Most products on this page are from partners who may compensate us. This may influence which products we write about and where and how they appear on the page. However, opinions expressed here are the author's alone, not those of any bank, credit card issuer, airline or hotel chain. This page may include information about American Express products currently unavailable on Slickdeals. American Express is not a partner of Slickdeals.

H&R Block for Small Business

This product is currently not available via Slickdeals. All information about this product was collected by Slickdeals and has not been reviewed by the issuer.

- Our Rating 4.5/5 How our ratings work

H&R Block for small business offers a wide range of services for small business owners, including freelancers and contractors. This flexibility means more business owners may be able to benefit from H&R Block’s tax products and services.

Accommodating Tax Solutions for Small Businesses

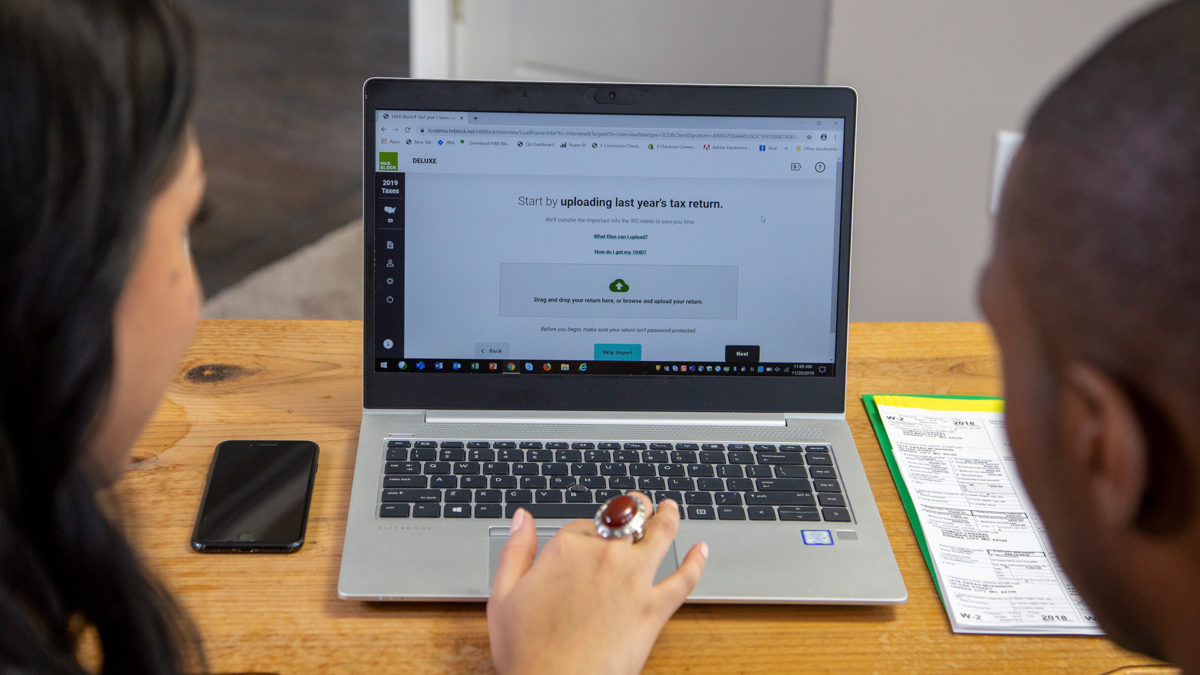

As a small business owner, managing taxes, bookkeeping, and payroll can be daunting. That’s why many entrepreneurs — whether freelancers or otherwise — turn to companies like H&R Block® for support. Getting outside help from reputable online tax services or a tax professional can make tedious and often confusing financial tasks easier to manage.

One of the key benefits of working with H&R Block is the flexibility the company offers its customers. As a small business owner, you have the ability to choose between different services like purchasing software to file your own taxes, getting in-person or virtual support with taxes and payroll, and many other year-round business financial services.

Here are some of the tax, bookkeeping, and payroll options available through H&R Block for small businesses.

