Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

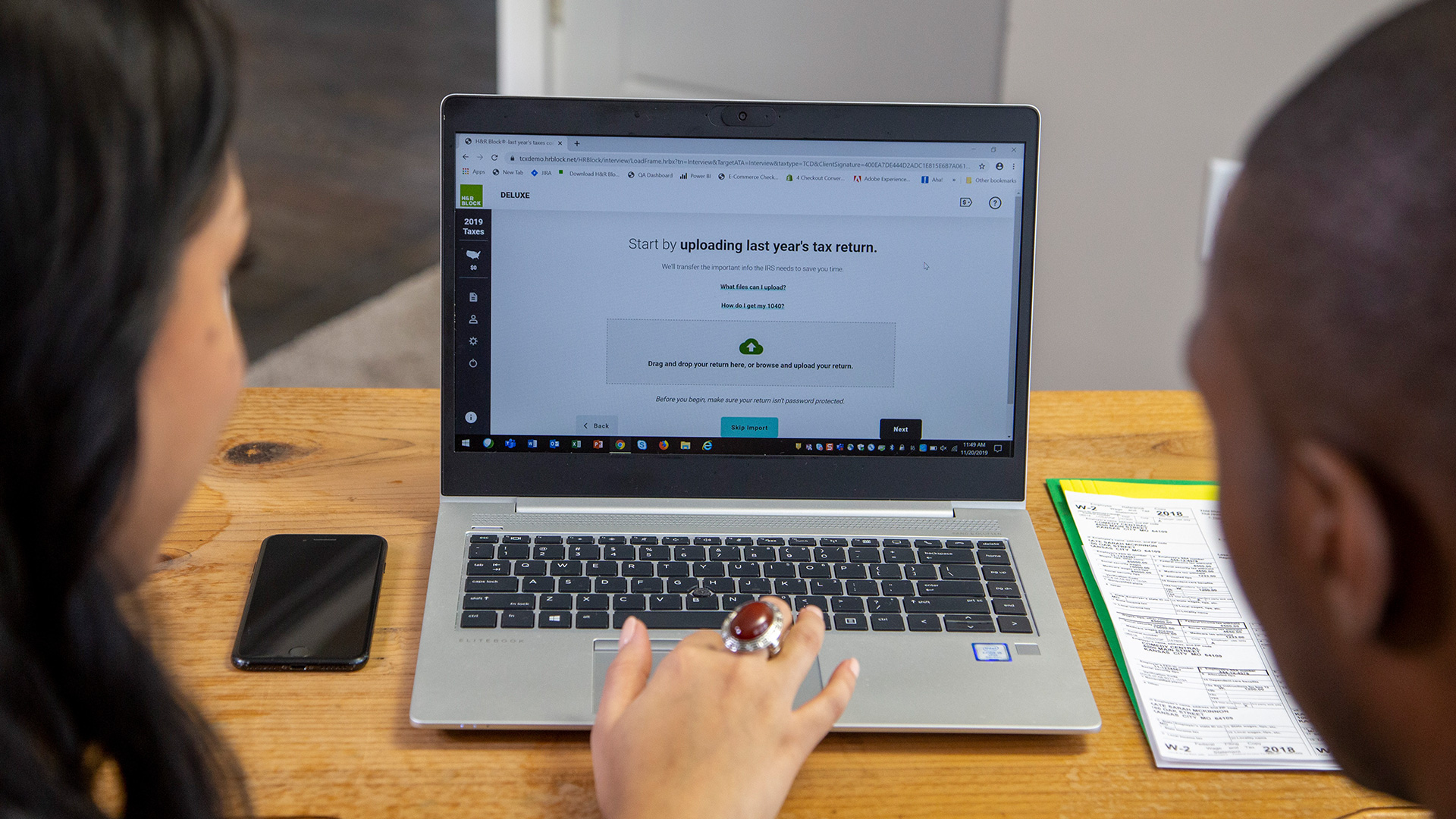

Filing taxes isn't a fun process for most people, but it's easier than ever with online tax preparation services. In some cases, you may be prompted to pay for assistance from one of these online preparers. Before you do, however, it's important to consider a few things.

Paying for a tax prep service may not be necessary, so make sure you know your situation and whether it justifies paying a fee. If you believe paying is necessary, compare multiple services before you choose one, and also consider hiring a professional to do all of the work for you.

1. You May Be Able to File Taxes for Free

Most tax preparation services offer a free version and paid versions. But even if you're prompted to pay for certain forms or features, it's important to know that you can likely still complete the process for free.

ProPublica found in early 2020 that 14 million people paid roughly $1 billion to tax prep services when they could've filed for free. In some cases, it may have been a simple misunderstanding, but in others, the nonprofit organization found that certain tax prep companies engaged in deceptive practices.

If your adjusted gross income is less than $73,000 in 2022, you can file for free using the IRS FreeFile program. Even if you make more, Credit Karma offers a free tax prep service that has no up-charges for anything.

2. Online Tax Service Are Not Created Equal

To simplify the tax return process, you may be tempted to just go with the first program you see (or the most popular). But each tax prep service offers a different set of features, costs and user experience. As a result, it's crucial that you take the time to compare several options to find the best fit for you.

Some of the factors you should consider include pricing, ease of use, tax forms supported, features, audit assistance and the payment and refund process.

The process of comparing services can take some time, and it may require you to go through at least part of the process with more than one company. But once you find a good one, it can save you time for years to come. Review our guide on how to compare online tax software to help identify the features and price points that are important to you.

3. You Might Be Better Off Hiring a Professional

Tax prep software can help you file your taxes by guiding you through a simple process. But if your tax situation is relatively complex, even the help of tax prep software may not be enough.

I used the likes of TaxAct, TurboTax and Credit Karma for several years, but switched to hiring a certified public accountant two years ago because my business situation is more complicated than ever. While hiring a professional costs me a lot more, it's worth it to ensure accuracy and saves me hours and hours of figuring out all the intricate details of the tax code for my situation.

Compare Different Tax Prep Services

You can easily compare different tax prep companies like TurboTax, TaxAct, H&R Block, FreeTaxUSA and more. Then, you can figure out which one will work best for you and whether or not you'll have to pay.