Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

Filing your tax return every year might feel like it's a necessary evil. But if you're among the roughly two-thirds of Americans who receives tax refunds, according to the IRS, the payoff is worth it. Even if you don't, failing to file your taxes could cause you to face harsh penalties, including jail time.

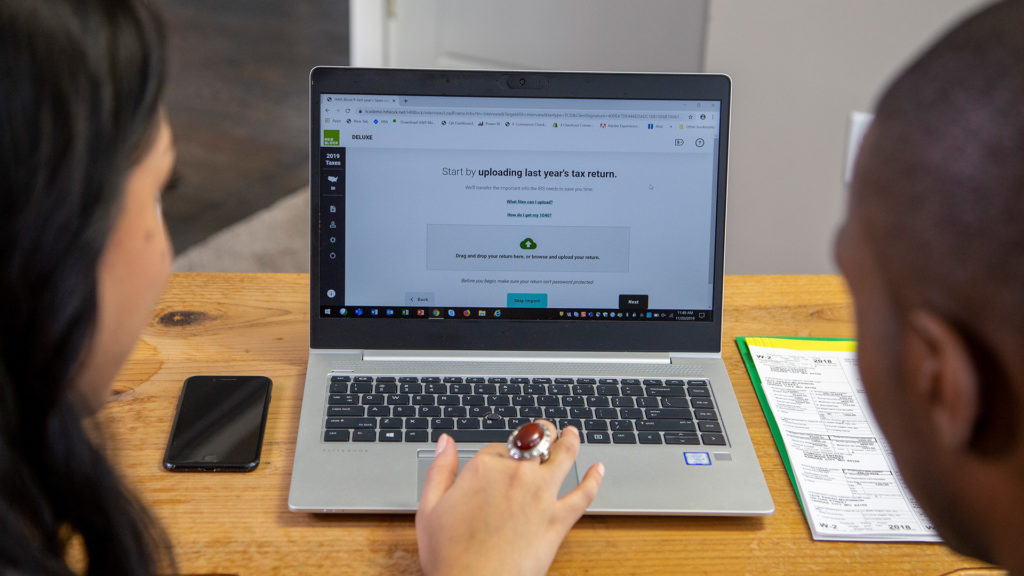

Based on IRS filing statistics for 2022, most people hire a tax professional to prepare and file their tax returns. But if you're thinking about filing on your own, you may be considering a tax preparation service to help you do it.

Taxes 101 How to Compare Tax Preparation Services

If you're considering a tax preparation service because of the promise of free or cheap filing, don't just settle for using the first one you see. While they all have the same basic function of helping you prepare and file your return, they're not all created equal, especially for people with complex returns. Here are six factors to consider as you shop around.

-

1

Compare cost

As you compare costs, make sure you know what's included in each tier and compare that to what you need to file your return. If paying some money makes sense for your situation, shop around to make sure you're getting the biggest bang for your buck.

-

2

Compare the ease of use for the tax service

Even with guidance, the tax preparation process can be confusing, so it may be worth going through at least some of your return with more than one service to get an idea of how easy they are to use. You'll also want to look into how they handle customer service if you have questions—is there someone available to talk to via chat, or do you have to wait a few days to get a response via email?

-

3

Make sure it supports the tax forms you need

One of Credit Karma's biggest flaws is that it doesn't support all tax forms. This won't be a problem for many taxpayers, but it can be frustrating to go through the process only to find out you have to start all over somewhere else. As you narrow down your list of candidates, search their websites to find out which forms are and aren't supported so you know beforehand which ones can do what you need.

-

4

See what features and customer service options are available

Filing your taxes can be a stressful experience, so look for features that could potentially make your life during tax season a little easier. For example, is there an option to speak live with a certified public accountant to ask questions about a complicated situation? Do they guarantee accuracy? How many educational resources do they provide to help you learn more about the process so you can feel more confident about doing your own taxes? Do a thorough rundown for each service to get an idea of which features are included.

-

5

See if you can get audit assistance

Audit assistance is actually one of the benefits of hiring a professional to file your return, but it's not required. Many tax preparers offer it. Just be sure to read the fine print so you know what's included. To be clear, the chances of the IRS auditing your tax return are slim — the agency typically audits less than 1% of most taxpayers. If it does happen to you, though, you're not going to want to go through it alone.

-

6

Review the payment and refund process

If you owe money to the IRS, figure out what the payment process is for each service. For example, can you pay your tax bill with a credit card, or do you have to pay from a bank account? If you're expecting a refund, how easy is it to add your bank account information to receive direct deposit? Also, some services will offer refund advances, giving you access to your cash before the IRS completes a review of your return. However, some may charge a fee for this service or put the money on a prepaid debit card instead of giving you cold hard cash. The best online tax services offer a mix of value, a good experience, and features that give you some peace of mind. Take your time to compare options, so you can file your return with confidence.

Related Article

Related Article

9 Best and Cheapest Online Tax Services in February 2026

Looking at Tax Preparation Costs

As previously mentioned, most tax preparation services offer a free option. What's covered under that free tier, however, can vary. Be sure to check the fine print on any free offer to find out exactly what's offered—and what costs you might be on the hook for if you have more complex taxes or need additional services.

For example, Credit Karma offers a fully free tax preparation service, but it doesn't offer some of the more complicated features that other services do.

Other services with free tiers include:

The Difference Between Hiring a Professional and Using Software

You may be wondering if you should file your tax return on your own or hire a tax professional to do it for you. The biggest differences between the two options are cost and effort. According to data gathered by the National Society of Accountants, you can expect to pay $220 on average if you hire a professional to file a simple state and federal return.

In contrast, most tax preparers offer free options for simple tax returns, and even the paid options are cheaper than having someone else do it for you.

That said, once you hand off all of your paperwork to a tax professional, you're done. They'll take care of the entire process from start to finish, filing your return on your behalf. All you need to do is pay their fee and wait for your refund to roll in.

If you were to go with a tax preparation software—which, again, is generally cheaper—you'd need to do it yourself. Fortunately, these services guide you through the process by asking relevant questions, and you can generally get help if you have questions. But regardless, you can expect more legwork if you do it on your own.