Pros

- 100% satisfaction guarantee available with desktop tax software (before filing return)

- Flexible options for small business owners who need DIY or professional tax help

- E-file up to five federal returns with desktop software

- Free audit support included with desktop software and add-on audit protection available when working with tax professionals

Cons

- Additional fees apply for an extended download timeframe and backup CD

- No live tax help with desktop software

- Additional $19.95 to e-file state tax return with desktop software

- Additional $75 fee applies for Business Tax Audit Support protection when working with a tax professional

H&R Block Small Business Services Overview

H&R Block offers services to support small businesses in three main areas. The company provides tax return preparation, bookkeeping, and payroll services.

Bookkeeping and payroll are available as stand-alone services. When elected, these options can help small businesses stay on top of their

Business owners can also use H&R Block

Related Article

Related Article

9 Best and Cheapest Online Tax Services in November 2025

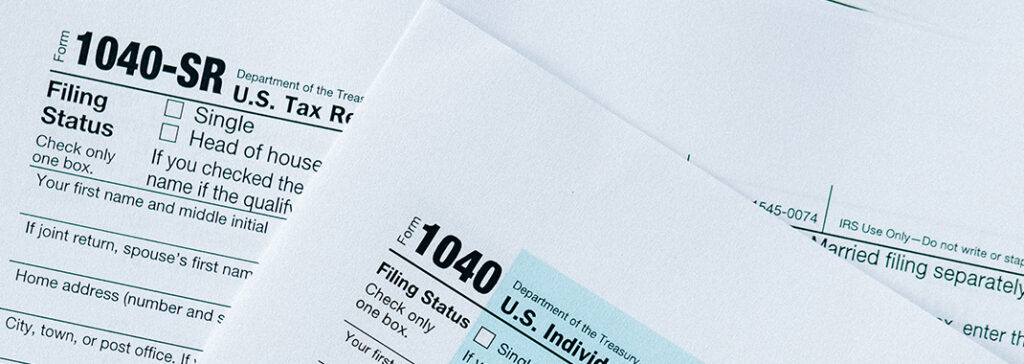

Tax Preparation Services

As a small business owner, there are two ways H&R Block can help prepare your business tax return. You can use t

Tax Software

H&R Block’s Premium & Business 2022 tax software may be a good fit for small business owners who want a user-friendly option to file

It will cost an additional $

If,

File Online

- Self-employed online tax preparation services start at $85 with the current sale price (or $110 at full price).

- Self-employed online tax preparation services with expert help starts at $115 with the current sale price (or $145 at full price).

An additional $

Related Article

Related Article

Tax Deadlines and Extended Filing Deadlines 2023

Work With a Tax Professional

Some small business owners prefer to work with a tax professional when it comes to filing annual tax returns. If your

- Meet in person

- Virtual tax preparation

- Drop off files at an office

Tax preparation costs for the three options above start at $

You also have the option to add Business Tax Audit Support protection to your tax return for $

Bookkeeping Services

Bookkeeping services, like those from Block Advisors by H&R Block, can help small business owners

Explore the Best Business Checking Accounts

Visit the Marketplace

Pricing

The cost of small business bookkeeping services with Block Advisors by H&R Block varies based on the types of services you choose.

- Starter bookkeeping services start at $

50 per month. - Full-service bookkeeping services start at $

150 per month.

Both starter and full-service bookkeeping options offer

Block Advisors by H&R Block offers a

Payroll Services

Block Advisors by H&R Block offers back-office support for payroll services that can help free up time for small business owners and make sure they remain compliant. The service is available to both

Pricing

As with Block Advisors by H&R Block’s other services, the cost of payroll services varies based on your business’ needs.

- Self-Employed payroll support starts at $59 per month for a team of one.

- One+ Employees payroll support starts at $79 per month plus $10 per employee (per pay run).

If you participate in the One+ Employees program, you can receive support to pay your employees

Again, a free

Is H&R Block for Small Business Right for Your Tax Needs?

H

Nonetheless, it’s always wise to shop around and compare multiple options before you make your final decision. With fee-based tax preparation services in particular, you may want to consider the average cost of getting your taxes done and see how H&R Block’s fees compare.