing

FreeTaxUSA is an online tax preparation software for federal and state returns. Federal returns are free to file, and all tax situations are covered, including filing jointly, homeownership, itemized deductions, dependents, investments, and more. Self-employed tax filings are free as well.

This free online tax service also allows you to import last year’s return from another service, like TurboTax, H&R Block, or TaxAct.

FreeTaxUSA guarantees to get you the maximum refund with 100% accuracy.

Customers receive support in the form of a searchable help section and email support. If you opt for the Deluxe Edition, you’ll receive chat support, as well as unlimited amended returns. The real draw is access to Audit Assist, which supplies support from audit specialists if you find yourself subject to an IRS audit.

Note that Audit Assist doesn’t cover state returns. Audit specialists don’t represent you locally. They only provide information to help you through your audit. Still, that’s not bad for a $7.99 fee. You can find more extensive audit support from other tax software providers, but you’ll also pay a lot more for that service.

7. Best Free Audit Support: Cash App Taxes

Pricing: $0

Supported tax forms: All common tax forms

Free features: Free federal tax return and state return filing, audit defense

Formerly known as Credit Karma Tax, Cash App Taxes is the new kid on the tax service block. Cash App Taxes is an online tax service offering free federal and state filings for most common tax situations. The free service supports several filing statuses, including:

- Single

- Married filing jointly

- Married filing separately

- Qualifying widower with dependent child

- Head of household

Cash App Taxes also supports some forms for self-employment tax situations, like 1040 schedule C, schedule E and schedule SE.

If you filed with Credit Karma Tax in previous years, don't worry — the rebranded Cash App Taxes will still let you access those returns.

Cash App Taxes customers can also estimate their refunds before formally doing their taxes. Additionally, you can get your refund up to two days faster when you deposit it into a free Cash App account.

Cash App Taxes stands behind its free service with a guarantee of 100% accuracy and says you will receive the maximum refund possible.

However, customer service for Cash App Taxes is limited to email support through its website.

This tax software also features free audit support for qualifying Cash App Taxes members. Audit support includes features like reviewing documents, consultations, written correspondence with tax authorities and attendance at conferences or hearings on your behalf.

Related Article

Related Article

Cash App Taxes: How It Works & Is It Worth It?

8. Best for Experienced Tax Filers: Liberty Tax

Pricing ($45.95-$85.95):

- Basic (Simple Returns): $45.95, plus state

- Deluxe: $65.95, plus state

- Premium (Self Employed): $85.95, plus state

- State: $36.95 for each state

Supported tax forms: Form 1040, 4562, 8829, 4136, 4684, 4835, 8839, 8853, Schedule A, B, C, E, F, K-1

Free features: Import of past tax returns from competitors, free double-check service (in person)

Liberty Tax is another tax preparation service known for its in-person tax help, with over 2,500 locations across the U.S. They also offer online tax software for customers who want to DIY their taxes from home.

Liberty Tax has three online offerings— Basic, Deluxe and Premium. With a price point of $45.95, you can find much better bargains than Liberty’s Basic version for simple returns through other companies on this list. If you’re an experienced tax filer, though, Liberty Tax is a solid choice.

There’s not a lot of hand-holding with Liberty or extra support features you may find with other top online tax software.

If you know what you’re doing, you won’t miss those features. Plus, you always have the option to hand off your tax return to your local Liberty Tax branch if you get in a bind.

Liberty’s website if full of free resources, like withholding and mileage calculators, income tax tables and other helpful tools.

9. Honorable Mention: e-file.com

Pricing ($0-$34.49):

- Simple Returns: $0, plus state

- Deluxe Plus: $20.99, plus state

- Premium Plus: $37.49, plus state

- State: $22.49 per state

Supported tax forms: All tax situations

Free features: Simple federal returns and expert support via email

If you’re one of millions of Americans who will file a simple return this year, then you’re better off using another service that allows truly free filing. Online tax preparers like FreeTaxUSA or H&R Block’s Free Edition allow people with dependents, HSA and student loan interest to file both federal and state for free. While e-file does offer free federal filing, its so-called Free edition charges $22.49 state tax returns.

However, e-file is worth considering if you’re shopping around for an online tax preparer that offers lower cost deluxe and premium features for more complicated returns.

Which Tax Preparation Service Is Right for You?

With the help of online tax software preparation services, like those mentioned above, you can file your own taxes like a pro. Many services allow you free account access to start, only paying once you actually file. Why not take advantage of the convenience and support found with online tax software? You’ll gain a better understanding of the entire tax filing process and save money at the same time.

Tax Filing FAQs

-

Outside of Liberty Tax, all of the tax services listed above offer free e-filing services for at least simple federal tax returns. Cash App Taxes, H&R Block, TaxAct, TurboTax and TaxSlayer also offer free state filings in some tax situations.

-

Cash App Taxes offers free audit support services for members who have their tax returns audited. Services are provided through a partnership with audit specialists Tax Protection Plus. The program offers free support like consultations, document review and collection, written correspondence with taxing authorities and representation at any conferences or hearings with taxing authorities.

-

The best free tax filing service depends on your tax situation and specific needs. Almost all of the tax services on our list offering some form of free tax filing. Cash App Taxes is the only option listed that includes free audit support. Review each service’s features and supported forms the find the right one for you.

-

If you don’t have experience filing your own taxes or have a more complicated tax situation, it might be worth it to pay a tax prep service to do your taxes. Many online tax services have created filing processes that are easy to understand and use no matter your level of experience. Some even incorporate mobile-friendly technology as an extra perk. One option is to try filling out your tax return through one of these inexpensive programs and if you get stuck, then turn to someone else for help. In some cases, you can pay for premium support through online tax services.

-

Free tax filings are usually limited to more common tax situations. If you have a more complicated tax situation, there’s a good chance you’ll need to pay to file your federal and state taxes. Qualifications vary from one tax service to the next. Take time to research all of the free tax filing options to determine your eligibility.

-

Small business owners should examine their specific tax needs to determine if using the cheapest tax service makes sense. If your business falls in the realm of self-employment, it could be a smart move. It’s more important, though, to find a tax service that covers your tax situation and offers extra services beneficial to a business.

-

If you hire someone else to do your taxes, they could be liable if they make mistakes that result in an audit. If you use an online tax service, do your homework to find out who is responsible if there are mistakes made. Many of the services listed above come with accuracy guarantees. Ultimately, it’s up to you to go over your return before it’s filed to ensure accuracy.

-

Both are designed to help people prepare their own taxes and offer additional assistance from CPAs for a cost. However, tax preparation software is downloaded to a device; whereas an online tax preparation service is completed entirely on your internet browser.